The cryptocurrency market is holding steady as traders await the U.S. Federal Reserve’s highly anticipated interest rate decision. Bitcoin (BTC) is consolidating between $114,600 and $117,100, currently trading in the upper range. Analysts view this setup as constructive, with market sentiment at 68.8%, a level close to peak bullishness.

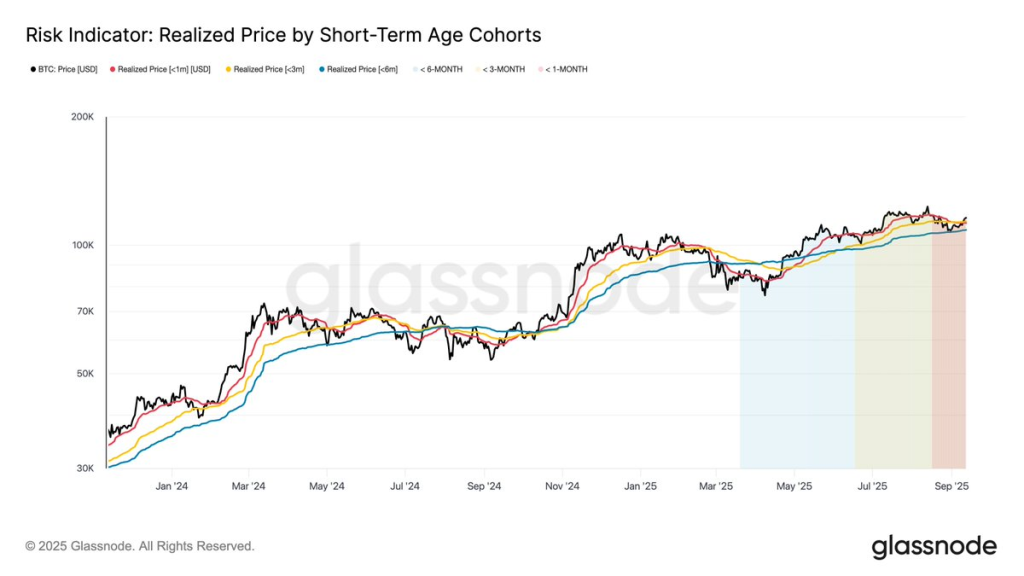

According to Glassnode, Bitcoin is respecting its short-term holder cost basis bands. Staying above the 1-month and 3-month realized price levels is seen as a sign of optimism heading into the Fed’s announcement.

Gold Price Today: Record Highs Before the Fed

Gold is also in focus as it trades just under $3,700 per ounce, holding firm near record highs. However, gold mining stocks dipped as investors booked profits ahead of the Fed decision.

Commenting on this divergence, economist Peter Schiff noted: “Gold remains strong even as miners take a breather. I expect buyers to come rushing back once the FOMC outcome is known.”

The connection between gold and Bitcoin lies in liquidity. A Fed rate cut not only strengthens gold as a hedge but also channels speculative flows into Bitcoin and other risk assets.

What Markets Expect from Powell’s Speech Today

Traders overwhelmingly expect a 25 basis point cut, with market odds above 90%. Such a move would keep the bullish structure intact for both crypto and gold. Still, analysts warn that front-running and leverage could spark short-term volatility.

Crypto strategist Biupa explained: “A 25 bps cut may continue the uptrend, but we could still see a pullback driven by profit-taking and liquidations, not by deteriorating fundamentals.”

For Bitcoin, the key level to watch is $117,900. A breakout could open the path toward new highs, while rejection might trigger a temporary dip toward the $113,300–$110,000 zone.

- Also Read :

- Top 5 Altcoins To Buy Before FOMC Meeting Today

- ,

FED Interest Rate Expectations

While unlikely, a 50 basis point cut could shock markets. In that case, Bitcoin might briefly spike to $120,000 as retail traders rush in before a possible “sell-the-news” reversal if recession fears take hold.

On the other hand, if the Fed were to skip a cut, analysts expect a sharp drop in both crypto and gold, followed by the potential for an emergency larger cut later, which could set the stage for a V-shaped recovery.

The setup closely mirrors September 2024, when the Fed cut rates and Bitcoin initially dipped before doubling to over $100,000 by year-end. With Powell set to speak, traders are bracing for volatility.

Whether it’s the expected 25 bps cut or a surprise move, the outcome of today’s FOMC meeting could set the tone for the next major trend in Bitcoin, gold, and the broader crypto market.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The FOMC announcement is scheduled for 2:00 PM Eastern Time (ET). This is followed by a press conference with Fed Chair Powell at 2:30 PM ET.

A 25 bps rate cut is expected to maintain Bitcoin’s bullish trend, though short-term volatility from profit-taking is likely. Key resistance is at $117,900 for a breakout.

Both act as liquidity-sensitive assets. Fed rate cuts weaken the dollar, boosting gold as a safe haven and Bitcoin as a speculative risk-on asset.

A surprise hold could trigger short-term drops in Bitcoin and gold, but may lead to larger emergency cuts later, potentially fueling a rapid V-shaped recovery.

While momentum is bullish, high leverage and “sell-the-news” risk mean cautious entry near support levels ($113,300–$110,000) may be prudent post-announcement.