Bitcoin  $118,702.92 While exceeding $ 121,000 for a moment on Thursday, October 2, Ethereum

$118,702.92 While exceeding $ 121,000 for a moment on Thursday, October 2, Ethereum  $4,391.45 The highest level of three weeks increased to $ 4,500. BTC and ETH, which has been withdrawn since then, are currently traded at $ 119.892 and $ 4,471, respectively. In the US, the partial government closure, which started on October 1, entered the third day as the recovery in the crypto currency market gained power. The increase in correlation with S&P 500 during the year provides power to crypto currencies with the positive performance of stocks during past closure periods. The record of gold prices on $ 3,900 and the narrative of protection against the depreciation of money also supports pricing.

$4,391.45 The highest level of three weeks increased to $ 4,500. BTC and ETH, which has been withdrawn since then, are currently traded at $ 119.892 and $ 4,471, respectively. In the US, the partial government closure, which started on October 1, entered the third day as the recovery in the crypto currency market gained power. The increase in correlation with S&P 500 during the year provides power to crypto currencies with the positive performance of stocks during past closure periods. The record of gold prices on $ 3,900 and the narrative of protection against the depreciation of money also supports pricing.

Photo of the rise in crypto currencies

Bitcoin’s contact for $ 121,000 has been the first time since mid -August. Ethereum The fact that the price increases over $ 4,500 points to the strongest appearance of the last three weeks. Despite the partial retreats, the depth of crypto currencies with high market value increases again. With the increase in the appetite on the spot and the futures side, the volatility is normalized and the price discovery expands upwards.

The gains in crypto currency -related shares are remarkable. Coinbase The shares were premiums above 7 percent on the last trading day. Opened to the public during the year Bullish And Circle It gained 11 percent and 16 percent, respectively. The combined ETF input of approximately $ 2.4 billion in Bitcoin and Ethereum ETFs on a weekly basis strengthened the liquidity base. Balancing Spreads and the open interest table indicate that the rise is more than a speculative splash, which is a movement accompanied by corporate -rope fund flows.

Why do Bitcoin and crypto coins rise?

Partial government closure in the US began on October 1, and despite the short -term uncertainty of the budget lock in Washington, it did not produce a negative model historically in risk assets. In every government closure since 1990 S&P 500The fact that the rise of the crypto currency has brought similar wind this year, when the correlation deepened. Gold marketThe record level, inflation and budget deficits, increases the need for protection against the alternative reserve narrative for Bitcoin.

Jpmorgan Analysts announced that Bitcoin carried a space to $ 165,000 towards the end of the year in the Gold-Parrite assessment adjusted according to volatility. Swan Bitcoin Manager Director John HaarNoting that strategic allocation replaces speculative transactions, drawing attention to global debt records and depreciation in nominal money. Xapo Bank Investment Manager Gadi chait The “upboard” seasonality has come to the fore with an average return of over 14 percent since 2013, and the first signals of the year came in a similar direction.

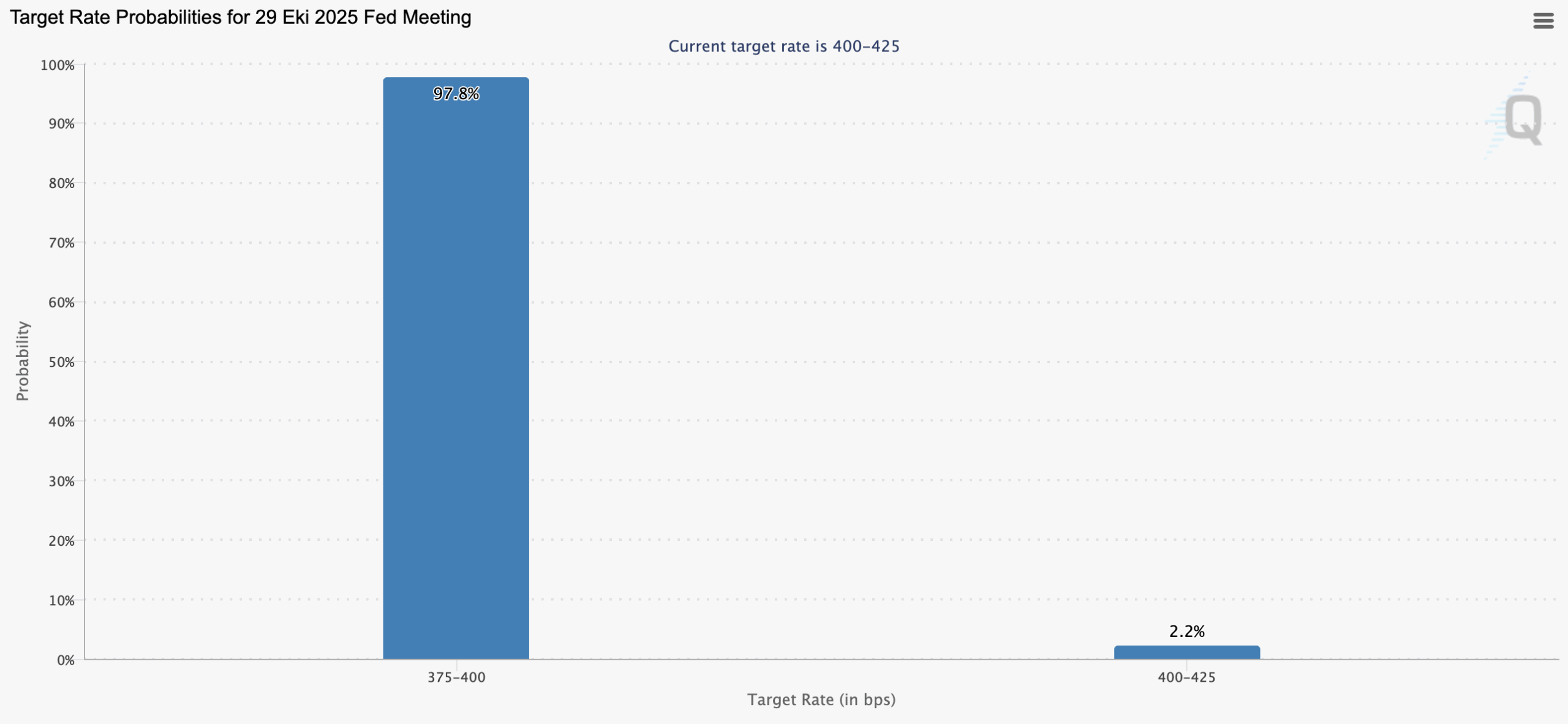

On the monetary policy front CME FEDWATCH Data points out that the FED’s meeting on October 29, 2025 is 98 percent likely to go to a new interest rate cut of 25 basis points. The interest rate reduction cycle, which started after four years of break in September, loosening financial conditions and supports the risk appetite. The continuation of the pigeon tendency keeps the ETF inputs and the possibility of closing the difference in the valuation difference with gold keeps the testing of new peaks on the agenda.