Onddo’s (ondo) management token has been remaining a significant support point of $ 0.87 since mid -July. The last month, the other Altcoin market has been forced to accelerate. The reason for this is Bitcoin (BTC), which has not shown a clear trend in recent weeks  $110,906.72 and Ethereum (ETH)

$110,906.72 and Ethereum (ETH)  $4,305.69 There may be volatility around it. The market structure in Onddo’s daily graph was a decrease. Token has made lower peaks in the last three weeks. In addition, CMF (Chaikin Money Flow) -0.05 was well below the threshold. This showed that there was a serious capital output and seller dominance from the market. If this sales pressure persists, Ondo may fall below $ 0.87 support zone.

$4,305.69 There may be volatility around it. The market structure in Onddo’s daily graph was a decrease. Token has made lower peaks in the last three weeks. In addition, CMF (Chaikin Money Flow) -0.05 was well below the threshold. This showed that there was a serious capital output and seller dominance from the market. If this sales pressure persists, Ondo may fall below $ 0.87 support zone.

Is Onddo below its value right now?

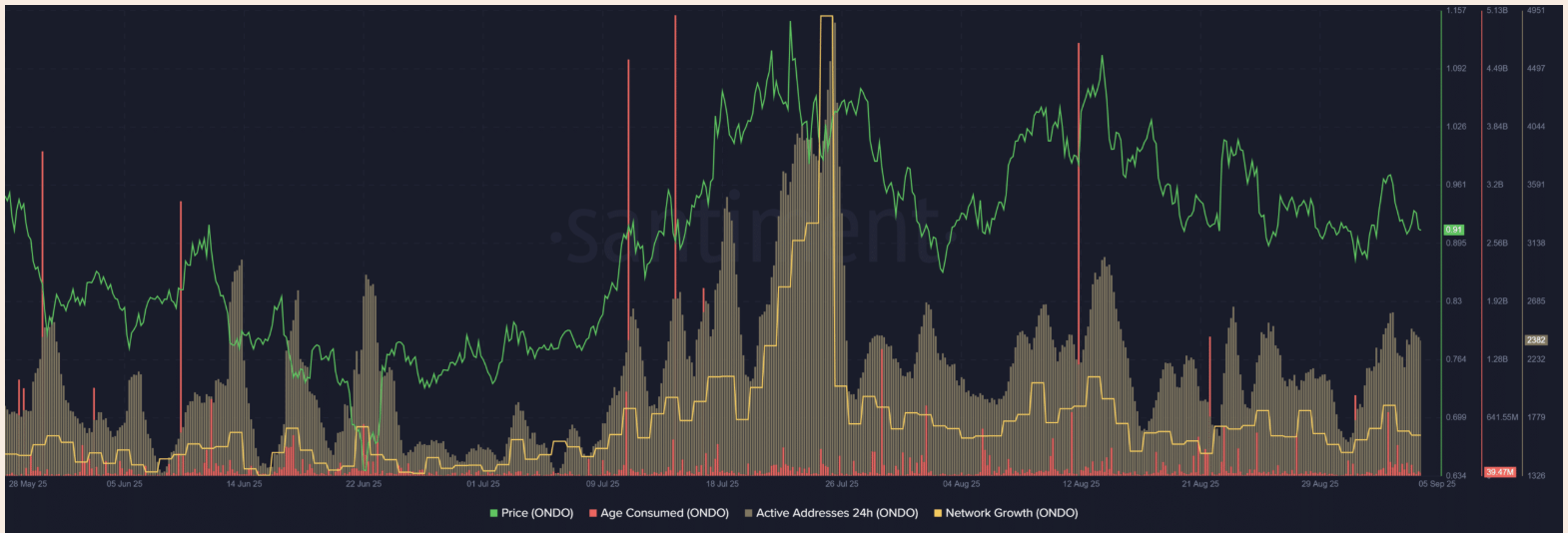

The data from the centimeter revealed that network growth and daily active address metrics have not changed relatively since the end of July. This stable trend showed that the network had not expanded or lost the ground. This was a positive development in a period of price volatility. Interestingly, the Age Consuned Metricity was relatively calm in recent weeks. This metric follows the movement of the tokens, which were still still. Numerous still token mobility causes an increase in Age Consumed. This is an indication that the idle token, which usually occurs before or during a sale, moves in large numbers. Although the ond prices were at an important support point, it was an encouraging sign that it was not happening.

The distribution of supply reflected a stable purchase pressure from smaller wallets up to 1 million ondo. The number of wallets with 1 million to 100 million investments has decreased to a quantity in the last ten days. When it was handled with Age Consumed Metric, they gave some accumulation signal for Onddo.

The article was written at 0.98. Since the SOPR has the ratio of the price sold at the price paid, values less than 1 indicate that the owners are at damage. SOPR was watching around 0.9-1 since the end of July, except for the short-term increase in August. The recent number of low SOPRs showed that it could be a good purchase opportunity because Ondo was probably below its value. As the CMF in the 1 -day graph signals, it brings such a purchase risks, and investors should be careful against more price loss.

Price Comments

This analysis offers a balanced perspective on the current state of the Ondo Token. On the one hand, indicators such as technical graphics and CMF indicate the decrease tendency in the short term and the seller pressure. This shows that Token is at risk of losing a significant support level of $ 0.87.

However, the top-chain data draws a more promising table. The stable network growth and active addresses show that the foundation of the network is strong and that the user interest continues. The calmness in the meyen age consumed ”metric suggests that large investors (whales) do not go to panic sales, but may be in a accumulation phase. Especially the fact that small investors continue to make purchases also supports this thesis.

As a result, ondo may offer a long -term purchase opportunity in terms of basic analysis, despite the risk of short -term decrease. The fact that SOPR is below 1 shows that the existing prices are below the average cost and that token is the potentially valued value. It is important that investors carefully evaluate these contradictory signals and do their own research before taking any position.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.