CARDANO  $0.822757‘s individual investor base, after weeks of decreases to the bear market, the whales have created appropriate conditions for the commissioning.

$0.822757‘s individual investor base, after weeks of decreases to the bear market, the whales have created appropriate conditions for the commissioning.

Suitable conditions for whales

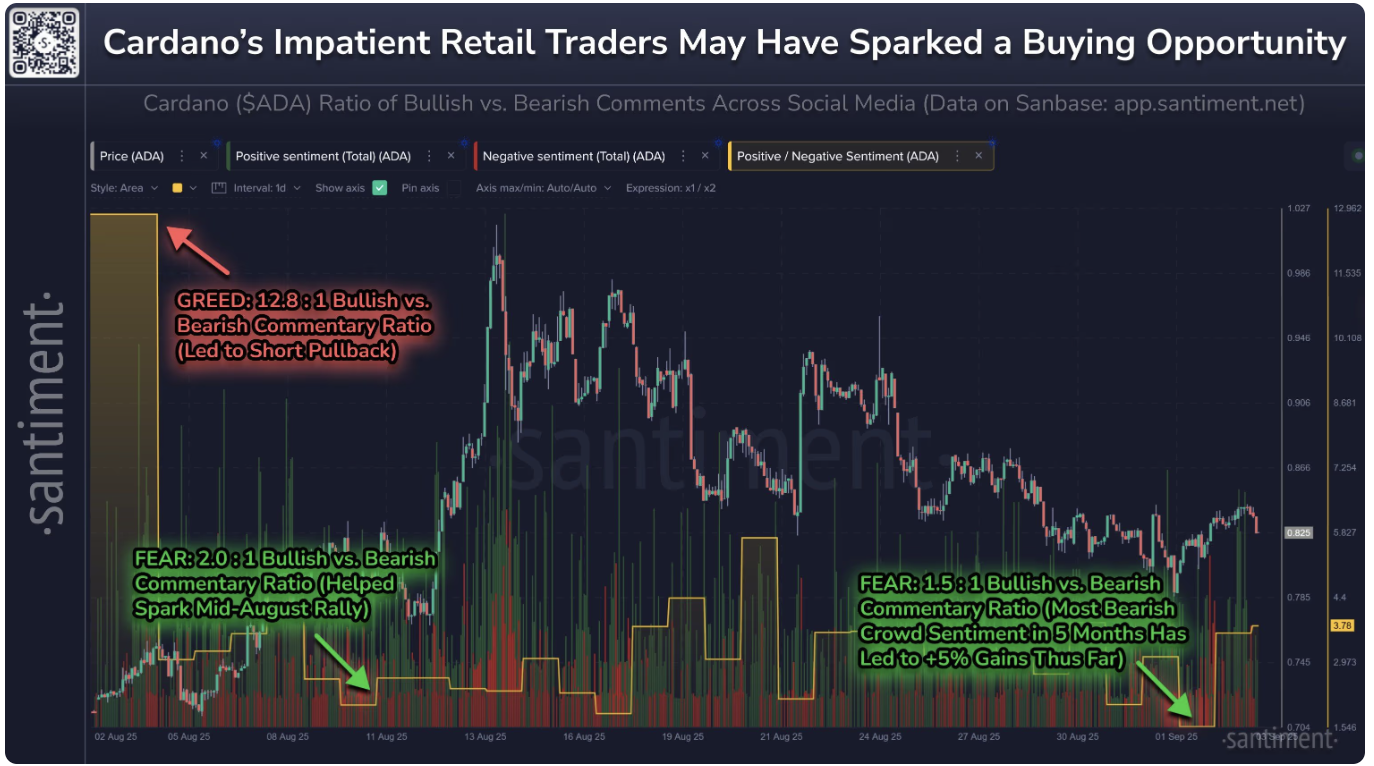

The data from the centimeter shows that the island’s bull-owned interpretation ratio fell to 1.5: 1 this week to the lowest level of the last five months. This decrease in sensitivity coincided with a 5 %recovery. This suggests that investors who sell with disappointment can help create a local footpath.

Historically, the island rally began when individual investor sensitivity was weakest. Centimeter, a similar situation in the mid -August, 2: 1 ratio in the period of a rise in the period, he said. On the contrary, situations such as 12.8: 1 peaks of 1: 1 in the beginning of this summer have come before sharp retreats.

The extremes of sensitivity are important because crypto markets are extraordinarily sensitive to individual investor psychology. When optimism reaches the peak, the crowd usually buys at the highest prices. When pessimism begins, larger players use to accumulate sales pressure. This model is Bitcoin this year  $110,843.70 and can be seen in many assets, including XRP.

$110,843.70 and can be seen in many assets, including XRP.

For Cardano, this change shows that especially if individual investors continue to give up, whales can use to increase their current weakness positions.

The decomposition between the crowd and the price continues to be one of the most reliable short -term trading signals in the crypto currency market. For now, the impatient investors of the island may have offered long -term investors entry points.

Are the whales and individual investors reversed?

This analysis clearly demonstrates a frequently seen dynamics in the crypto currency market: whales tend to act in contrast to the sensitivity of individual investors.

Individual investors usually act according to the price and general atmosphere in the market. When the prices rise rapidly, they get enthusiastic and buy, and when the decreases occur, they go on sale with panic. This behavior can often be summarized as ı purchase at the summit of sensitivity, selling at the bottom ”.

Whales use this psychology in their favor. The periods when individual investors sell with disappointment create opportunities for them to accumulate assets at affordable prices. This can be called “on the contrary, psychology .. So, what the crowd is doing can be more profitable in the long run.

However, it should not be forgotten that this is just a market signal. It is important to keep in mind that these signals may not always yield accurate results and that market conditions may change rapidly. For this reason, it is important not only to look at sensitivity data, but also to the basic analysis and general market trends of the project.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.