While there was a record liquidation of $ 20 billion in the cryptocurrency market in the last 24 hours, Crypto.com CEO Kris Marszalek called on regulators to examine the transactions in the stock markets. Marszalek, in his post on social media platform

Binance Promised Compensation to Its Users

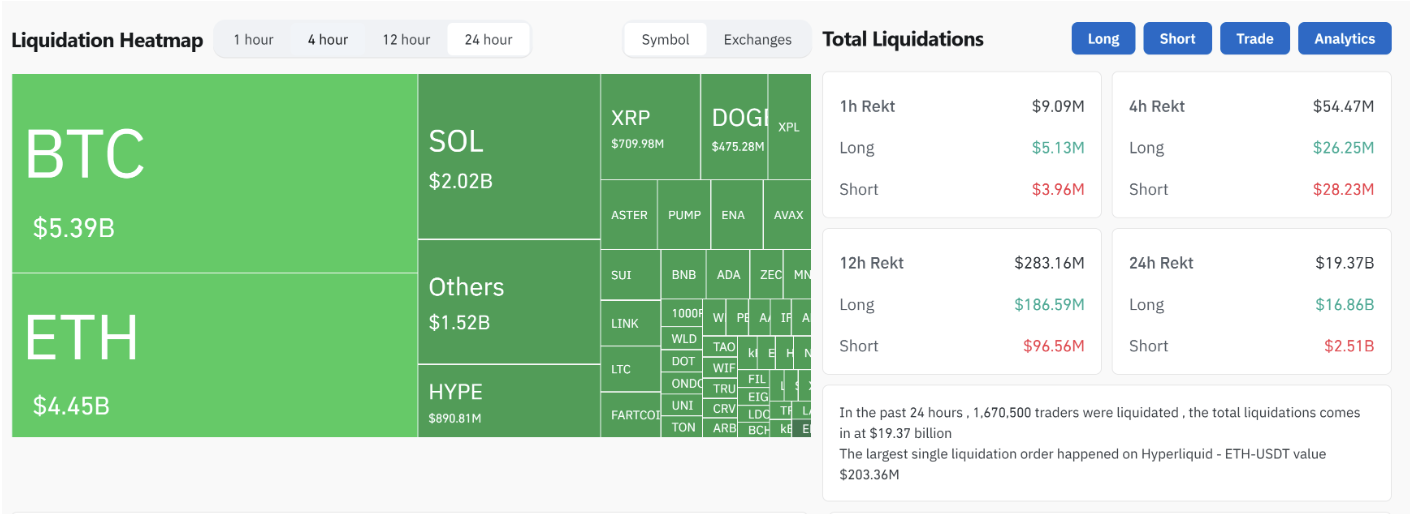

According to CoinGlass data, the platform with the most liquidations was Hyperliquid, and a total of $10.31 billion in positions were deleted. It was followed by Bybit ($4.65 billion) and Binance ($2.41 billion). On other major exchanges such as OKX, HTX and Gate, losses were recorded as 1.21 billion, 362.5 million and 264.5 million dollars, respectively.

Binance has confirmed that price divergence regarding Ethena’s USDe, BNSOL, and WBETH tokens has caused some users to face forced liquidations. The company announced that it is examining the affected accounts and will make compensation payments when deemed appropriate.

Binance co-founder Yi He responded to user complaints with a public apology and said, “Losses caused by platform errors will be compensated, but losses resulting from market volatility will be excluded from the scope of compensation.”

According to crypto analyst Quinten François, the latest crash has surpassed all past liquidations. The $19.31 billion liquidation far exceeds the $1.2 billion loss seen during the COVID-19 crash and the $1.6 billion loss in the FTX bankruptcy.

Tariff Shock from Trump Shook the Market

Behind the market collapse is US President Donald Trump’s harsh tax plan on Chinese imports. Trump announced that 100% customs duty will be applied to all imports from China as of November 1. This decision is in response to China’s move to limit rare earth element exports. The Beijing administration recently introduced a license requirement for the export of products containing more than 0.1% rare earth elements.

In summary, this major liquidation wave in the crypto market seriously shook investor confidence. Comments are made that technical errors and fair transaction doubts, especially in centralized exchanges, may lead to increased regulatory pressures. This volatility, combined with the economic moves of the Trump administration, may make it difficult to maintain stability in the markets in the short term. Investors need to act cautiously and avoid positions with high liquidity risk.