We are in the last days of October and the most important events of the month will take place in these last days. Interest rate decision today, tomorrow Chinese The agreement between Turkey and the USA and the earnings reports of trillion-dollar giants. During periods of volatility, BTC moves in both directions and has remained negative so far.

Altcoins Comment

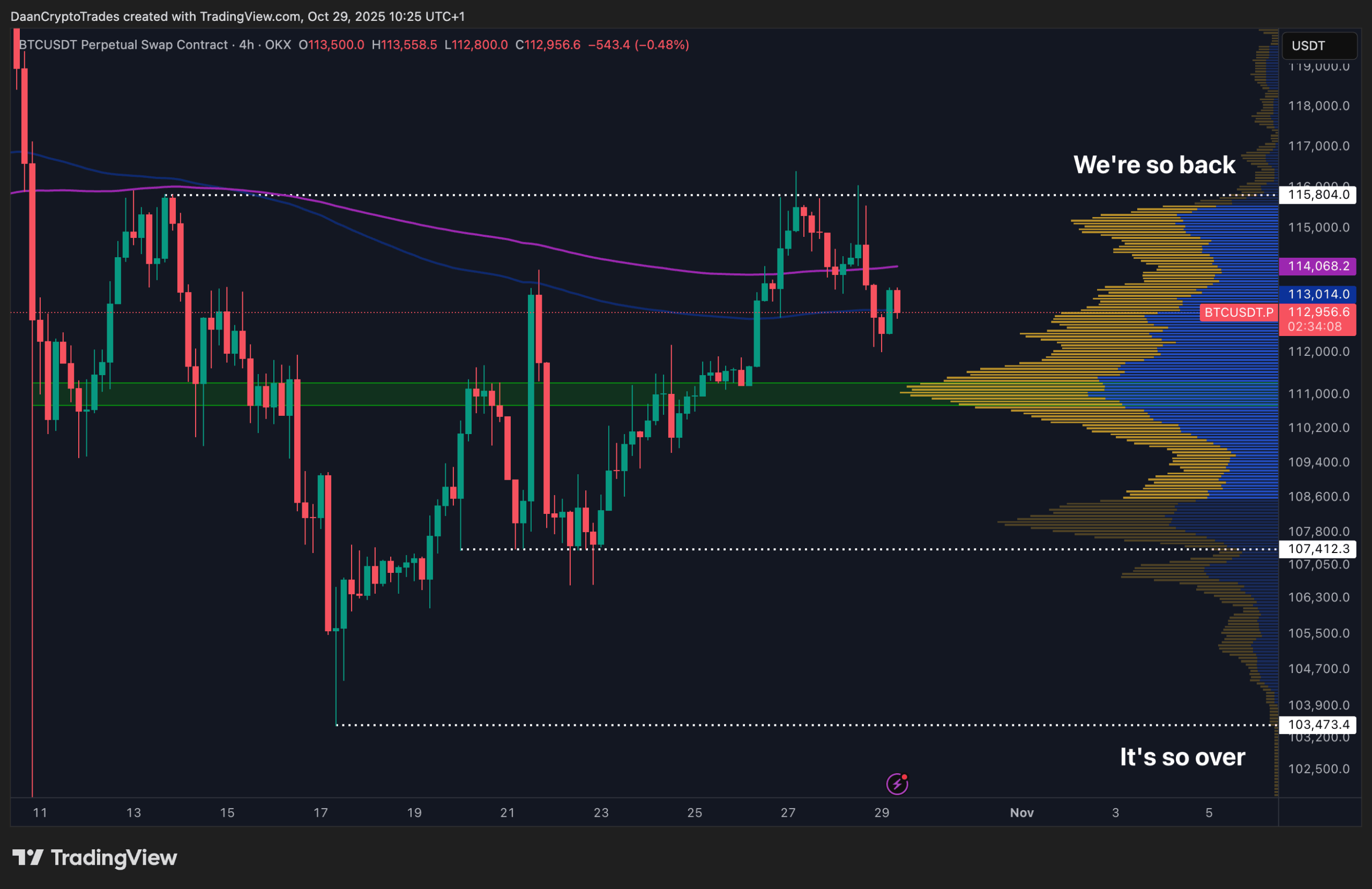

BTC The chart is negative and CME is trying to fill the gap. The decline in altcoins is evident, with cryptocurrencies losing over 4 percent. The Fed interest rate announcement will come in minutes and it is clear what the decision will be. It is difficult to expect a return in altcoins without taking the BTC price back to the 116-118 thousand dollar range. The analyst with the pseudonym DaanCrypto pointed out two key areas and wrote that one of them should be broken.

“BTC is still in the range. $116,000 was rejected twice and the price returned to the large volume node around $111,000. After losing the 200MA (Purple), it is currently trading around the 4H 200EMA (Blue). There has definitely been some loss of momentum following the rally from the previous days. In the short to medium term, the main levels are still $107,000 and $116,000. This everything between levels is just fluctuation.”

Powell If he makes dovish tone statements and earnings reports come as expected, cryptocurrencies are expected to accelerate their rise as the stock market closes. Tomorrow’s China agreement will be another development that increases risk appetite. To see a breakout in either direction, the analyst’s lower upper limits can be taken into account.

LTC and XRP Coin

XRP Coin It continues the day at $2.63. ETF approval could not come due to the closure. Nevertheless Ripple  $2.63 continues to work to expand its business. Ripple Prime was announced just this week. Ali Martinez does not say good things about XRP Coin in the short term, even if the resistance point of the falling channel is tested. According to him, even if the $2.8 resistance is tested, we will see a decline here.

$2.63 continues to work to expand its business. Ripple Prime was announced just this week. Ali Martinez does not say good things about XRP Coin in the short term, even if the resistance point of the falling channel is tested. According to him, even if the $2.8 resistance is tested, we will see a decline here.

$2.42 and $2.185 are possible targets.

LTC It has a strong community and the accumulation has been extended with the halving. Although the rally period technically started, the price did not rise vertically as planned. Yoddha says what is missing here is the peak we need to see during the rally period and predicts a peak close to $400.