Bitcoin  $114,239.93Discussions about the long-term price cycle of have been reignited. 10x Research In your final analysis He warned that the trend of decreasing returns of the largest cryptocurrency may not be just a natural consequence of maturation. The research firm noted that statistical inferences based on Bitcoin’s three past cycles “lack scientific credibility.”

$114,239.93Discussions about the long-term price cycle of have been reignited. 10x Research In your final analysis He warned that the trend of decreasing returns of the largest cryptocurrency may not be just a natural consequence of maturation. The research firm noted that statistical inferences based on Bitcoin’s three past cycles “lack scientific credibility.”

“Bitcoin Cycle Nears Saturation Point”

According to 10x Research’s report, in 2021 bull marketThe stock-to-flow model, which failed in the 1990s, is no longer valid. The company underlined that the biggest mistake of the model is that it reads price movements only through supply and excludes the demand factor. However, 10x Research also reminded that it could accurately predict the bottom of the bear market in October 2022 by using the modified version of the model.

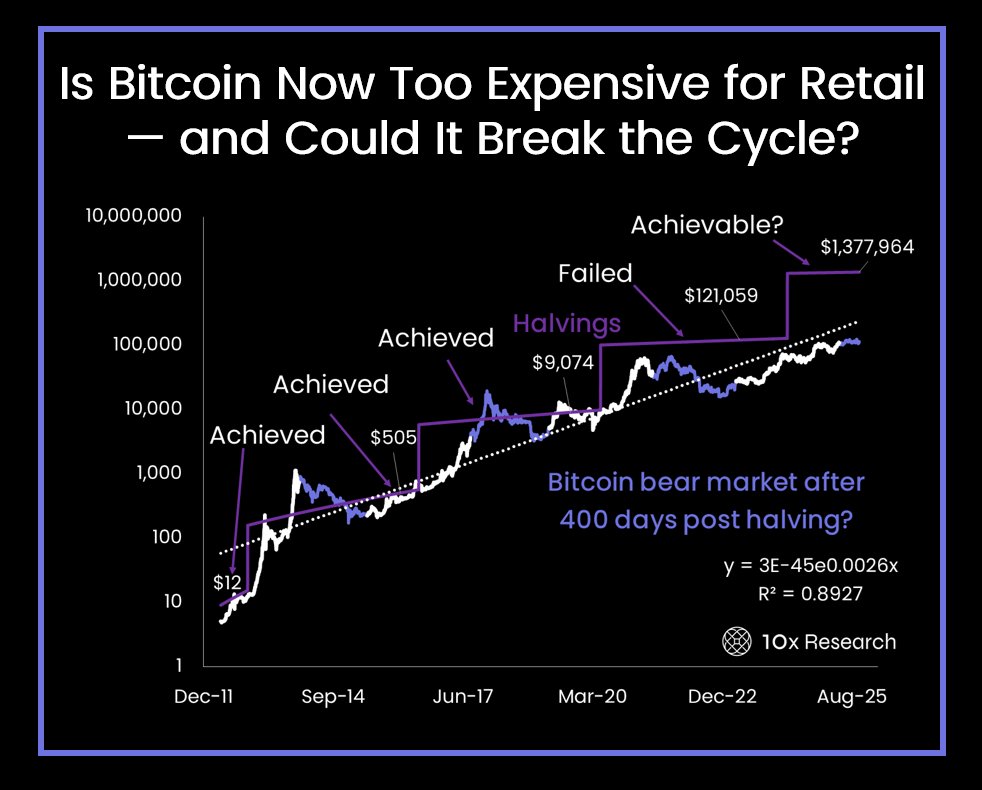

New analysis compares Bitcoin to everything in the past block reward halvingIt reveals that it experienced an increase for a certain period of time after the halving, but generally entered a correction phase after 400 days. The chart also included the information that it was possible to reach the $ 121,000 band in the last cycle, following the previous targets of $ 12, $ 505 and $ 9,074, but astronomical targets such as $ 1.3 million were difficult.

Is Cycle Theory Collapsed?

10x Research is in the bull market in 2021 stock-flow modelHe reminded that although Bitcoin was predicted to exceed $100,000, it did not reach this target. However, he pointed out that the same logic applies to $1 million price predictions today. In the company’s previous analysis dated July 2023, a ceiling price of $ 125,000 was predicted for Bitcoin, but it was emphasized that the view of the cycle dynamics has changed significantly in the last evaluation.

According to 10x Research, Bitcoin is now becoming increasingly expensive for retail investors, weakening the credibility of the classic “four-year cycle” theory. The report states that the cryptocurrency market should be analyzed based on demand-based data sets, not supply-side models. The message “Bitcoin’s past performance does not determine the future” drew attention in the analysis.