ProSharestook action to offer a new investment tool based on diversity in the cryptocurrency market. The company filed a lawsuit with the US Securities and Exchange Commission (SEC). in application Bitcoin  $107,888.00Ethereum

$107,888.00Ethereum  $3,874.69is based on the CoinDesk 20 Index, which tracks major cryptocurrencies like XRP and Solana. ETF He announced that he wanted to present it. The ETF aims to offer investors a wide range of cryptocurrency themes through a single index by measuring the performance of the 20 cryptocurrencies with the highest market value.

$3,874.69is based on the CoinDesk 20 Index, which tracks major cryptocurrencies like XRP and Solana. ETF He announced that he wanted to present it. The ETF aims to offer investors a wide range of cryptocurrency themes through a single index by measuring the performance of the 20 cryptocurrencies with the highest market value.

ProShares CoinDesk Crypto 20 ETF is structured to take positions indirectly through swap contracts, derivatives and similar financial instruments based on index components, rather than holding cryptocurrencies directly. The ETF is planned to establish a subsidiary in the Cayman Islands and conduct some of its derivative transactions through this structure, but there will be a limit of not exceeding 25 percent of its assets.

CoinDesk 20 Index, Bitcoin, Ethereum, XRP, solana, Cardano  $0.641982 And Avalanche

$0.641982 And Avalanche  $19.84 It includes cryptocurrencies with the highest market value and liquidity, such as. The index is rebalanced quarterly and excludes stablecoins, memecoins or wrapped tokens. This structure concentrates the ETF’s focus on cryptocurrencies with lower volatility risk and high transaction volume.

$19.84 It includes cryptocurrencies with the highest market value and liquidity, such as. The index is rebalanced quarterly and excludes stablecoins, memecoins or wrapped tokens. This structure concentrates the ETF’s focus on cryptocurrencies with lower volatility risk and high transaction volume.

In an increasingly competitive environment, with VanEck reducing the fees for the Solana ETF application to 0.3 percent, this move by ProShares is considered a sign of a new era among cryptocurrency index ETFs. The company’s plan is presented to investors within a regulated framework. cryptocurrency marketIt is based on providing access to the overall performance of.

ETF Race Heats Up as Institutional Demand Grows

ProShares set out to expand its cryptocurrency-themed product range after the intense interest in the Bitcoin futures ETF it launched in 2021. The company’s latest cryptocurrency ETF application is a response to the demands of institutional investors for a multi-asset basket, aiming to reduce volatility in single assets.

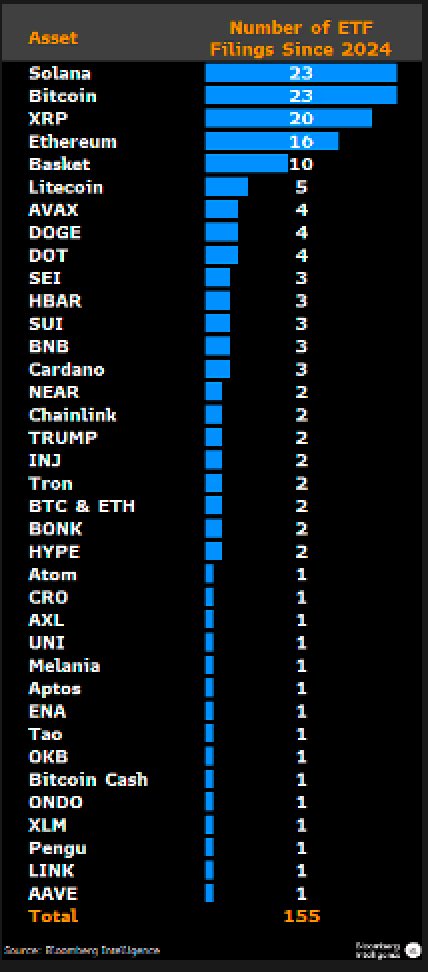

Bloomberg ETF analyst Eric BalchunasAccording to , there are currently 35 different cryptocurrencyA total of 155 cryptocurrency-based exchange investment product files are before the SEC. Balchunas stated that this number may exceed 200 in the next 12 months. Additionally, other issuers such as REX–Osprey are also increasing diversification with new ETF applications for altcoins such as ADA, HYPE, XLM, and SUI.

If the SEC approves the ProShares CoinDesk Crypto 20 ETF, it will be the first broad-based U.S. cryptocurrency index ETFIt is expected to be one of the. This could accelerate traditional financial institutions’ more systematic inclusion of cryptocurrencies in their portfolios.