Bitcoin  $120,326.87 The weekly net entrance to the ETFs increased to $ 2.25 billion by exceeding the threshold of $ 2 billion. The entrance to Blackrock’s ETF IBIT increased over $ 1 billion in three days between Tuesday and Thursday. Despite the $ 46.6 million output on Monday, the tendency quickly returned to positive. Bitcoin climbed over $ 120,000 again on 3 October, on the price front, Crypto Money MarketThe discourse of “upboard” began to give strength to ETFs.

$120,326.87 The weekly net entrance to the ETFs increased to $ 2.25 billion by exceeding the threshold of $ 2 billion. The entrance to Blackrock’s ETF IBIT increased over $ 1 billion in three days between Tuesday and Thursday. Despite the $ 46.6 million output on Monday, the tendency quickly returned to positive. Bitcoin climbed over $ 120,000 again on 3 October, on the price front, Crypto Money MarketThe discourse of “upboard” began to give strength to ETFs.

Latest situation in Bitcoin ETFs

In the distribution of fund flows during the week IBITWhile the total of three days of $ 1 billion, Fidelity’s FBTC‘s 622.3 million dollars, Ark Invest ARKB‘s 219 million dollars, Bitwise’s BITBIt attracted $ 187.9 million. Since the launch of Spot Bitcoin ETFs in the US in January 2024, cumulative net entries have approached $ 60 billion. The acceleration of fund flows reflects the desire of corporates to take positions through regulated products, avoiding non -balance sheet risk.

IBIT stands out on the scale and process side. ETFThe size of assets under the management of the existence of over 90 billion dollars in the US, according to the size of assets entered the largest 20 ETF list. On the same day, IBIT’s trading volume formed the majority of the total Bitcoin ETF volume with 4.3 billion, and was among the biggest 10 ETFs in daily process with giants such as SPY, QQQ, GLD. In market pricing, the strong seasonality of October and the expectations of monetary relaxation from the Fed front, as well as support for the recovery ETFs in the risk appetite supported fund flows.

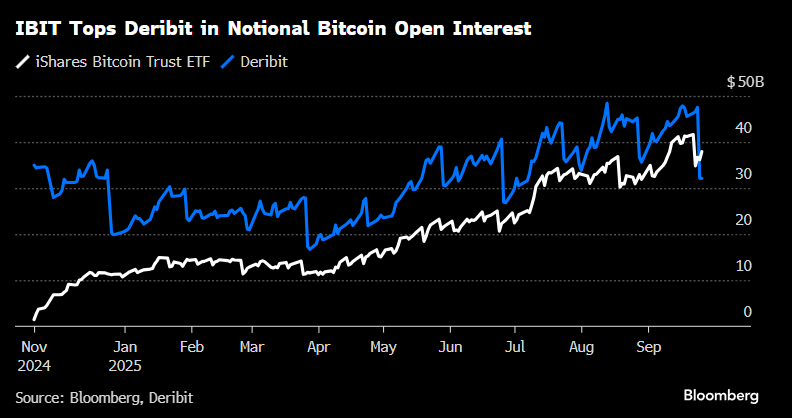

IBIT superiority in options

After the end of the maturity last Friday IBIT OPTIONSIn the open position size of approximately 38 billion dollars, leaving behind 32 billion dollars Deribit for the first time. Bloomberg ETF analyst Eric Balchunas“IBIT left Coinbase’s Derbit platform as the largest platform for Bitcoin options with an open position of 38 billion dollars. It showed it as an important development with its sharing. The $ 38 billion level corresponds to about 45 percent of its open position in global Bitcoin options. In November last year, IBIT options were settled in a decisive position in the market depth in a short time.

Deribit’s leadership has been maintained for years through ETF crypto currency It caused the liquidity map to be reshaped in its derivatives. According to experts, the option market has a structure that the winner earns more due to its nature. For this reason, IBIT’s share in options is more intensified than the distribution of asset size under the management of Spot ETFs. Market professionals emphasize that liquidity in US -based crypto currency options may increase further depending on maturity termination and volatility.