Standard CharteredThe US Central Bank (FED) will reduce 50 basis points at the meeting next week, the crypto currency market attracted the attention of the currency market. The bank’s estimated US employment data came to the agenda after the weakness.

Standard Chartered’s 50 basis points interest rate reduction estimation

ReutersAccording to the Standard Chartered, the FED at the meeting this month interesti is waiting for him to download half a point. The Bank previously foreseen a 25 basis point discount, but after August employment data, it revised its expectation. The report recorded the weakest employment increase in the last four years, while the unemployment rate rose to 4.3 percent.

Other large banks expressed different expectations. Barclays And Bank of America While predicting smaller and gradual discount, Morgan Stanley And Deutsche Bank It is cautious about a fast 50 base -point step. On the other hand, all institutions agree that the interest rate reduction is on the agenda.

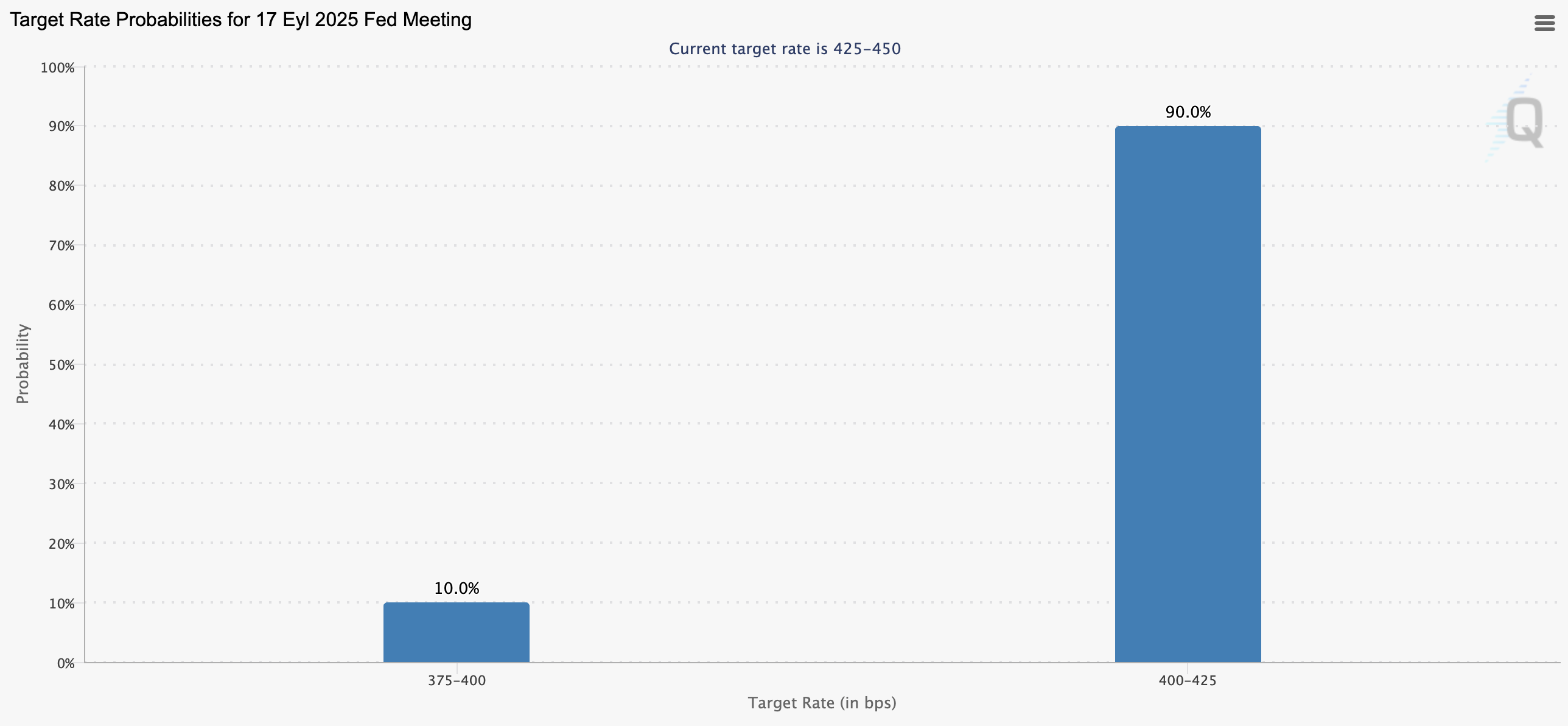

CME Fedwatch Tool According to the data, the markets are currently waiting for an interest rate reduction of 25 basis points with 90 percent. However, there is a 10 percent possibility for a 50 -base point larger step. Inflation data to be announced on September 10-11 is expected to directly affect the FED’s decision.

Optimism increased in the crypto currency market

If the Fed goes to interest rate cuts, risky assets may come to the fore. Because the fall of interest rates reduces borrowing costs and may affect fund flows to investment products. This is the case crypto currencyIt is emphasized that there may be important reflections for s.

The explanations from the Fed officials point to this process. Fed Member Chris WallerCNBC’ye assessment, “the next meeting should start interest rate reduction,” he said. Waller said that more than one discount can be made in the next six months. Another Fed Member Michelle Bowman In September, the interest should be reduced, stating that the labor market should be protected, he noted.

The Fed’s step in interest rate reduction is both in traditional markets and Crypto Money Marketclosely followed. The decision to be taken at the September meeting is expected to have a direct impact on the markets.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.