After weeks of sideways trading, veteran trader VirtualBacon believes the crypto market is standing on the edge of something massive, a full-blown liquidity-driven rally. He believes the Federal Reserve’s quiet shift toward ending quantitative tightening (QT) marks the beginning of the next major “crypto melt-up”, sending Bitcoin and altcoins soaring once again.

Fed’s Liquidity Shift Begins

According to VirtualBacon, the biggest event for crypto this year isn’t the Bitcoin halving or ETF approvals, it’s the Federal Reserve’s liquidity pivot.

For over 18 months, the Fed has been in Quantitative Tightening (QT) mode, reducing its $7 trillion balance sheet to fight inflation. This tightening drained cash from markets, pressuring Bitcoin and altcoins.

Now, signs indicate this phase may end soon, potentially refilling liquidity and sparking the next crypto rally. Major banks like Goldman Sachs, Bank of America, and Evercore expect QT to conclude by November or December, setting the stage for renewed market momentum.

History Shows Liquidity Drives Crypto Cycles

According to VirtualBacon, every major crypto bull run has aligned with periods when the Fed loosened liquidity.

- In 2019, when the Fed prints money, investors rush back into risk assets like Bitcoin, which tripled within months. And when QT stopped, altcoins soared.

- In 2022, QT restarted, and altcoins began to tumble.

- Now in 2025, as QT comes to an end again, the setup looks strikingly similar to 2019, the year Bitcoin tripled in price.

When central banks inject money, investors typically turn “risk-on,” favoring volatile assets like crypto. The pattern is simple: when the Fed prints, altcoins pump.

- Also Read :

- Crypto News Today [Live] Updates On October 29 2025

- ,

Why Markets Expect the Pivot Soon

Economic indicators are flashing familiar warning signs. Bank reserves are falling, stress in the repo market is rising, and the U.S. Treasury recently added $800 billion to its cash account, temporarily removing liquidity from the system.

This mirrors 2019, when the Fed quietly injected cash in a move called “stealth QE.”

Supporting this outlook, the CME FedWatch tool shows a 99.9% chance of a rate cut this month and an 87.9% chance of another in November or December, pointing to a clear move toward easing.

How This Will Impact Bitcoin and Altcoins

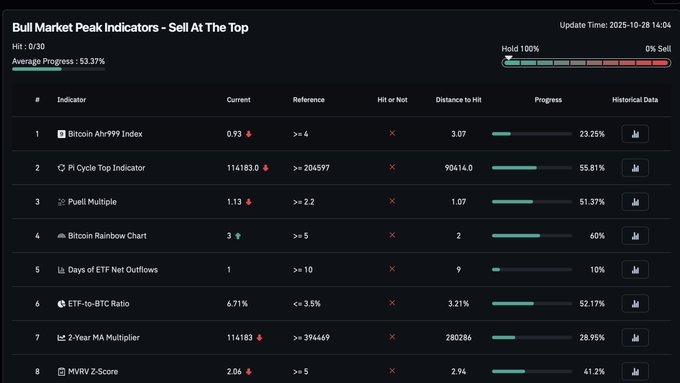

VirtualBacon points out that Bitcoin hasn’t topped yet, and none of the 30 historical peak indicators have triggered. He believes this is a mid-cycle phase, not a market top. With global M2 money supply already rising, and gold leading the way, Bitcoin could soon follow with a sharp move higher.

If liquidity indeed returns, VirtualBacon believes Ethereum, Solana, XRP, and BNB could be the first to surge, paving the way for another broad-based crypto rally.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

It signals rising liquidity, which often boosts Bitcoin and altcoins as investors shift toward riskier assets.

When the Fed adds liquidity, money flows into risk assets like crypto, driving prices higher across major tokens.

Yes, many analysts believe more liquidity could ignite a new rally, similar to Bitcoin’s surge after 2019’s easing.

Rate cuts lower borrowing costs and increase liquidity, creating a favorable environment for Bitcoin and altcoins to rise.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.