Bitcoin  $109,411.71The price of continues to move in a narrow band, remaining below its short-term cost base. BRN Research Head Timothy Egyptstated that the squeeze in the market has turned into a test of patience. Bitcoin, which was traded around $109,000 as of October 23, has lost more than 3 percent in value in the last month.

$109,411.71The price of continues to move in a narrow band, remaining below its short-term cost base. BRN Research Head Timothy Egyptstated that the squeeze in the market has turned into a test of patience. Bitcoin, which was traded around $109,000 as of October 23, has lost more than 3 percent in value in the last month.

Open Position Broke a Record in the Options Market

According to BRN data Bitcoin optionsThe open position value in has reached new heights. Misir emphasized that investors’ preference for put options has changed the market dynamics. The density of put options causes short gamma positions to increase in the derivatives market. This structure hardens price movements by increasing volatility with aggressive hedging transactions in small price changes.

The analyst stated that the failure to exceed $ 113,000 permanently pushed weak investors to sell. He added that if the $ 108,000 level is lost, there may be a risk of a drop to 104,500 or even $ 97,000.

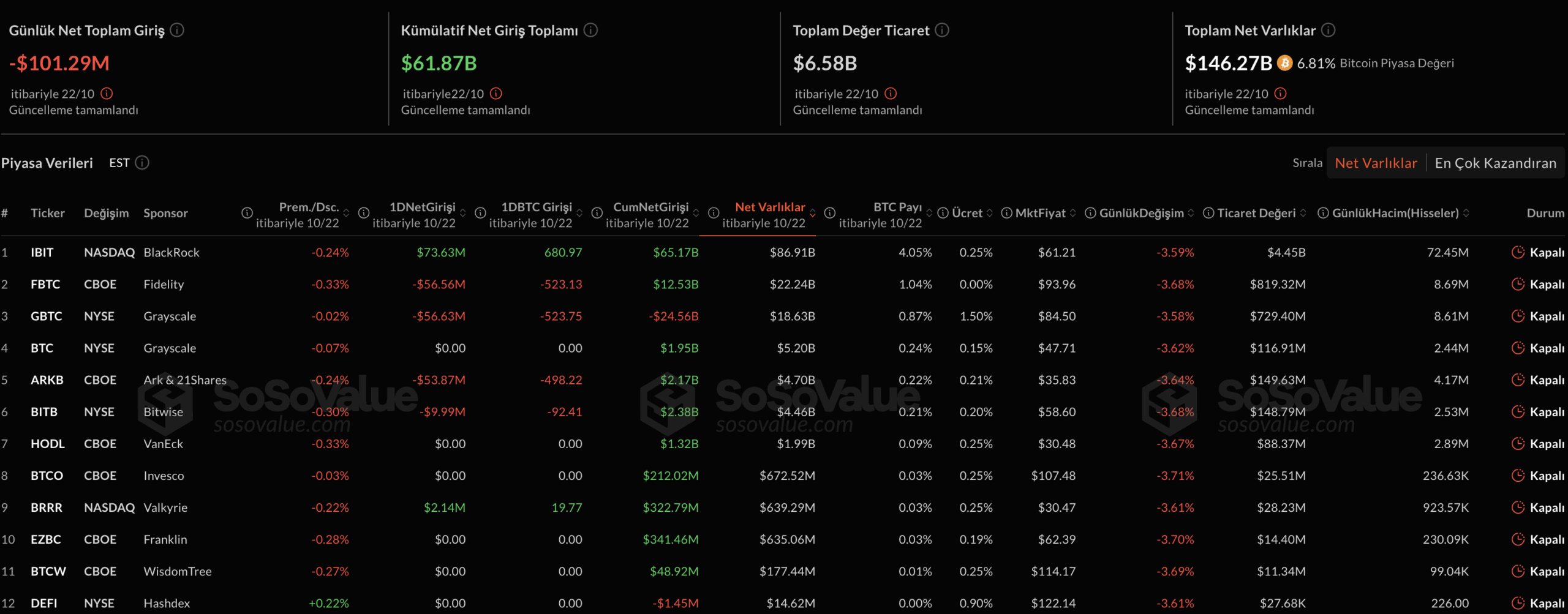

ETF Flows and Macro Uncertainty Pressure

SoSoValue Data show that the weak trend continues on the corporate side. spotlight on wednesday Bitcoin ETF$101 million from Ethereum  $3,887.23 There was an outflow of 19 million dollars from ETFs. BRN warned that these withdrawals on the liquidity side could accelerate long-term investor sales.

$3,887.23 There was an outflow of 19 million dollars from ETFs. BRN warned that these withdrawals on the liquidity side could accelerate long-term investor sales.

On the macro front, the halt in data flows due to the US government shutdown caused investors to focus on the CPI data to be announced on Friday. QCP Capital reported that a soft monthly inflation data of around 0.2 percent could support Bitcoin’s rise, while a higher data flow could fuel the decline by accelerating risk aversion.

Standard Chartered, on the other hand, stated that it seems inevitable to fall below $ 100,000 in the short term, but the decline may remain short-lived. BRN said the market is still in the proof-of-confidence phase. ETFHe added that purchases in ‘s and long-term investor sales balanced each other and the rises became fragile.

CryptoAppsy According to data, Bitcoin is trading at $109,222 with an increase of 1.50 percent in the last 24 hours at the time of writing.