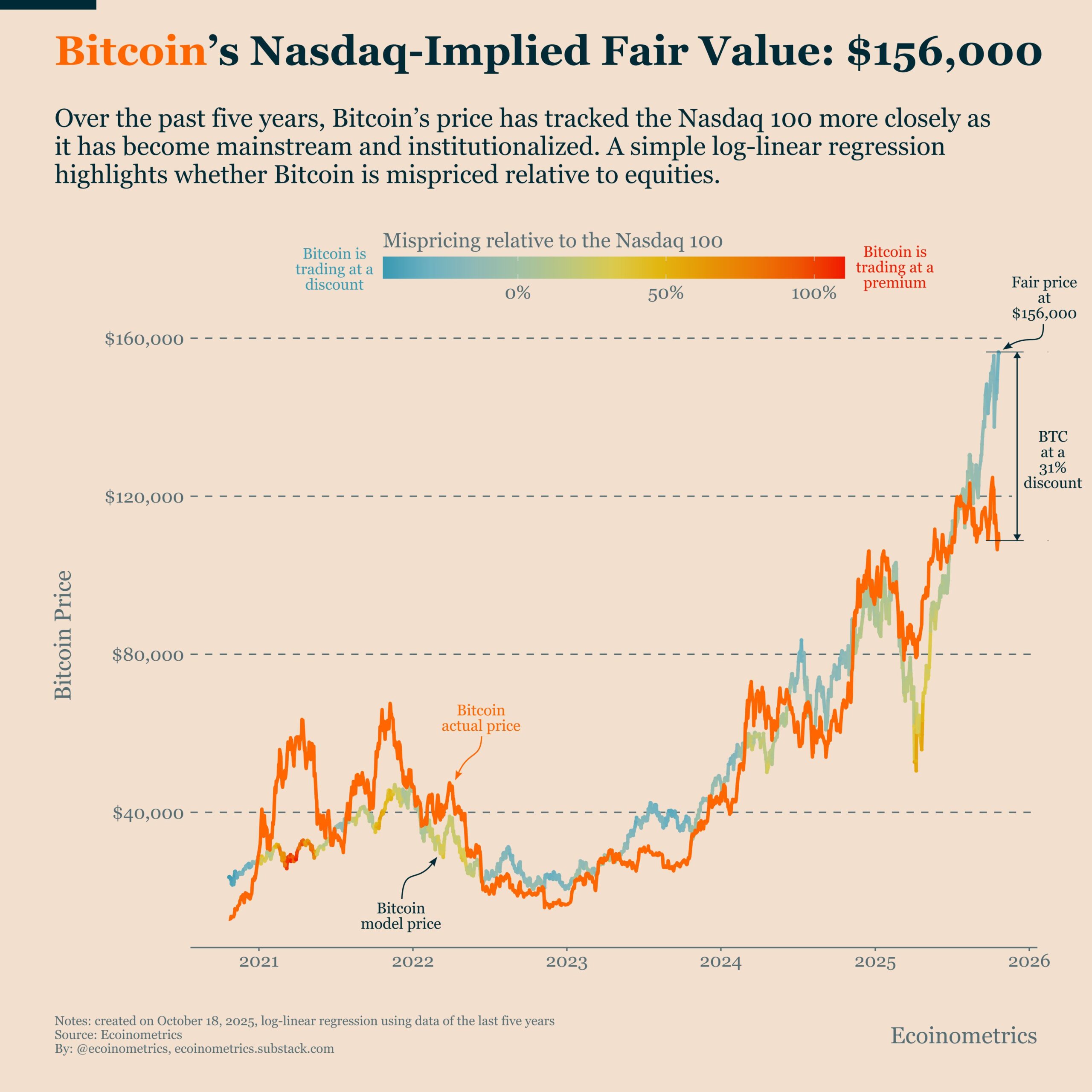

Bitcoin  $111,672.87It is traded at a discount of approximately 30 percent compared to the Nasdaq 100 index, which represents technology stocks. ecoinometricsAccording to data from , considering the long-term correlation with the index, the current fair value of Bitcoin is around $156,000. The market price is at $110,000. This difference has historically signaled significant undervaluation. Analysts express their rally expectations, reminding that there was a strong rise after a similar divergence in 2023.

$111,672.87It is traded at a discount of approximately 30 percent compared to the Nasdaq 100 index, which represents technology stocks. ecoinometricsAccording to data from , considering the long-term correlation with the index, the current fair value of Bitcoin is around $156,000. The market price is at $110,000. This difference has historically signaled significant undervaluation. Analysts express their rally expectations, reminding that there was a strong rise after a similar divergence in 2023.

Leverage Clearance and Historic Drop in Futures

The sudden price collapse in October reduced the open position size in Bitcoin futures from $47 billion to $35 billion, resulting in a contraction of over $12 billion. This, Bitcoin derivatives market It was recorded as one of the harshest deleveragings in history. BitMine and Fundstrat analyst Tom LeeIn his statement to CNBC, he said that organic demand will be seen in the market again after the liquidation of a large leverage. stated.

Glassnode data shows that open interest in options futures exceeds $40 billion. This change reveals that investors are turning to risk-defined strategies rather than speculative leverage. According to analysts, price movements are starting to be shaped by option flows, not forward liquidations.

Capital Rotation from Gold to Bitcoin Strengthens

gold marketThe sharp correction following the record rise in currencies directs investors to cryptocurrencies again. BloombergAccording to the news dated October 22, the sharpest weekly drop in gold ounces of the last decade worried even gold bulls. Reuters reported that after the ounce price exceeded $ 4,000, many funds switched to assets with high risk appetite.

Investor Anthony Pomplianopointed out historical cycles by stating that there will be a great rotation from gold to Bitcoin. He emphasized that Bitcoin, which has followed the rise of gold approximately 100 days behind in the past, could draw a similar scenario this quarter. The trend of young investors towards digital-natural assets and the limited supply of Bitcoin support that the transformation may be permanent.

Long-Term Opportunity Appears on the Horizon

The 30 percent difference compared to Nasdaq fair value marks the highest discount in the last two years. While the hoist is being cleaned spot Bitcoin ETFEntrances to ‘s have found balance.

Analysts state that the current outlook is a consolidation phase, not a post-peak movement. If the bull narrative continues, it is likely that Bitcoin will quickly close the value gap and start a new upward wave.

CryptoAppsy according to data BTC At the time the news was being prepared, it was traded at $111,617, with an increase of 0.14 percent in the last 24 hours.