The waters are not settled on the popular Altcoin Solana side. Solana Treasury Company Sharps Technology Stock Review Program up to $ 100 million explained. The program will be advanced simultaneously with the plan to enlarge their solea -oriented treasury assets. On the other hand, Rex Shares’s Solana Stinging Etf’s existence size (AUM) under the rule of SSK reached 382 million dollars and rose to a new summit. VisionSys also announced the 2 billion dollars of solana Treasury strategy.

Review Program announced by Sharps Technology

The program announced by Sharps Technology will allow for $ 100 million to buy up to $ 100 million through open market and special agreements. Authorities aim to increase liquidity and produce shareholder value by providing flexibility in capital distribution. The transactions are planned to be carried out gradually depending on the market conditions.

The company recently over 2 million Solana He reported that he kept and the portfolio size exceeded $ 400 million. The left moved to head assets in the company’s balance sheet. The management aims to direct a part of the Left at Bonksol to liquid Stake and to contribute to the network liquidity from Blockchain.

In a separate development VisionSysIntroduced the 2 billion dollars of solana Treasury program. Within the framework of the first phase, the left purchase of $ 500 million in six months and the stake process is targeted. The program was initiated with the objectives of strengthening the corporate balance sheet and producing long -term investor value.

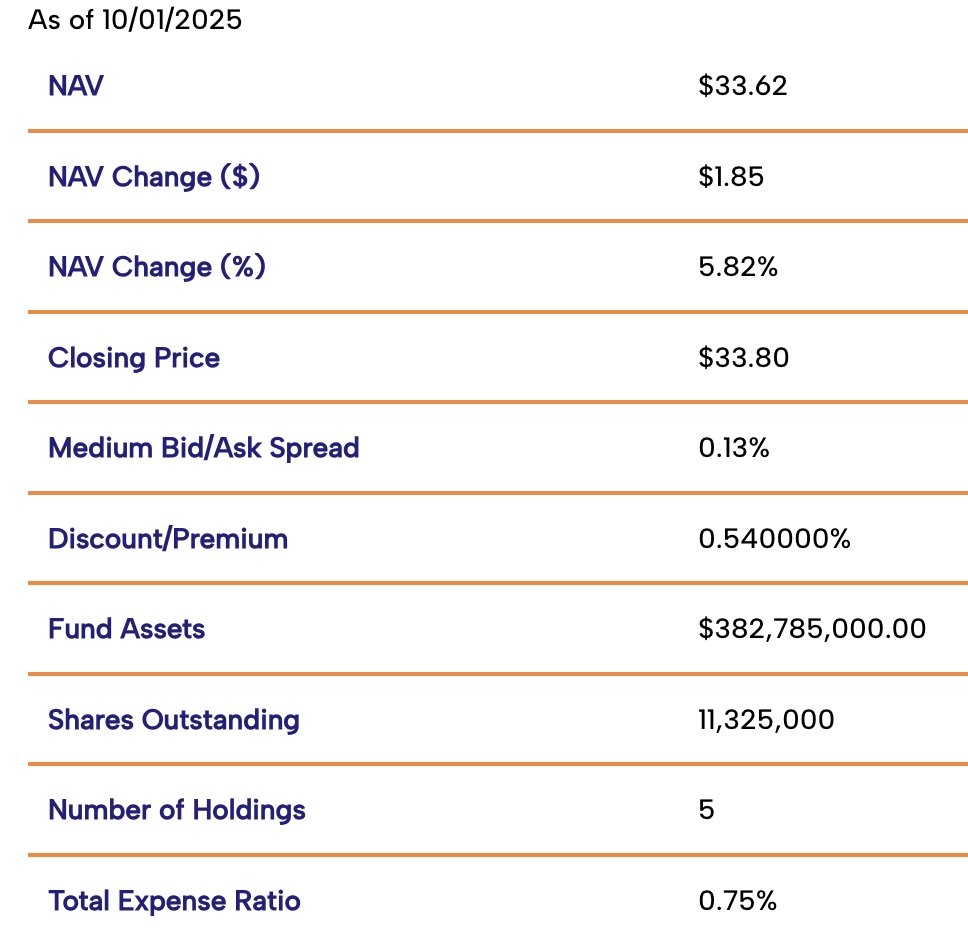

SSK ETF’s AUM has exceeded $ 380 million

On the other hand, it was recorded as the first ETF in the United States, which is traded in CBOE BZX and combines Spot’s left investment with in -blockchain awards. SSKAUM’s AUM increased by $ 380 million and rose to 382 million. Two months after the launch of ETF’s AUM, the threshold of $ 250 million exceeded.

ETF’s manager Rex-ospreyIntegrated Jitosol into the background of the ecosystem’s leading liquid Stake Token. Integration, stinging returns, while taking a share of stock market transactions through the protection of trading flexibility. Liquidity management and return transfer are presented under the same structure.

Rex Osprey recently Ethereum  $4,480.54 It also commissioned the focused anchor stinging ETF. The product offers investors a model aiming at the distribution of real Blockchain stinging revenues as well as Spot ETH investment.

$4,480.54 It also commissioned the focused anchor stinging ETF. The product offers investors a model aiming at the distribution of real Blockchain stinging revenues as well as Spot ETH investment.