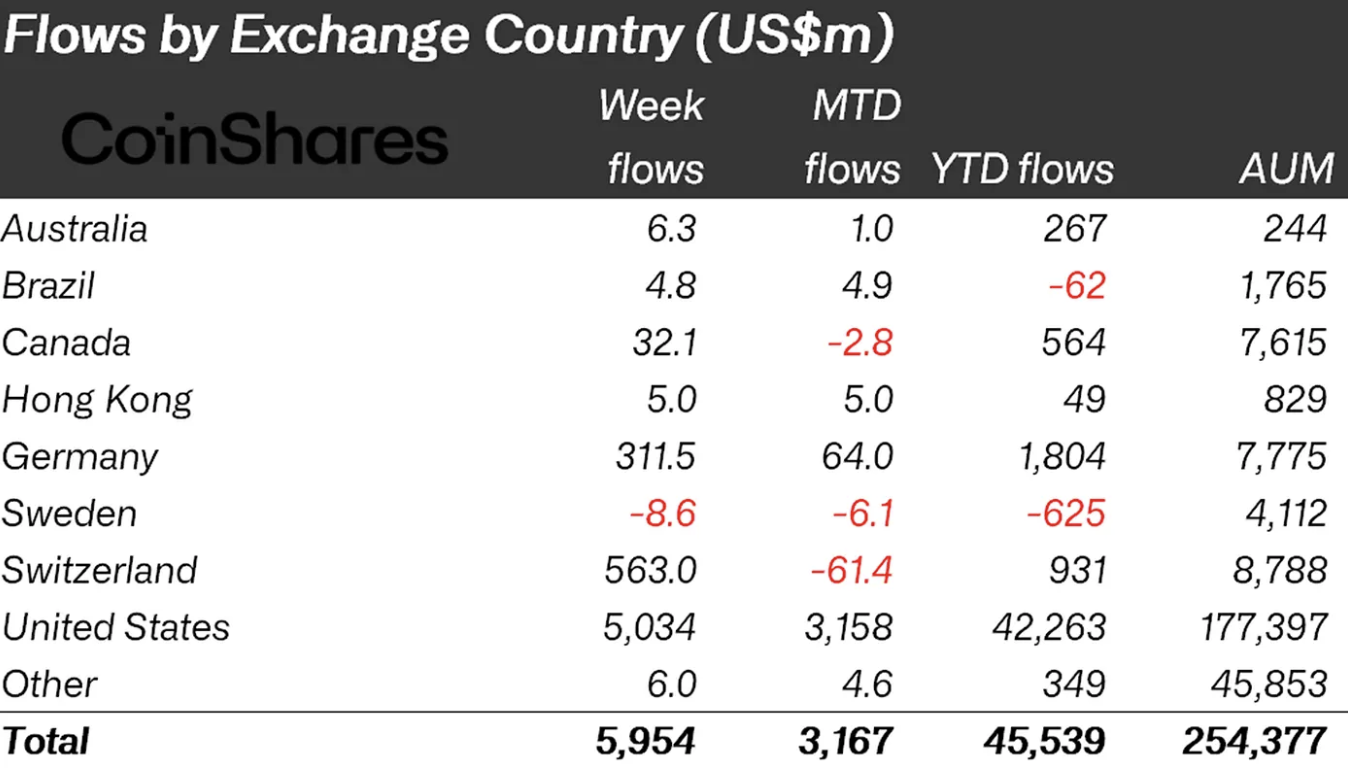

Publishing 254 of the weekly reports CoinsharesNet 5.95 billion dollars to crypto currency investment products last week happened. Reaction to interest rate reduction behind the entrances, weak employment data (ADP) and the US closure in the United States concerns about the risks brought forward. With the rise in prices, the size of the assets managed in investment products (AUM) moved to the historical summit with 254 billion dollars. The leader of the last week was the US, while Switzerland and Germany reached record levels in the entrances.

Record on Crypto Money Based Investment Products

Interest rate reduction Reflected on the market, confidence, combined with the weak signals on the employment side accelerated the orientation of crypto currency -based investment products. Last week, a significant relaxation was observed in investors’ risk perception of investors, and there was no interest in Short -oriented products. Thus, despite the fact that the fund flows were close to the summit, the prices were not cut and carried the total AUM series to the new hill.

USACrypto currency -based investment products from $ 5 billion from the global fund flows gathered in one center. The liquidity depth and the access of the ETF ecosystem reinforced the tendency to enter by supporting price movements with volume. It is understood that the perception of weakness created by ADP data in terms of timing and the uncertainty in the federal government increases the motivation of risk protection.

Switzerlandwhile the new weekly record breaks with 563 million dollars of entry, GermanyThe second highest weekly entry in its history with $ 312 million was observed. Regional expansion shows that the inputs are scattered in multiple product baskets, not a single instrument, and the theme is adopted on a global scale.

