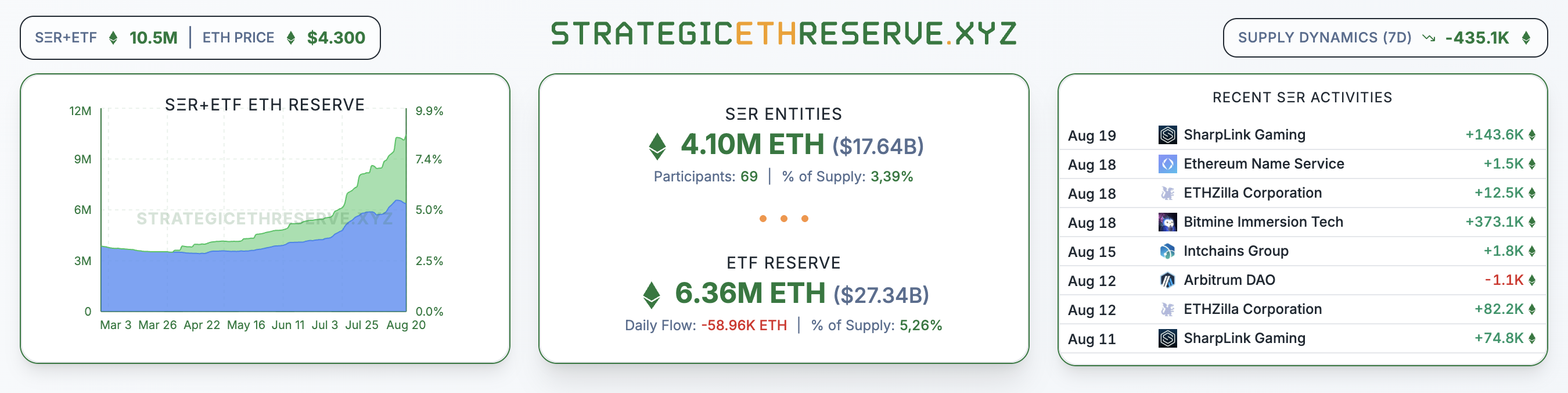

The largest subcoin Ethereum $4,161.19While corporate interest increased, the amount of ETH in the treasury of 69 companies exceeded 4.1 million. Thus, the total value of ETH in the reserve of the companies reached approximately $ 17.6 billion. Data StrategicethreseterBased on the data compiled from, it covers companies with a total of 100 ETH balances. Currently, the amount of ETH in the reserves of the companies corresponds to about 3.39 percent of the circulatory supply.

ETH has become more visible in corporate treasures

As a company with the largest share in the list Finishing Immersion Technologies in the first place. The company controls 1.6 billion dollars of 1.5 million ETH. As it will be remembered, finish, focus of activity Bitcoin  $113,239.43 He shifted from mining to the accumulation of Ethereum. In the second place with 740,800 ETH, worth approximately $ 3.2 billion. Sharplink Gaming is located. With approximately 345,400 ETHs for the rest of the list The Ether Machine and with 231,600 pieces Ethereum Foundation there is.

$113,239.43 He shifted from mining to the accumulation of Ethereum. In the second place with 740,800 ETH, worth approximately $ 3.2 billion. Sharplink Gaming is located. With approximately 345,400 ETHs for the rest of the list The Ether Machine and with 231,600 pieces Ethereum Foundation there is.

With the gathering of 69 companies around the world, 4.1 million ETHs emerge. Here are the threshold value 100 pieces Eth And the balance is based on the balance. Calculations are that 69 companies control 3.39 percent of the supply. This indicates that the weight of companies in the Ethereum ecosystem is carried to a significant dimension.

What about Ethereum ETFs and company balance sheets?

On the other hand, the public companies Ethereum treasuresAs of August 20, the total value of 2.6 million units reached about 10.9 billion dollars. The ETH accumulation in the company’s balance sheets is the second leg of the institutional trend. TEĞİL shows that access channels to Ethereum are not limited to technology -oriented companies, but also intense interest from public companies.

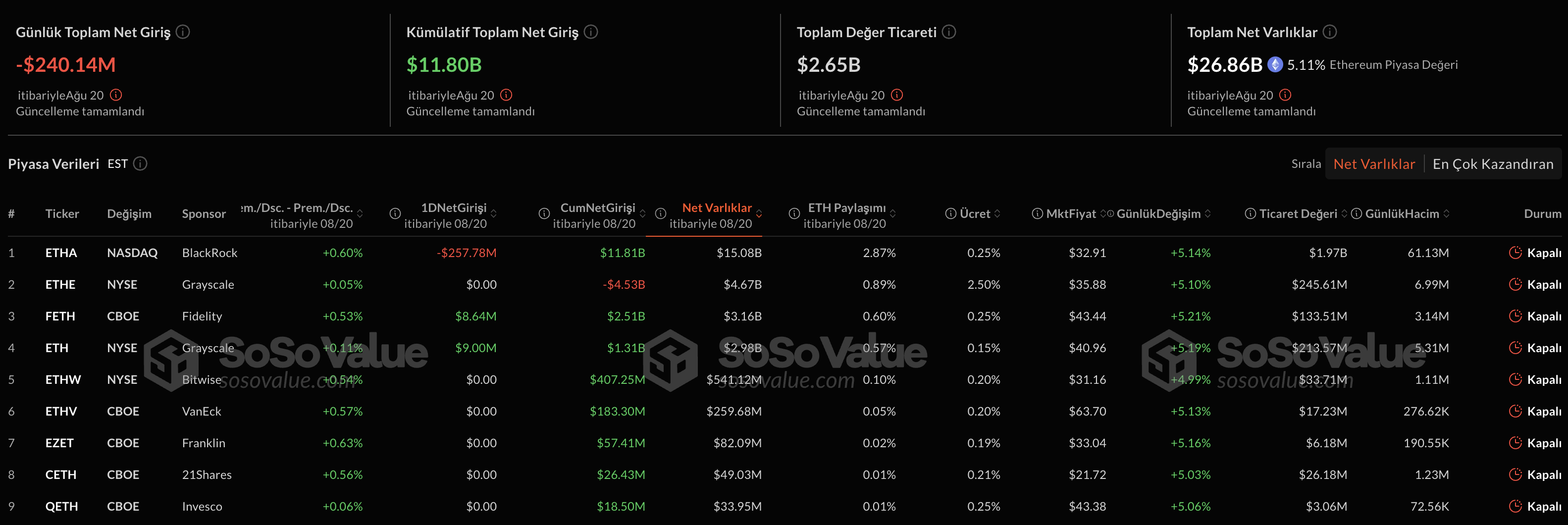

On the other hand Sosovalue‘s data traded in the USA Spot Ethereum ETF‘s approximately 6.7 million ETH holds and this amount corresponds to about 5.5 percent of the current supply. Crypto currency treasures have also accepted. Ethereum treasures, which have become one of the focal points of the market, confirm that accumulation deepens both in the company’s balance sheets and ETF structures.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.