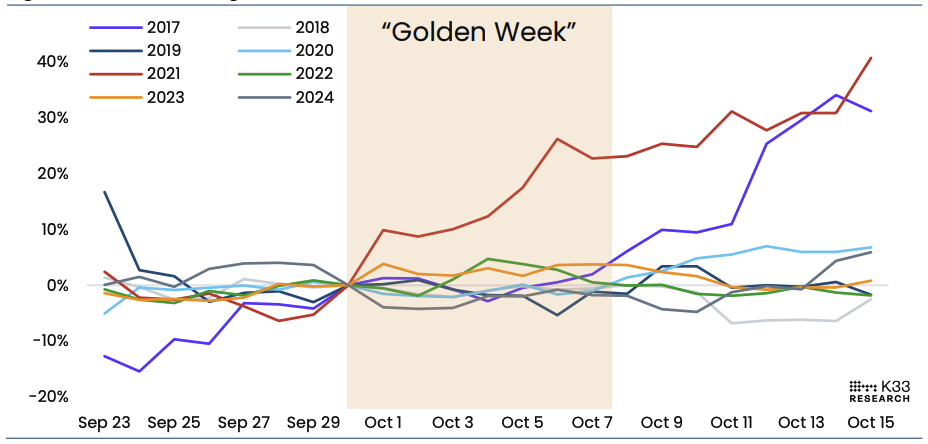

Bitcoin  $116,250.69In China, Golden Week started to October with the beginning of the start of the United States and the partial government closure in the United States. Although the price is moving up, the research company K33last according to the report The weak Asian liquidity during the holidays may bring horizontal or negative returns at the beginning of October. The research company pointed to 2021 as an contrary example. The delay of data such as employment and inflation from the USA was also shown as an additional element that could increase volatility. Bitcoin, September by 4.7 percent of the rise of about $ 114.120, while the moment is traded around 116,700 dollars.

$116,250.69In China, Golden Week started to October with the beginning of the start of the United States and the partial government closure in the United States. Although the price is moving up, the research company K33last according to the report The weak Asian liquidity during the holidays may bring horizontal or negative returns at the beginning of October. The research company pointed to 2021 as an contrary example. The delay of data such as employment and inflation from the USA was also shown as an additional element that could increase volatility. Bitcoin, September by 4.7 percent of the rise of about $ 114.120, while the moment is traded around 116,700 dollars.

Liquidity and volatility dynamics for the first week of October

In China Golden Week Official holidays in South Korea will be between 3-9 October. Volatility usually sees local bottoms at the beginning of October because the regional breaks reduce participation. K33 Research Director Vetle lundesince the beginning of the year, the Asian session of the compound return is -9.7 percent, and the majority of significant movements have occurred during the US transaction hours after the spot ETFs. Snow intake and relative low liquidity session -based performance difference is among the main reasons.

In Washington, the budget package does not exceed partial as of October 1 government closure in force. When some public employees are devoted to permission, the fact that critical macro data will be shifted by not being disclosed on the relevant dates makes the price discovery difficult. K33 warned that the dilution in the order notebooks can trigger excessive movements in Asia -USA overlap. The derivative indicators also support the cautious approach. In the CME, the open position is at the bottom of the last five months, the funding rates are under the neutral and the demand for idols stands out.

In the light of Grayscale effect, Long on the left, Short Thesis in LTC

On the other hand, SEC’s Crypto Money ETFSolana and Litecoin  $109.15 Spot ETFs are expected to come to the table within weeks. However, the closure of the government may cause the calendar to be delayed. Lunde, Grayscale He said that the supply pressure from welded is not symmetrical. On the Solana side, Grayscale’s circulating supply rate will only be traded for 0.1 percent and the product will be traded without discounting. So the risk of collective dissolution is limited. More than one Solana ETF application and corporate treasury strategies strengthen the demand side in Altcoin.

$109.15 Spot ETFs are expected to come to the table within weeks. However, the closure of the government may cause the calendar to be delayed. Lunde, Grayscale He said that the supply pressure from welded is not symmetrical. On the Solana side, Grayscale’s circulating supply rate will only be traded for 0.1 percent and the product will be traded without discounting. So the risk of collective dissolution is limited. More than one Solana ETF application and corporate treasury strategies strengthen the demand side in Altcoin.

LitecoinThe table is different. Grayscale’s share of circulating supply was 2.65 percent and historically deep discount periods took place. As in GBTC/ETHE transformation altcoinsales flow can be triggered. K33, Bitcoin and Ethereum  $4,287.68on the first 200 trading day, about half of the nominal administration assets flowed to the market. In Litecoin, where the exporter’s interest is relatively limited, the Long approach in Solana against the Short approach stands out as a strategy aiming at the relative difference.

$4,287.68on the first 200 trading day, about half of the nominal administration assets flowed to the market. In Litecoin, where the exporter’s interest is relatively limited, the Long approach in Solana against the Short approach stands out as a strategy aiming at the relative difference.