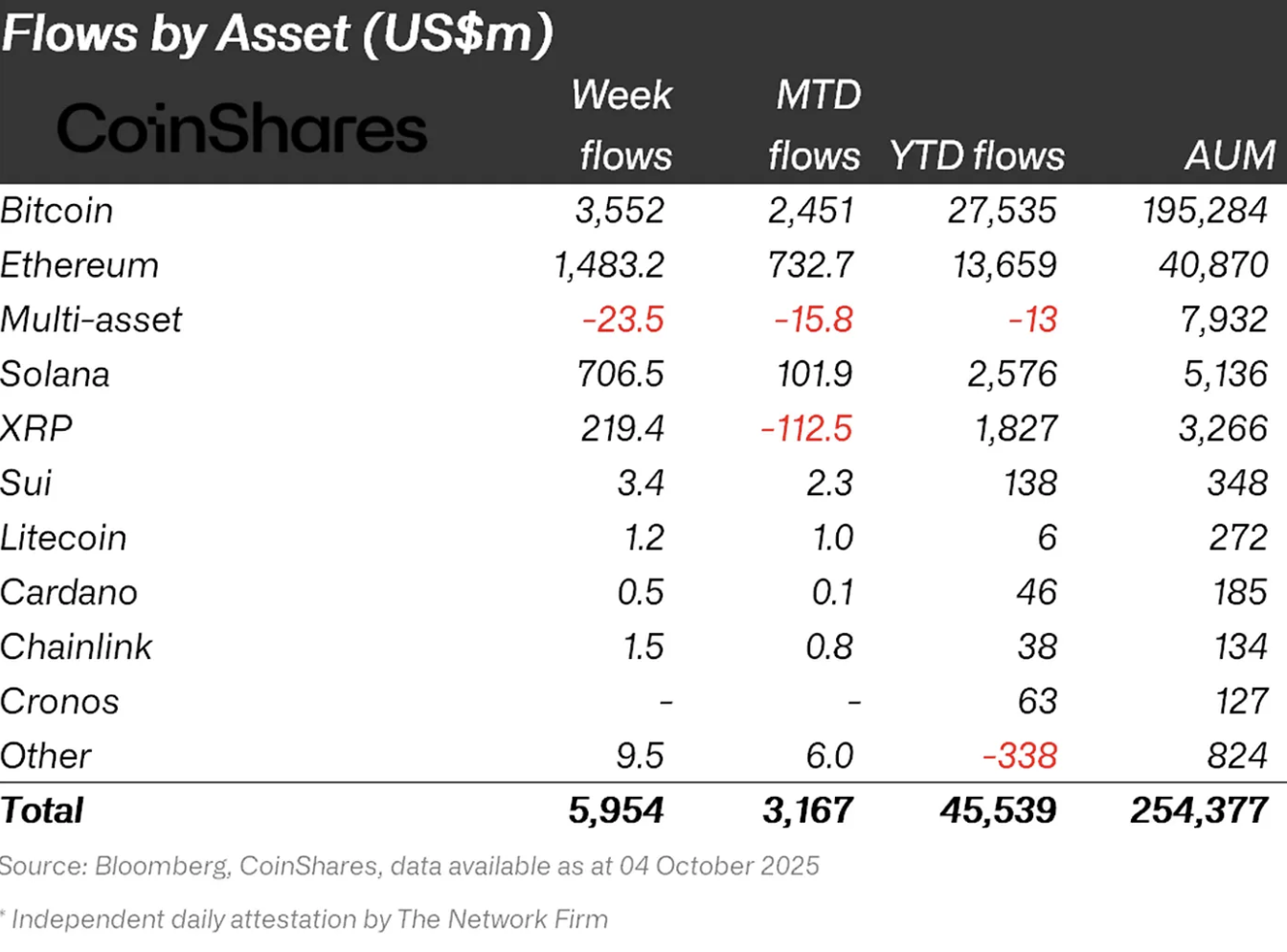

Which crypto currencies did the corporates?

The main focus on crypto currency -based investment products  $123,961.58 was. Bitcoin With 3.55 billion dollars to based products, the highest entry in its history on a weekly basis. Although the price sees the historical summit of around $ 126,000 ($ 125,889 in the Binance Exchange), the fact that investors do not turn to Short products indicates that the rise is fed with a net position increase, not with hedge sales.

$123,961.58 was. Bitcoin With 3.55 billion dollars to based products, the highest entry in its history on a weekly basis. Although the price sees the historical summit of around $ 126,000 ($ 125,889 in the Binance Exchange), the fact that investors do not turn to Short products indicates that the rise is fed with a net position increase, not with hedge sales.

Ethereum  $4,566.71 1.48 billion dollars for based products have increased the total fund flow from the beginning of the year to $ 13.7 billion and brought almost three times last year. Cost decreases in Layer-2s and expectations for corporate inclusion were the main driving force of interest in Ethereum products.

$4,566.71 1.48 billion dollars for based products have increased the total fund flow from the beginning of the year to $ 13.7 billion and brought almost three times last year. Cost decreases in Layer-2s and expectations for corporate inclusion were the main driving force of interest in Ethereum products.

Solana While breaking a record with an entry of 706.5 million dollars per week, XRP 219.4 million dollars entrance to based investment products. Other altcoinThere was no significant collective flow in the s. The fund entrances concentrated on large crypto currencies with scale and corporate access.