Bitcoin price has been trading in a tight consolidation range, leaving traders wondering whether the next move will be a strong breakout or a deceptive fakeout. After weeks of sideways price action, market participants are closely watching key support and resistance levels for signs of momentum. With sentiment shifting and trading volumes fluctuating, every move now carries significance. In this delicate phase, BTC’s next direction could set the tone for the broader crypto market, making it a critical juncture for investors and traders alike.

Bitcoin Consolidating Within Major Liquidation Zone

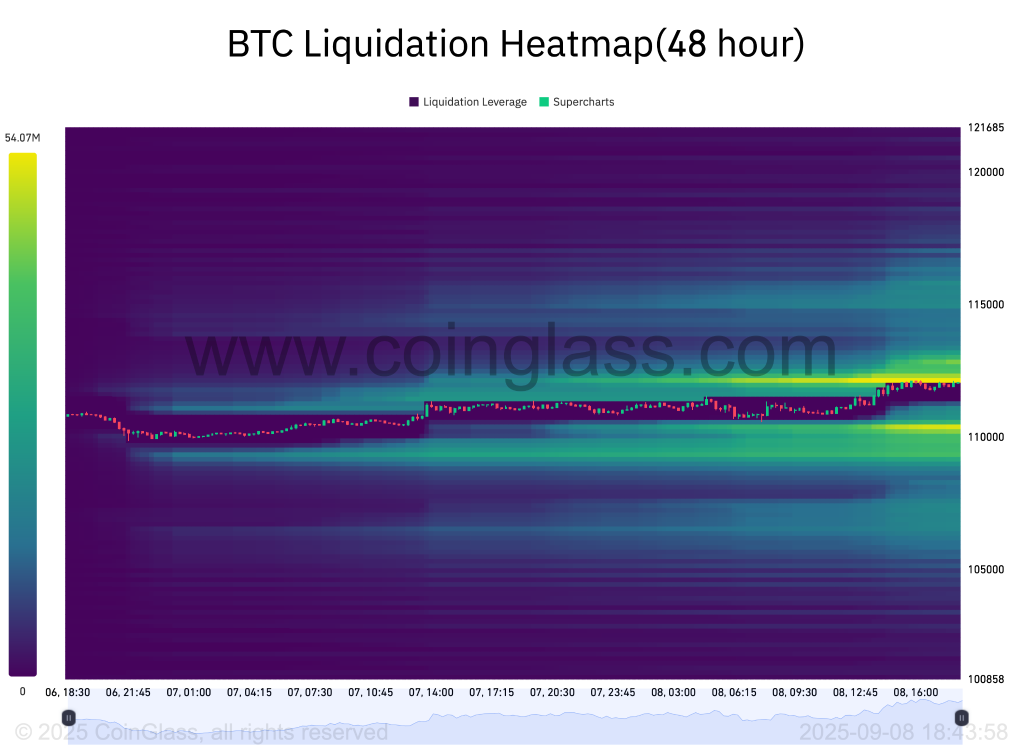

The current price action seems to have compelled the investors to create a safe cluster around the range. The liquidation heatmap of Bitcoin shows the price trading between the liquidity cluster, which is accumulated between $112,100 and $112,300 and around $110,800. The bulls are failing to break the upper cluster, which is expected to drag the levels lower to squash the sellers.

On the other hand, the Open Interest has been consistently plunging from over $87 billion to close to $80 billion. This suggests the future traders are either not opening new positions or closing their positions. Now that money is flowing out of the market, signalling the beginning of the exhaustion phase, the BTC price is now believed to reverse the trend as well. Additionally, the Coinbase premium is also negative and the US inflation data is coming this week. With this, the Bitcoin price is expected to sweep the lower liquidity.

Will Bitcoin Price Test the Support at $108,000?

Although the price has rebounded from the local support at $107,300, the rally, in the wider perspective, remains consolidated within a descending channel. Meanwhile, the bulls are attempting to break the resistance and if they are successful in doing so, the price is believed to rise above $113,400, paving the way to test the higher targets. However, the current price action displays a diverse price action, indicating a potential pullback.

As seen in the above chart, the BTC price is trading within a descending parallel channel and is trying to break the upper resistance. Moreover, it is trading within the Ichimoku cloud, hinting towards an extended consolidation. A breakout followed by a retest hints towards a bullish confirmation; however, the chart pattern suggests the possibility of a rejection.

The RSI and CMF are incremental, which is a bullish signal, but the previous pattern pushed the price lower after testing the resistance zone at $116,800, hinting towards a potential pullback to $110,000. Therefore, the next few days are pretty crucial for the Bitcoin price rally as a rejection before the breakout could activate the lower targets around $110,000 or lower.