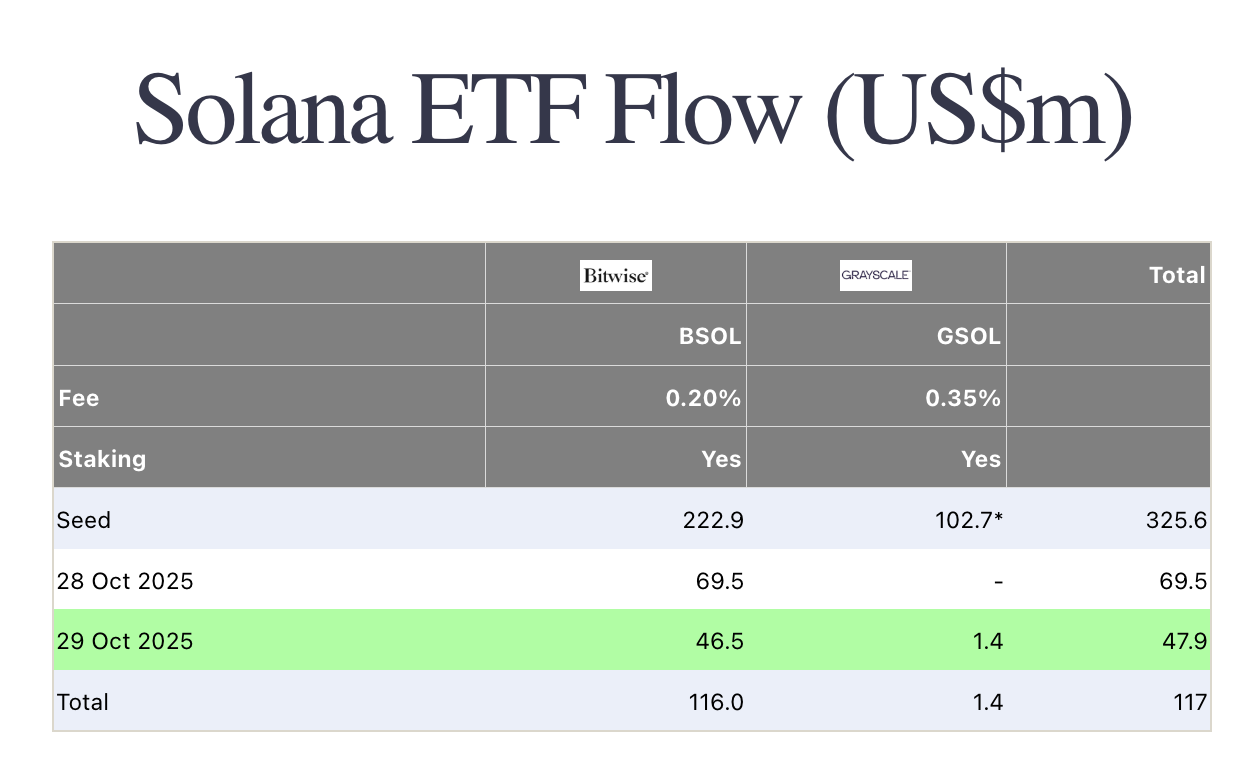

Grayscale’s altcoin started trading in the USA solana -based spot ETF GSOL attracted net inflows of $1.4 million on its first trading day on October 29. Farside And SoSoValue According to data, it completed its transformation from closed-end fund to ETF. GSOL Bitcoin on launch day  $110,521.68 and Ethereum

$110,521.68 and Ethereum  $3,911.77 Despite the sharp outflows in ETFs, it managed to attract investment.

$3,911.77 Despite the sharp outflows in ETFs, it managed to attract investment.

While Bitwise Takes the Lead, Grayscale Follows Behind

Bitwise, which was released a day before GSOL BSOL ETFIt attracted a net inflow of $69.5 million on October 28 and $46.5 million on October 29, receiving a total investment of over $116 million. BSOL, which had the highest opening performance of 2025 with a volume of 57.9 million dollars on the launch day, reached 75 million dollars on the second day, Bloomberg ETF Analyst Eric Balchunas It was described as gigantic by.

Grayscale‘s GSOL ETF, on the other hand, offers a higher cost with a 0.35 percent fund management fee compared to BSOL’s 0.20 percent fund management fee. GSOL reached a transaction volume of 4.9 million dollars on its first day. BitwiseIt started the competition at a disadvantage due to its advantage of “opening to transactions one day early”. “One day difference actually makes a huge difference. It makes it harder to keep track,” Balchunas said.

Markets Price in Powell’s Message: Strong Breakout in Bitcoin and Ethereum ETFs

HBAR And Litecoin  $97.76 Altcoins also received investor interest with the launch of their ETFs (HBR and LTCC) around the same time. The HBR ETF attracted $2.2 million in net inflows, while LTCC attracted $485,000. On the other hand, spot Bitcoin in the USA and Ethereum There was a total outflow of over $500 million from their ETFs.

$97.76 Altcoins also received investor interest with the launch of their ETFs (HBR and LTCC) around the same time. The HBR ETF attracted $2.2 million in net inflows, while LTCC attracted $485,000. On the other hand, spot Bitcoin in the USA and Ethereum There was a total outflow of over $500 million from their ETFs.

Fidelity Bitcoin Its ETF FBTC saw a net outflow of $164.4 million, while its Ethereum ETF FETH saw a net outflow of $69.5 million.

Analysts say outflows are due to Fed President Jerome PowellHe stated that this was due to the fact that, despite yesterday’s announcement of a 25 basis point interest rate cut, it did not guarantee a new cut in December. BRN Research Head Timothy Egypt“Markets responded to Powell’s cautious tone rather than the discount. This discourse tightened financial conditions again,” he said.