Spot Ethereum  $4,676.74 Funds towards ETFs and corporate treasury companies have taken over the serious part of the circulating ETH. According to the data compiled by Stockanalysis, Spot ETFs control more than 5 percent of the supply with 6.3 million ETHs. Company treasures have a serious control with more than 4 million ETH accumulation. It strengthens the tendency on this side in the newly described huge purchases. The market pricts in the decline and increasing demand balance in circulating supply.

$4,676.74 Funds towards ETFs and corporate treasury companies have taken over the serious part of the circulating ETH. According to the data compiled by Stockanalysis, Spot ETFs control more than 5 percent of the supply with 6.3 million ETHs. Company treasures have a serious control with more than 4 million ETH accumulation. It strengthens the tendency on this side in the newly described huge purchases. The market pricts in the decline and increasing demand balance in circulating supply.

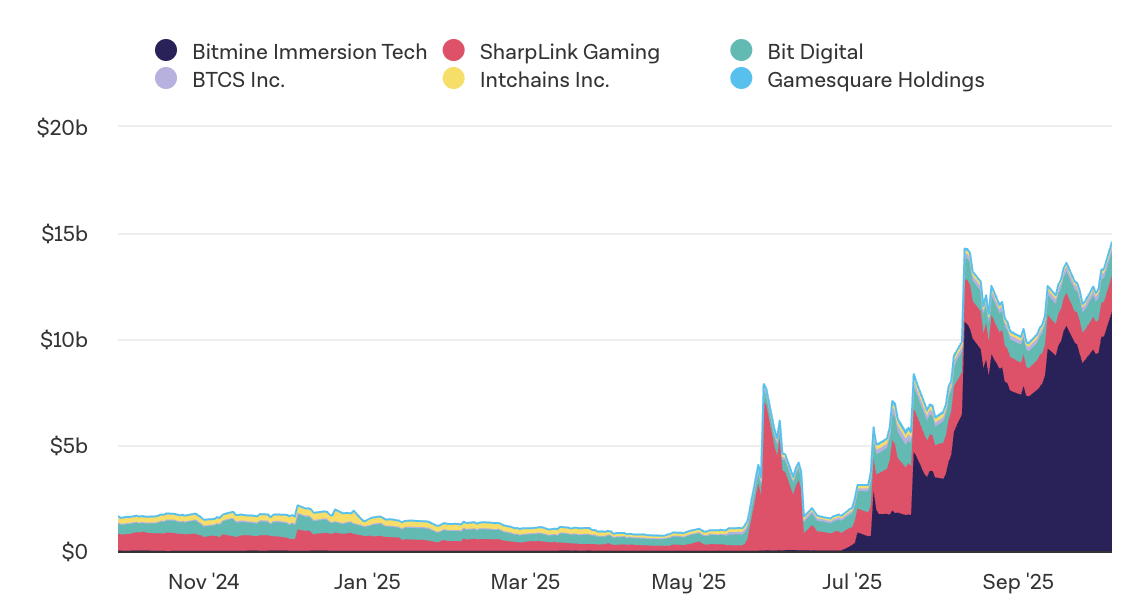

Effect of the purchases of ETF and Treasury companies on Ethereum Supply

In the middle of August Spot ETF‘s share of 5 percent of the threshold, while the accumulation of treasury companies gained momentum. Standard Chartered said in his latest assessment that Treasury companies have collected the meaningful part of the circulating supply since the summer months and has reached the head level with ETFs. The resulting table points to a united ETH share that reaches 8 percent through ETF and Treasury throughout the year.

From the end of September Finishing With the prominence of aggressive buyers such as treasure companies caught a new momentum. With current data, the size of Ethereum under the control of Bitmine rose to 2.83 million ETH and corporate Ethereum Treasury Companies He settled in the first place in the league. This withdrawal in the supply triggered the descending ETH reserves on the lowest levels of recent years.

Liquidity, pricing and risks

Supply contraction is a structural catalyst that pushes the price discovery. ETH/BTC parity As you approach the summits of the year, investor interest reinforces with its net entries to spot products. While ETFs provide predictable storage and transparency, the long -term Al and Tut approach of Treasury companies further limit the saleable supply in the market.

As strategic purchases increase, corporate risk management and dilution discussions are on the agenda. In some scenarios, Vaneck draws attention to the risk of dilution that export and stinging dynamics can create. Nevertheless, the existing data indicate that ETFs and Treasury balance sheets will support the price of ETH by providing demand support for the rest of the year.

Cryptoappsy according to data Eth At the time of the preparation of the news, it is traded for $ 4,679 with an increase of 2.35 percent in the last 24 hours.