Bitcoin  $111,463.88The steady rise of , which has continued since the summer months, has lost momentum. At the time of preparation of the news CryptoAppsy According to data, the largest cryptocurrency traded around $ 111,000 could only rise by 2 percent in the last week. The pullback from record highs above $126,000 indicates that momentum is waning and investors are turning to hedging.

$111,463.88The steady rise of , which has continued since the summer months, has lost momentum. At the time of preparation of the news CryptoAppsy According to data, the largest cryptocurrency traded around $ 111,000 could only rise by 2 percent in the last week. The pullback from record highs above $126,000 indicates that momentum is waning and investors are turning to hedging.

Derivative Volume Increases While Spot Demand Decreases

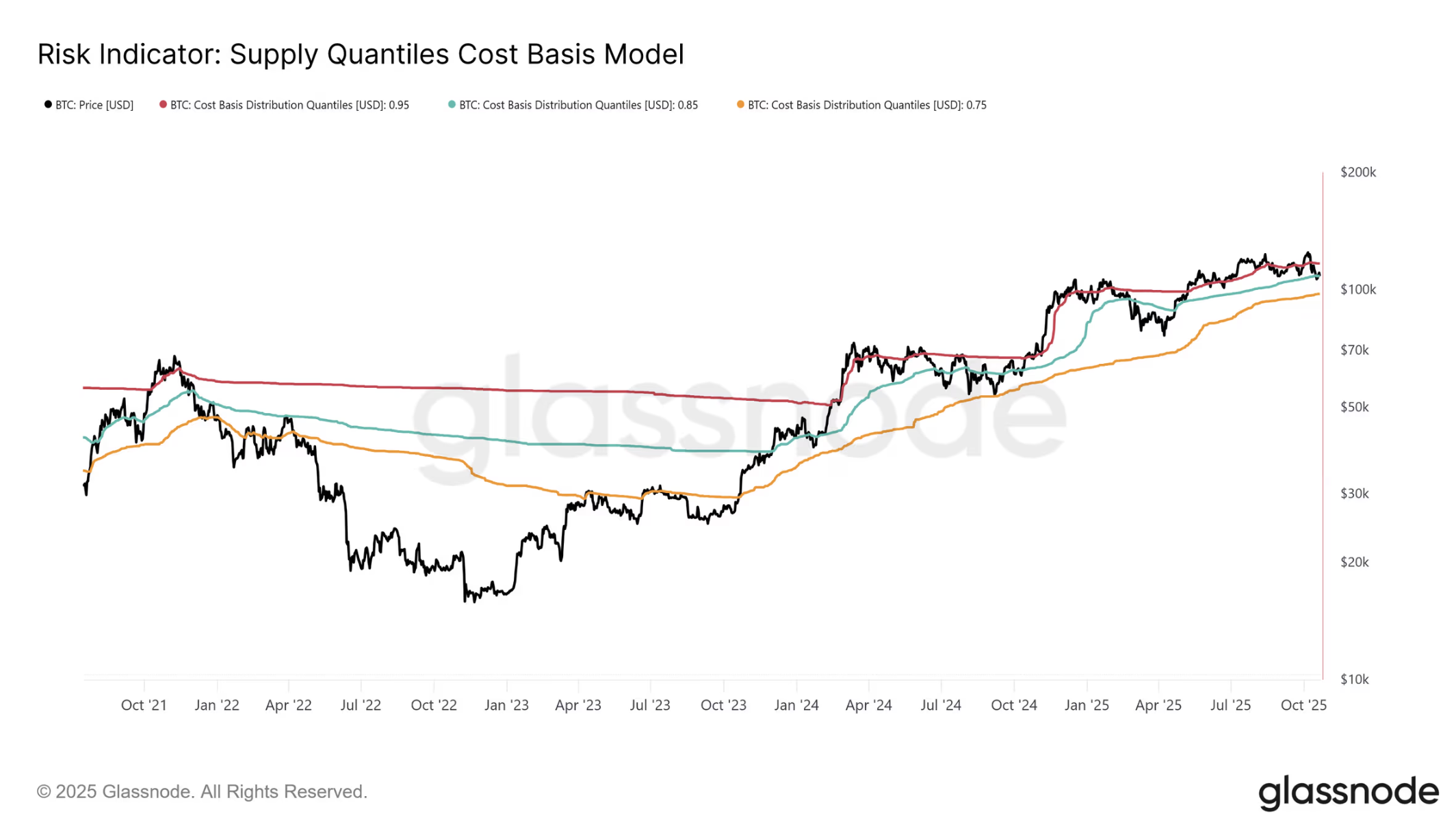

According to current data compiled by Glassnode, Bitcoin is facing a loss of strength below the $113,000 threshold, which is the cost base for short-term investors. The drop below the $113,000 level indicates that new buyers are at a loss and market confidence is weakening. The analysis company added that the $108,000-$97,000 band historically corresponds to the region where supply is at a loss of 15-25 percent. Long-term investors have been buying 22,000 units per day since July. BTCSales of up to 100,000 are suppressing attempts at recovery.

CryptoQuant data shows that the capital cryptocurrency marketIt reveals that it has not left the market but has shifted from the spot market to derivatives. The halt in ETF inflows and the increase in stock market reserves again reflect investors trying to benefit from volatility. Similar to the structural transitions in mid-2021 and 2022 cryptocurrency The market seems to have entered a derivative-centered cycle again.

Option Demand Becomes the Mirror of Risk Aversion

glassnodereported that the open position in the options market reached record levels. It is noticeable that investors are now focusing on protection rather than rise. Put demand across maturities has increased significantly. Delta neutral positions of market makers limit price fluctuations, covering increases with sales and decreases with buying. Thus, price movements are shaped by risk management strategies rather than directional belief.

CryptoQuant Analysts interpret the current situation in Bitcoin as a sign of consolidation, not collapse. While liquidity remains within the ecosystem, investors avoid taking new positions without a clear macro signal or the expectation of a Fed interest rate cut. It is stated that for a permanent recovery, spot demand should strengthen again and derivative volatility should normalize.