BitwiseSpot Bitcoin in the USA in the fourth quarter  $122,655.72 ETFs are waiting for a record entry. Until the end of the year, a fund flow is envisaged to exceed the total of 2024. Bitwise CIO Matt Hougan Sent to customers on Tuesday night Note He emphasized the acceleration of investment consultant approvals, the value of the value of the erezion in cash -like assets, and the acceleration of prices. Hougan note that with the double -digit rise at the beginning of the month, interest increased again and media visibility also feeds the demand. According to current data, on the first four trading day of the quarter Bitcoin 3.5 billion dollars of a net entry into their ETFs, and the last trading day was 875.6 million dollars on Tuesday.

$122,655.72 ETFs are waiting for a record entry. Until the end of the year, a fund flow is envisaged to exceed the total of 2024. Bitwise CIO Matt Hougan Sent to customers on Tuesday night Note He emphasized the acceleration of investment consultant approvals, the value of the value of the erezion in cash -like assets, and the acceleration of prices. Hougan note that with the double -digit rise at the beginning of the month, interest increased again and media visibility also feeds the demand. According to current data, on the first four trading day of the quarter Bitcoin 3.5 billion dollars of a net entry into their ETFs, and the last trading day was 875.6 million dollars on Tuesday.

Three titles that raise expectations for the 4th quarter in Bitcoin

Hougan said that formal authorities in the investor consultant wing opened the door to the increase in demand. Among the developments on this side Morgan Stanley It was to publish limits that frame crypto money allocation in multiple asset portfolios. Finance services giant recommended 0 percent for cautious portfolios and a 2–4 percent allocation rate for higher risk appetite. Wells Fargowhile opening the way to access to Bitcoin ETFs to his advisors UBS And Merrill lynchis expected to take similar steps. Although the approval processes on large -scale networks are gradually progressing, the professionals that Bitwise has met in recent months indicate that a strong demand is waiting.

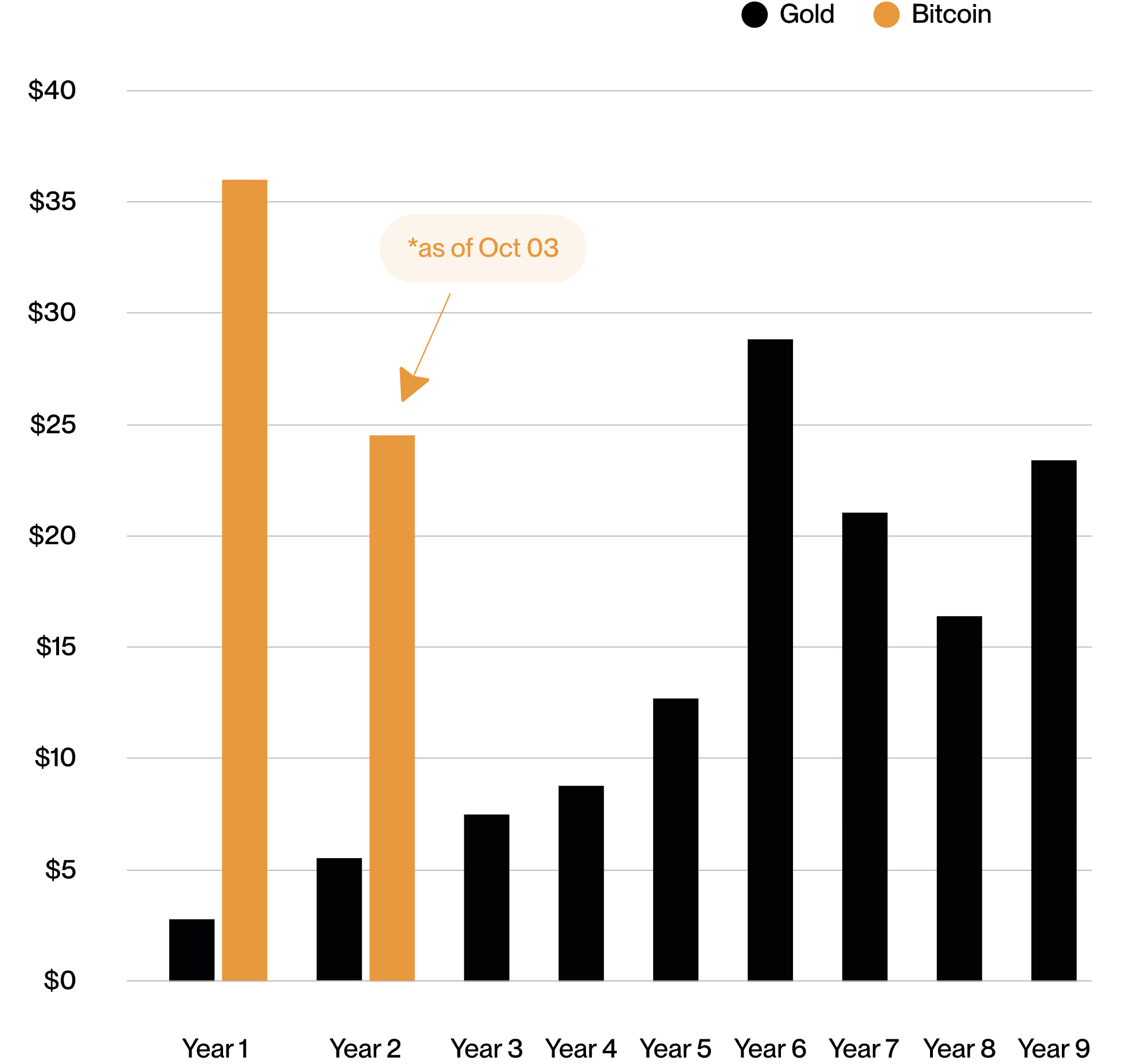

Value Erezion The narrative also feeds the acceleration in the market. 44 percent increase in money supply since 2020 and Jpmorgan‘s evaluations that bring the discussion to the mainstream of the year for the end of the year in the portfolio review gold with Bitcoin. The most powerful major asset performances of the year, Gold and Bitcoin’s prominence increases the motivation of allocation of investment consultants towards the closing of the year.

Fund flow dynamics for ETFs

The historical bond between the acceleration in the price and the entrances to ETFs strengthens the expectation. Bitcoin moved over $ 1260,000 with a 9 percent rise at the beginning of the month and then withdrawn to $ 121,600. Bitwise noted that in every quarter of a double -digit return on ETF side, a double -digit billion -sized fund entrances were reached.

Current fund flow data for ETFs also support optimism. After the $ 3.5 billion fund stream on the first four trading day of the month, an additional entrance of $ 875.6 million was on Tuesday. Blackrock’s IBIT’s led by $ 899.4 million. The daily entrance of $ 1.21 billion on Monday has reached the highest volume after the US Presidential election in November last year. Hougan since the beginning of the year ETFHe added that the threshold of 25.9 billion dollars was overcome in the entrances of the $ 64 days before the end of the year.