cryptocurrencies is recovering and Trump’s statements at 22:00 were not shocking for the markets. Tomorrow we will see US inflation figures, and on Wednesday the Fed will make its interest rate decision amid increasing tension. Martinez drew attention to the 1064-day detail on the BTC chart. Let’s make a quick summary and evaluation. There is also some important data regarding China and US trade.

Day 1064 on Bitcoin Chart

Bitcoin  $109,411.71 The graph contains the laws of four-year cycles. Many on-chain metrics, BTC chart and more diverse indicators contain patterns that are expected to repeat in familiar cycles. It is clear that the current cycle is different from others, but Martinez still thinks that an interesting coincidence is signaling to investors.

$109,411.71 The graph contains the laws of four-year cycles. Many on-chain metrics, BTC chart and more diverse indicators contain patterns that are expected to repeat in familiar cycles. It is clear that the current cycle is different from others, but Martinez still thinks that an interesting coincidence is signaling to investors.

In the last 2 cycles BTC price It reached its bull peak exactly 1064 days after the bottom of the bear markets. From the November 2022 bottom to this month’s new and final ATH level of $126,220, BTC took 1,064 days. So, if history repeats itself, BTC saw its bull peak this month. But these are not laws of physics, and we have seen many loop laws violated. For example, in the last bear markets, BTC could not maintain the previous ATH level as support because there was an abnormal environment. Just like the environment today (crypto reserve companies, ETFs, incipient interest rate cuts and dozens of other things) that shows that the opposite direction may continue.

US-China Trade

NVIDIA CEO Huang recently mentioned that its business in China has stopped. The USA first introduced high taxes, then prevented the sale of some products to China, then NVIDIA He offered to pay the taxes to the USA out of his own pocket, and in the end China said “we don’t want NVIDIA chips anymore.”

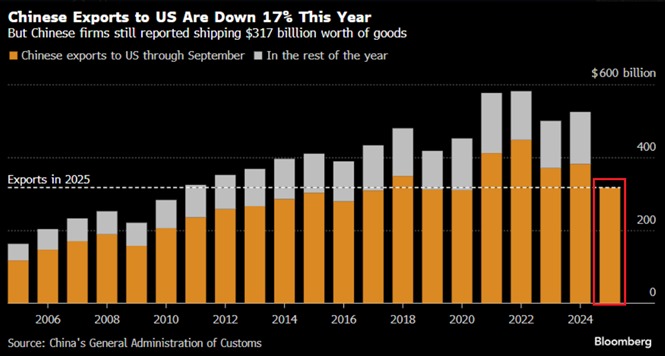

As a result, the following graph was created.

TKL wrote the following on this subject;

“China’s exports to the USA decreased by 18% on an annual basis in the first 9 months of 2025 to 317 billion dollars, reaching the lowest level in the last 5 years.

Since 2022, exports have decreased by 29%, or 131 billion dollars.

This figure is comparable to the level of $309 billion seen in the first 9 months of 2017, when the first trade war began.

Additionally, small package shipments fell 50% since April to $1.15 billion in September. While all this was happening, LCD TV exports from China to the USA decreased by 73% in value in the last quarter. “Trade between the two major economies is slowing down rapidly.”

Look at this graph when there is no compromise and reciprocal tariffs and export controls are introduced.

Chainlink, ETH and BTC

Chainlink  $17.52 reserve Something good happened for you today. Scott Melker expressed his satisfaction with the newly added 63,481 LINK Coins to the reserves. LINK Coin reserves reached 586,640 in total. LINK Coin continues the day up 1.2% at $17.47.

$17.52 reserve Something good happened for you today. Scott Melker expressed his satisfaction with the newly added 63,481 LINK Coins to the reserves. LINK Coin reserves reached 586,640 in total. LINK Coin continues the day up 1.2% at $17.47.

Nic shared the current BTC chart for those wondering what will happen next and said;

“We are currently above the 200-day moving average and hopefully we can manage to close above this level. The next zone I am following is 110,000 – 111,000. This is where the 61.8% Fibonacci extension and the previous support/resistance zone are located. I hope we can reverse this level.”

CryptoBullet pointed out what changed at the cycle peak. While ETH is making larger highs at the cycle peak, BTC is making lower highs, and the analyst says it’s about time.

“They say: So you think ETH will reach a new ATH but BTC will not? How is this possible?

In fact, this is a pattern we see at the end of every cycle.

Always at the top of the cycle ETH And BTC There is a downward trend between . This is called “liquidity rotation”. ETH reaches a higher high while BTC reaches a lower high.

Then they say: But sir, during previous BTC peaks ETH held up pretty well.

No, it wasn’t holding up!

December 2017 is down 39%, April 2021 is down 23% and October 2023 is down 27%.

“We made our final correction on ETH before entering into price discovery.”

The most important thing these days is to stay up to date in the midst of a busy agenda. Because so much is happening and conditions/processes are changing so quickly. That’s exactly why CryptoAppsy The live news feed will be very useful and will keep you up to date. Here, you will be able to access both news summaries and details of important developments with just one click. You will also not miss the important developments of the week.