Bitcoin  $110,283.55 Today, it declined to about 109,000 dollars and saw the lowest level of seven weeks. The decline combined with compulsory liquidations in the derivative markets and brought about 2 percent melting in the total value of the crypto currency market. Coinglass According to the data, over $ 900 million in the last 24 hours has liquidated the leveraged position and most of the amount came from Long transactions. Analysts say that increasing uneasiness before macro data triggers the increase in short -term volatility.

$110,283.55 Today, it declined to about 109,000 dollars and saw the lowest level of seven weeks. The decline combined with compulsory liquidations in the derivative markets and brought about 2 percent melting in the total value of the crypto currency market. Coinglass According to the data, over $ 900 million in the last 24 hours has liquidated the leveraged position and most of the amount came from Long transactions. Analysts say that increasing uneasiness before macro data triggers the increase in short -term volatility.

Under Bitcoin volatility and derivative market pressure

Derive.xyz Research Head Dr. Sean Dawsonthat the crypto currency market has made a bloody start next week, in Bitcoin, the daily oanykalın from 15 percent to 38 percent, Ethereum  $4,472.79” from 41 percent to 70 percent reported. This mobility in the market in the USA Producer Price IndexIt is associated with increasing macro concerns after the (PPI) is higher than expected. Investors are looking for protection before GDP and employment data at the beginning of September, which will be announced on August 28th.

$4,472.79” from 41 percent to 70 percent reported. This mobility in the market in the USA Producer Price IndexIt is associated with increasing macro concerns after the (PPI) is higher than expected. Investors are looking for protection before GDP and employment data at the beginning of September, which will be announced on August 28th.

Option Markets25-DELTA SKEW indicator turned negative. The indicator returns to negative BTC as well as Eth shows that the demand for selling options has increased. Dawson added that the last two weeks have been the most powerful downward protection demand. According to Derive data, the likelihood of $ 100,000 in Bitcoin until the end of September and the level of $ 4,000 in Ethereum increased.

Glassnode data shows that total open positions (OI) decreased by 2.6 percent in Bitcoin futures. On the other hand, Long -oriented funding payments increased by 29 percent to $ 3.6 million. This shows that if the momentum weakens, it will face a fragile painting.

Speaking to The Block BRN Research Head Timothy Egypt and the decline in the table weakened as leverage cleaning. According to Egypt, 24 -hour liquidations approached $ 1 billion, while Bitcoin’s short -term investor cost base can weaken the technical appearance. He underlined that the levels of 103,700 and $ 100,800 stand out as critical thresholds.

Corporate purchases continue

However, it continues to purchase corporate investors, albeit limited. Strategy The company added 3,081 BTC to its portfolio for 357 million dollars on Monday. Bitmine Immersion Bitcoin increased its assets 2.2 billion dollars last week. In addition, the Spot Ethereum ETFs on the Bitcoin ETFs, $ 444 million in a net entrance of $ 444 million.

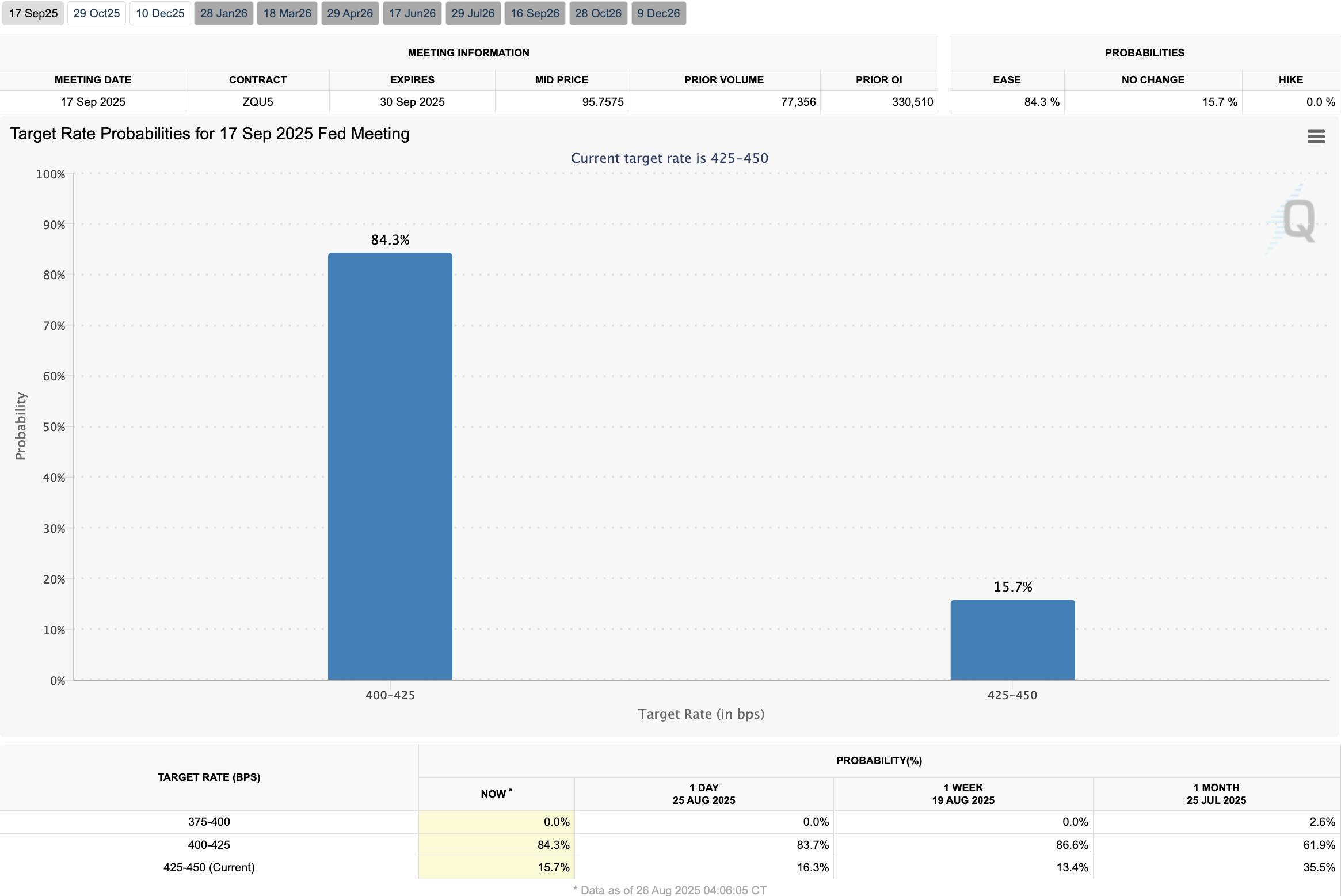

On the macro front, the uncertainties regarding the Fed’s interest rate reduction path is on the agenda again. FED President Jerome PowellAlthough pigeon gave tone messages at the Jackson Hole meeting last week, the president Donald TrumpThe attempt to dismiss Lisa Cook, the FED Governor of the FED, increased question marks on the independence of the Central Bank. The CME Fedwatch vehicle shows the possibility of interest rate deduction at 84.3 percent at the Fed interest meeting in September.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.