US Federal ReserveWith the statement in the minutes of the (Fed) September FOMC meeting that additional easing may be made until the end of the year, Bitcoin  $121,644.47 It started to move horizontally in the $121,000–124,000 band. According to meeting minutes, nearly half of policymakers foresee two more interest rate cuts before the end of the year. Interest rate futures pricing also points to softer financial conditions in the fourth quarter.

$121,644.47 It started to move horizontally in the $121,000–124,000 band. According to meeting minutes, nearly half of policymakers foresee two more interest rate cuts before the end of the year. Interest rate futures pricing also points to softer financial conditions in the fourth quarter.

Expectations Regarding the Fed’s Monetary Policy

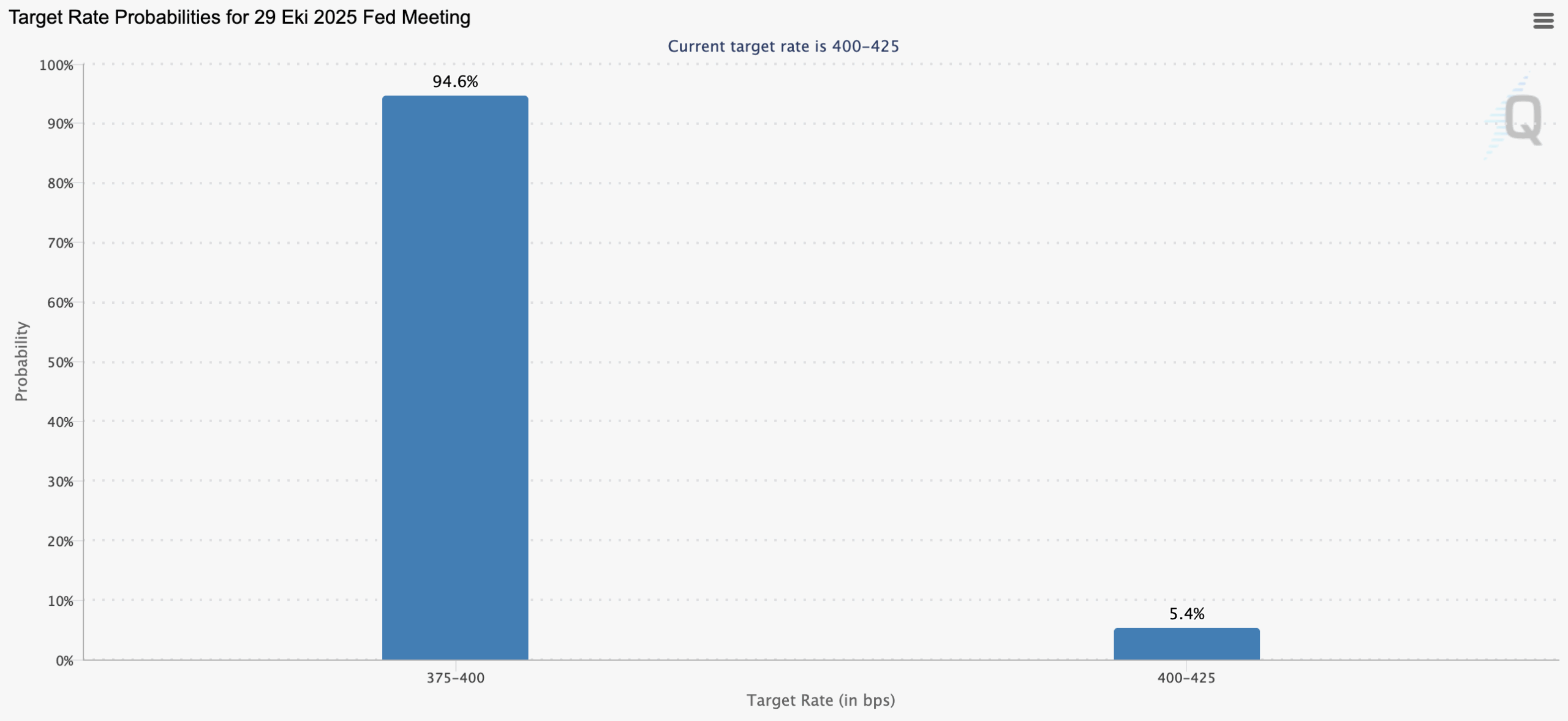

BRN Research Director Tim Egyptfound the assessment that “The needle is turning in the global liquidity cycle, central banks are shifting from tightening to easing” and emphasized that the markets are pricing in the high possibility of a 25 basis point cut in the Fed’s next FOMC meeting on October 29. The emphasis on “additional reduction” in the minutes points to a simultaneous softening in monetary policy conditions in the US as we enter the fourth quarter, creating a backdrop that is historically consistent with the increase in risk appetite.

CME FedWatchThe data provided by , and contracts on forecasting platforms such as Polymarket, show that the possibility of an additional interest rate cut decision at the meeting on October 29 has increased significantly, and the expectation for more than one interest rate cut until the end of the year has strengthened.

Experts, ETF Stating that the fund flows on the institutional investor side are the clearest signal regarding the trend on the institutional investor side, he emphasizes that a slowdown in fund inflows will be the leading signal of the trend reversal.

Latest Status of Bitcoin Price

In intraday transactions in Bitcoin, the search for balance around $ 123,000 came to the fore. Analysts state that the $121,000–126,000 range is the short-term reference range, and a permanent break above this range may open the door to $130,000. While the structure indicates a digestion phase just below the previous peaks, it is emphasized that upward attempts may continue as long as spot demand continues.

options marketThe fact that the open position size remains above 50 billion dollars keeps the potential for increase in volatility attacks on the agenda. Experts emphasize that the primary variable in determining direction is the Fed’s interest rate cut schedule and the continuity of ETF demand, and that these two factors clearly direct the course of the price. It is evaluated that if the technical threshold of 121,000–126,000 dollars is clearly exceeded in the price chart, the option-induced acceleration may accelerate.