solana (SOL) became horizontal after rising to $195 on the last trading day of the week. Whether the price can hold in the $188-195 range in the transactions that took place in the last 24 hours has become the most discussed issue in the market. Fidelity opens SOL to retail investors and volume increases in technical indicators altcoinIt indicates that investor interest in is strengthening.

Fidelity’s Solana Move Increased Institutional Interest

Fidelity‘s addition of Solana to its retail brokerage platform in the US on October 23 SOL coinBitcoin’s access  $112,712.16Ethereum

$112,712.16Ethereum  $4,003.69 and Litecoin

$4,003.69 and Litecoin  $98.33moved it to the same category as . This expansion is considered an important gateway that can increase liquidity flow to Solana from the corporate channel. According to analysts, although the increase in access will not be decisive in the short term on the price, it may expand the long-term investor base.

$98.33moved it to the same category as . This expansion is considered an important gateway that can increase liquidity flow to Solana from the corporate channel. According to analysts, although the increase in access will not be decisive in the short term on the price, it may expand the long-term investor base.

Also, the Solana-themed credit card introduced by Gemini on October 20 altcoinIt introduced a new user channel to ‘s ecosystem. The card, which provides users with SOL rewards of up to 4 percent on fuel, transportation and restaurant expenses, also creates in-ecosystem earning opportunities with its automatic staking option. The fact that the card has no annual fee and no foreign transaction fees are among the factors that increase user interest.

Technical Outlook on SOL Coin: Defense of $188 is Critical

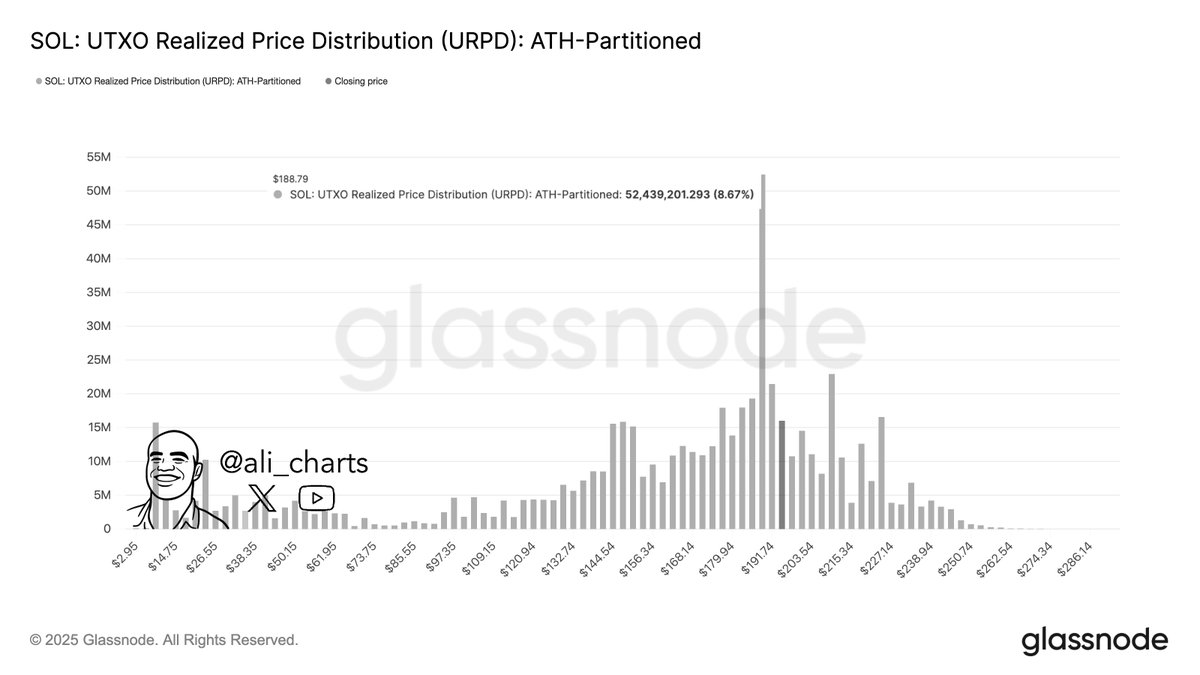

Analyst Ali MartinezCiting Glassnode data, the $188 level is considered the most critical support threshold for Solana. defined. The large amount of supply changing hands in this region creates the cost base for investors. For this reason, while the price remaining above $ 188 will reduce the selling pressure, falling below may trigger new supply waves.

CryptoAppsy According to data, SOL is trading at $194.03, with a 0.29 percent decrease in the last 24 hours, at the time of writing. Data reveals that the altcoin has increased by 5.42 percent in the last 7 days. Solana’s total market value is at 106.64 billion dollars.