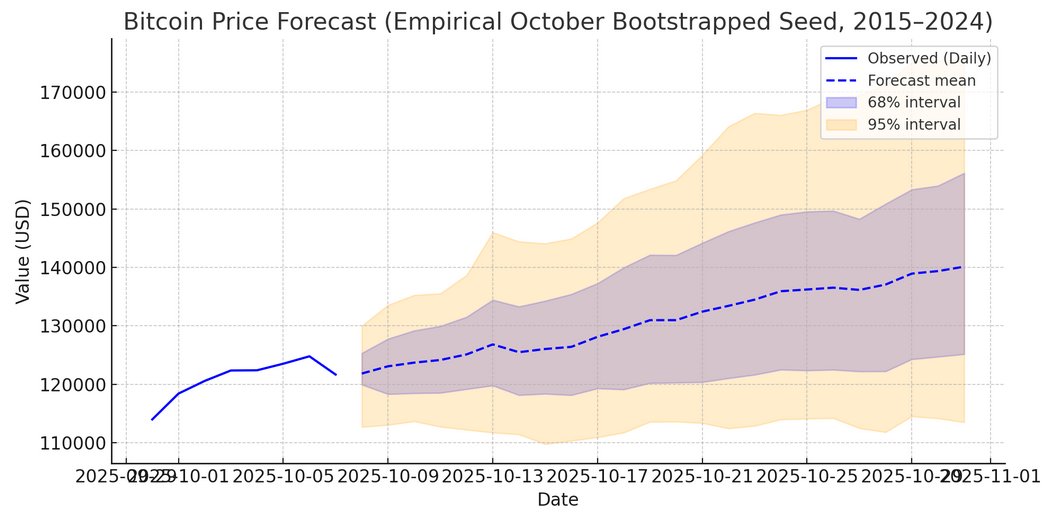

It broke the record with $126,200 at the beginning of the week. Bitcoin  $122,655.72It is trying to find balance above $122,000 after falling to $121,600 following the correction in the last 24 hours. Despite the decline, some analyzes keep a new bullish scenario on the table, which could reach $140,000 within the month. Economist Timothy Petersonwith simulations dating back to the last decade, there is a 50 percent chance that the price will close the month above $140,000. shared. He reported that the probability of closing below $ 136,000 is 43 percent.

$122,655.72It is trying to find balance above $122,000 after falling to $121,600 following the correction in the last 24 hours. Despite the decline, some analyzes keep a new bullish scenario on the table, which could reach $140,000 within the month. Economist Timothy Petersonwith simulations dating back to the last decade, there is a 50 percent chance that the price will close the month above $140,000. shared. He reported that the probability of closing below $ 136,000 is 43 percent.

Factors Supporting the $140,000 Thesis in Bitcoin

Spot Bitcoin ETFThere has been a net inflow of over $60 billion since their launch in January 2024. ETFs saw near-record inflows last week alone, with $3.2 billion inflows.

Moreover, centralized cryptocurrency exchanges BTC Its balance fell to 2.83 million units, corresponding to a six-year low. 170,000 BTC were withdrawn from the exchanges in the last month alone. The combination of institutional purchases and shrinking circulating supply allows the price to maintain its upward trend despite the pullback triggered after the last record. While the “Uptober” narrative used for October supports the technical outlook, weak short position accumulation contributes to shallow corrections.

Risk appetite on the stock market side also gives strength to Bitcoin. From SignalPlus Augustine FanPointing out that there is a possibility, albeit limited, that prices an additional 10 percent rise in the S&P 500 by the end of the year, he pointed out that investor positions are relatively low but risk-taking. It is a known fact that Bitcoin is positively affected by liquidity cycles when risky assets find support in synchronization.

Not Without Risks

From LVRG Research Nick RuckStating that the strong technical basis is balanced with macro uncertainty, he emphasized that although corporate demand and accumulation trend make new peaks possible, surprises in the Fed’s monetary policy may have a hard impact on pricing. The failure to publish new macro data due to the government shutdown in the USA narrows the scope of decision-makers, especially regarding inflation indicators, and may postpone interest rate cut expectations.

The interest rate decision to be issued by the FOMC at the end of the month and the balance sheet period of the “Mag-7” companies will meet with expanded valuations. If the data confirms risk appetite, acceleration towards $140,000 could be triggered. Otherwise, pricing may return to a search for a healthier bottom. Market direction ETF will be determined depending on these two catalysts, along with the tempo of inflows and off-exchange supply dynamics.