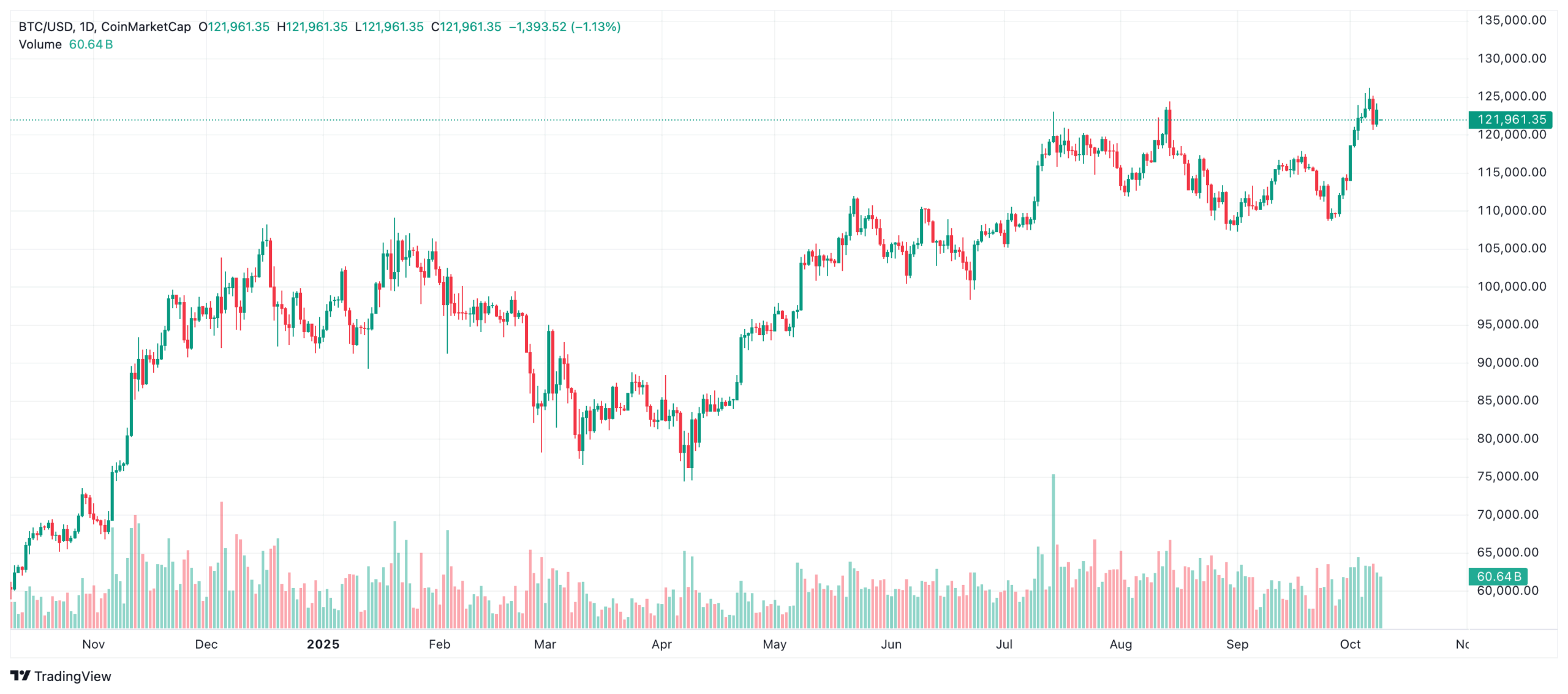

Famous for his predictions that came true Arthur Hayes“Long Live the King!” titled ending in the blog post He claimed that the possibility of a bear market for the coming months has weakened, making the traditional four-year block reward halving cycle effectively obsolete. Maelstrom’s co-founder and CIO said previous sharp declines were triggered not by the block reward halving calendar but by the impact on major economies. monetary tightening showed as. Hayes placed the Fed’s decision to cut interest rates by 25 basis points in September to around 4 percent, opening the door to an additional 100 basis point reduction in the next 12 months, at the center of the narrative. The monetary expansionary tone expected from Washington, Tokyo and Beijing will ultimately Bitcoin  $121,644.47 and added that he will support cryptocurrencies.

$121,644.47 and added that he will support cryptocurrencies.

Hayes’ Monetary Policy Thesis: Follow Liquidity, Not the Cycle

Hayes underlined that the common denominator of the 70-80 percent depreciation in 2014, 2018 and 2022 is global monetary tightening. Block reward halvingHe emphasized that it is a technical milestone indicating a supply shock, but the main direction is determined by the fiat liquidity trend. He based his opinion that the four-year block reward halving model will not work this time on “cash abundance – risk appetite”.

According to the analyst, the common approach in Washington is to warm up the economy and provide relief to households by reducing housing costs. He added that at this point, the Fed’s interest rate reduction path as well as the desire for expansion on the economic side are in favor of risky assets. He stated that the Beijing administration’s search for reflation against the threat of low inflation is in the direction of supporting liquidity, not absorbing it.

Macro Levers That Support Cryptocurrencies

USAThe expectation of gradual relaxation from the Fed after the interest rate cut in September points to a phase in which dollar liquidity is no longer squeezed. Markets expect additional gains of up to 100 basis points in total within 12 months interest rate reductionThe relaxation in the yield curve is expected to reduce the discount rate of technology and cryptocurrencies. The picture that emerges with ETF inflows and the shrinkage of supply in stock exchanges affects the supply-demand balance upwards.

JapanThe new prime minister’s closeness to the Abenomics line signals that monetary conditions will remain soft. Chinese If the focus on combating deflation is transferred to the real sector through credit expansion and targeted incentives, regional liquidity pools can create an additional transmission channel for cryptocurrencies. Hayes summarized his expectation with the statement, “Money will be cheaper and more abundant.”