The cryptocurrency market closed the week with heavy losses. Bitcoin (BTC)  $105,106.73falling to a three-month low below $104,000 on many exchanges. The largest altcoins were also affected by this decline. Ethereum (ETH)

$105,106.73falling to a three-month low below $104,000 on many exchanges. The largest altcoins were also affected by this decline. Ethereum (ETH)  $3,731.70BinanceCoin

$3,731.70BinanceCoin  $1,042.20 (BNB), XRP, Solana (SOL) and Dogecoin

$1,042.20 (BNB), XRP, Solana (SOL) and Dogecoin  $0.178042 Leading crypto assets such as (DOGE) have lost significant value. Friday became known as “bloody Friday” among investors.

$0.178042 Leading crypto assets such as (DOGE) have lost significant value. Friday became known as “bloody Friday” among investors.

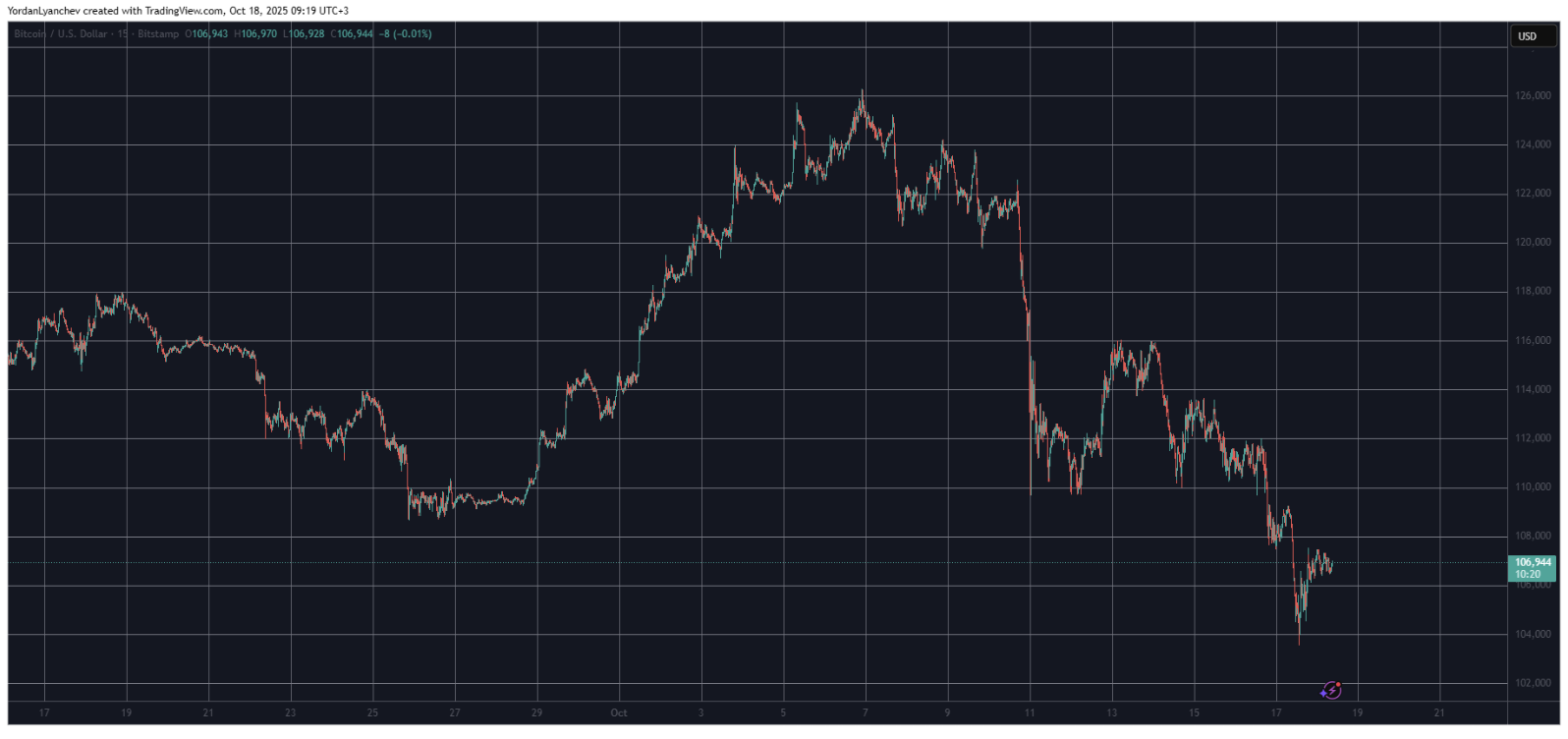

Three-Month Bottom in Bitcoin and Trump’s Impact

The selling wave that started last Friday was triggered by BTC falling from $122,000 to $110,000. The price, which dropped to $101,000 on major exchanges such as Binance, recovered at the beginning of the week and rose to $116,000. However, with a sharp rejection at this level, the decline accelerated again. The $110,000 support was broken on Thursday evening, and on Friday BTC fell below $104,000, hitting a three-month low.

On the other hand, US President Donald Trump’s announcement last week that he would withdraw new customs tariffs against China created a short-term relief in the markets. Following the announcement, Bitcoin showed a limited reaction rise, rising above $ 106,000. However, the overall outlook remains weak. While Bitcoin’s market value decreased to 2.13 trillion dollars, its dominance over altcoins increased to 57.3 percent.

Heavy Losses in Altcoins

Losses were deeper in the altcoin market compared to Bitcoin. While Ethereum (ETH) fell below $3,900, BNB lost 3 percent of its value and lost the $1,100 support. While TRX, DOGE, ADA, LINK, HYPE, BCH, SUI, AVAX and HBAR are in the red zone; XRP, SOL and XLM remained positive, albeit limited. While COAI lost 17 percent in value in the last 24 hours, AAVE decreased by 5.3 percent and ASTER decreased by 5 percent. On the other hand, ENA increased by 12.5 percent and TAO increased by 8 percent.

Although the total cryptocurrency market value is trying to stabilize around $ 3.7 trillion, there has been a loss of approximately $ 500 billion since last week. This shows that investor confidence has decreased and the market has become vulnerable to global developments. Analysts state that US-China trade tensions, interest rate policies and ETF fund flows will determine the direction in the coming weeks.

As a result, Bitcoin’s loss of critical support levels in recent weeks once again revealed how sensitive the market is to global economic and political developments. New developments in US-China relations, macroeconomic stability and central bank decisions will be the determining factors in the short term. If global uncertainty continues, new lows may be seen in altcoins as investors turn to safe havens.