Today, Fed members will not make assessments on the current situation of the economy at the Banking Conference. A few hours later, Trump will have some explanations with Carney. Tomorrow too Fed minutes there is. In other words, crypto coins were largely left to itself and the US closure came into the crypton. So what are Martinez’s current XRP, Ada, Seı and Algo Coin estimates?

XRP and Ada Coin

XRP Coin normally wanted to make summits over $ 3 on such an increase, but we cannot see it. The rising from Trump’s winning elections and managed to remain strong in decreases and remain excited about the rise. XRP Coin He finds buyers below $ 3. Moreover, XRP Coin ETF approval is expected to come in this quarter.

Ali Martinez, who deals with the current situation, is hopeful for Xrp Coin. Analyst, who says that $ 3.6 will be tested by breaking $ 3.15 soon, is sure that we will see the new AC before the end of the year.

Ada Coin In the graph that he shared for, he mentioned that the key level that needs to be monitored $ 0.9. However, because the BTC article began to move away from $ 125 thousand at the time of being prepared, Ada Coin, which approaches $ 0.83, declines without seeing the rise. If BTC returns and Ada Coin follows it, $ 1.15 can be recovered with closing over $ 0.9.

Sei and algo comment

SEI He talks about the analyst’s favorite crypto currencies and now the resistance line is about to break. Of course, when he talked about it, BTC did not return to 122,500 dollars of prices. BTC It has seen the lowest price of the last 24 hours, which has already brought a 5 percent decrease in Avax.

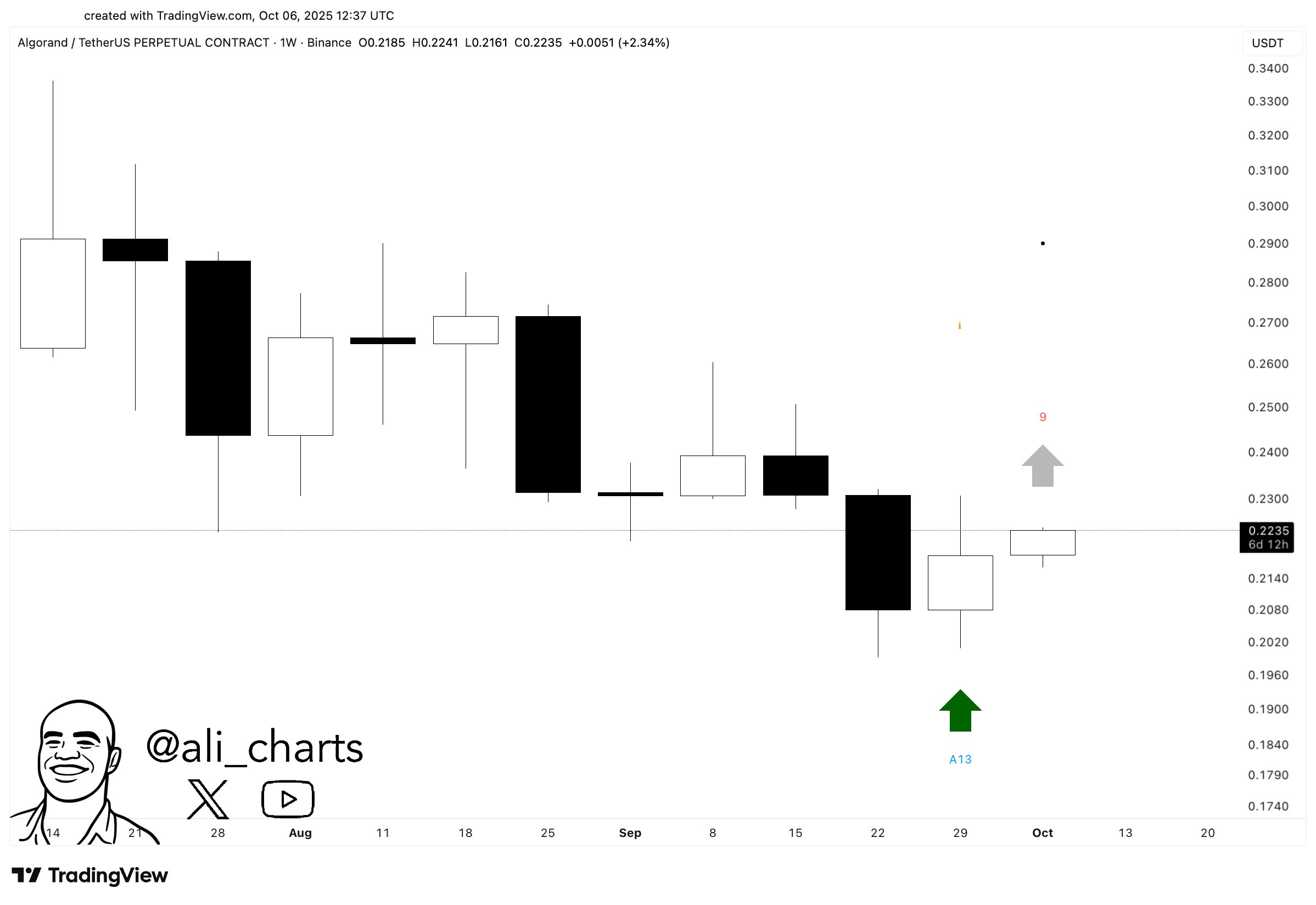

TD Sequental, Martinez, who shares a warning in the form of a purchase signal for algorand, rely on this indicator. However, the risk of change in the general market sensation may have been frustrated by the signal in the following minutes.

Although the FED member Miran Gündem was not currently an economic appearance, the article said the following;

“In the uncertainty environment, growth in the first half of the year remained below expectations. Many uncertainties regarding the economy have disappeared.

With the disappearance of uncertainty, there are reasons to be more optimistic. Since the neutral interest rate has decreased, the Fed’s policy has become more restrictive and the restrictive monetary policy has risks. Risks arise if monetary policy is not set. My opinion is that monetary policy should be forward -looking. ”