BNB The coin is the largest altcoin Ethereum with its price performance and structural durability since the beginning of the year.  $4,003.69It left behind (ETH). Although Ethereum lost its momentum after the dissolution process in leveraged positions, the technical structure in BNB Chain remained strong and the period referred to as “BNB Season” in the market became permanent.

$4,003.69It left behind (ETH). Although Ethereum lost its momentum after the dissolution process in leveraged positions, the technical structure in BNB Chain remained strong and the period referred to as “BNB Season” in the market became permanent.

Power and Participation within Blockchain Started to Increase Again

Blockchain analytics company Altcoin Vectorshared data supporting BNB’s structural resilience. of the company to the report Although the number of active addresses decreased from 1.6 million to 800,000 during the debt reduction period, it recovered in a short time and approached previous levels. The return in the number of active addresses is attributed to the healthy functioning of the network and maintaining user interest.

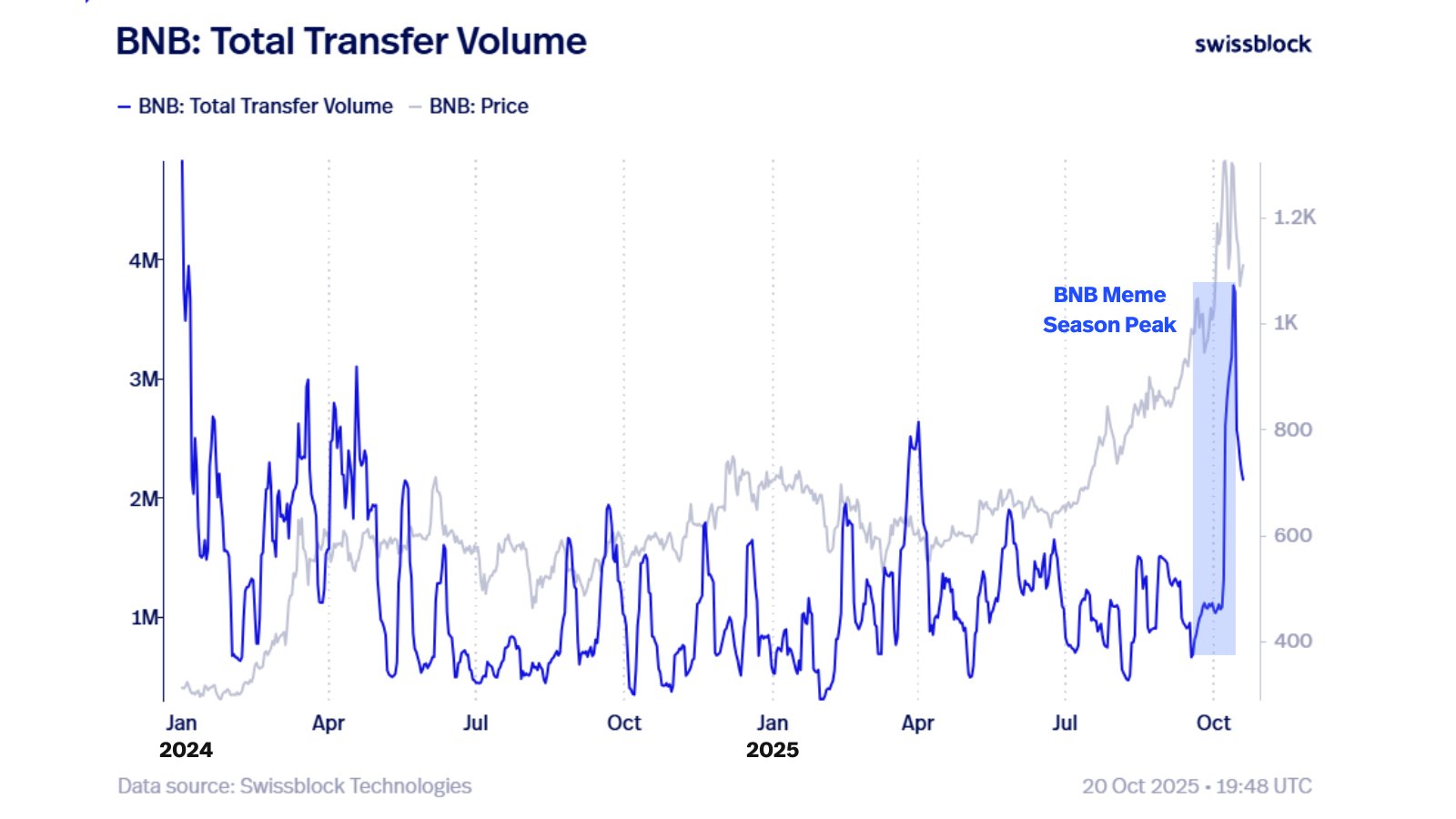

BNB ChainThe transfer volume in also shows that liquidity is maintained. While large-scale transactions and active coin mobility continue, speculative movements within the Blockchain remain alive, even though the “BNB Memecoin Season” ends before it fully matures. While the astronomical rises of coins such as PALU, 币安人生, PUP and 4 brought fortunes to many investors, some whales suffered serious losses due to extremely risky transactions.

Altcoin Vector, BNB coinHe emphasized that ‘s power is fueled not only by speculation but by fundamental indicators. The company pointed out a mature market structure where liquidity and active user participation continues and said, “When both the narrative and fundamental data overlap, the asset enters a long-term momentum cycle.” In the case of BNB, it is considered that the current structure not only survived the collapse but also paved the way for a new phase of rise.

Technical Outlook and Market Structure Gives Confidence

CryptoQuant According to data, BNB’s price last traded around $1,138, aligning right with its 45-day moving average. The fact that the 90-day average remains at $941 shows that the medium-term trend is still upward. Despite the limited increase of 2.7 percent in the daily time frame, the fact that the price remains above important support levels indicates that the market has found balance.

In the past, every recovery from the 45-day average was the pioneer of strong increases in BNB. Short-term averages (7-30 days) turning upwards again and the continuation of the volume increase signals that a new price increase is approaching. In particular, the convergence between the 7 and 45-day averages defines a period in which volatility is compressed. These types of structures are generally seen before strong directional breakouts.

Analysts state that buyers are actively defending the support zones and the positive trend continues on the volume side. All this technical alignment shows that BNB can create a long-term growth trend, not just a short-term recovery.