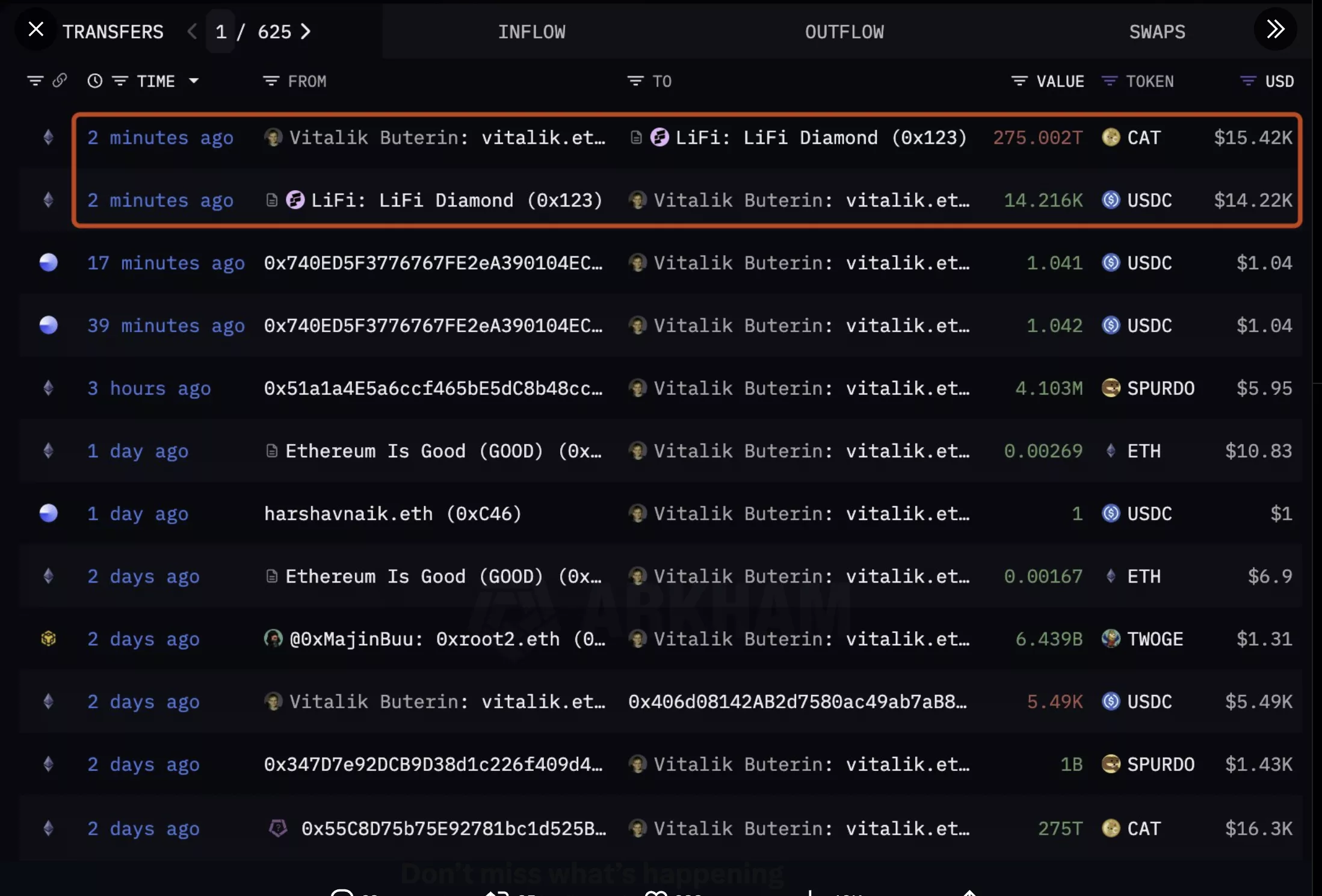

Ethereum  $3,911.77co-founder of Vitalik Buterinattracted attention again by selling a new memecoin that was sent to his wallet without his permission. Buterin recently received 275 trillion coins sent to his wallet without his permission. CAT coinHe sold it through Lifi Diamond, converting it into USDC worth approximately $14,216. The transaction took place with the sale of coins transferred to his wallet only two days ago, and after the sale, the price of CAT decreased by 0.81 percent.

$3,911.77co-founder of Vitalik Buterinattracted attention again by selling a new memecoin that was sent to his wallet without his permission. Buterin recently received 275 trillion coins sent to his wallet without his permission. CAT coinHe sold it through Lifi Diamond, converting it into USDC worth approximately $14,216. The transaction took place with the sale of coins transferred to his wallet only two days ago, and after the sale, the price of CAT decreased by 0.81 percent.

Buterin’s Repeat Memecoin Sales

Buterin’s transaction is a continuation of similar sales in the past. lookonchainThe intra-blockchain data transmitted by the Ethereum developer is usually sent to him/her. memecoinIt shows that he sold and disposed of the ‘s without any warning or approval. These sales, made through multi-blockchain liquidity aggregators like Lifi Diamond, once again revealed his disinterest in such assets.

Also, recently, 1 billion coins were transferred to Buterin’s wallet without his permission. SPURDO and it appears that 6.43 billion TWOGE coins were sent. According to experts, these transfers are just promotional attempts by small-scale projects in an attempt to gain visibility by using Buterin’s name. Buterin has in the past described memecoins as worthless cryptocurrencies and called on projects not to send him coins.

In October, Buterin sold memecoins sent to his wallet without his permission and bought $96,000 worth of memecoins. ETHHe turned it to . The purpose of the developer’s latest transaction, who frequently donates sales to charity, has not been disclosed, but past examples show that his disinterested stance towards memecoins continues and his name continues to be used for market manipulations.

Latest Status in Ethereum

On the other hand EthereumThe general weakness in the market coincided with Buterin’s latest move, as the price of ‘s fell below the $4,000 threshold. While more than 812 million dollars of positions were liquidated in the last 24 hours, the total open position value in the market decreased by 1.28 percent to 161 billion dollars. Even the 25 basis point interest rate cut by the US Federal Reserve (Fed) was not enough to strengthen investor confidence.