BernsteinIn the last investor note he shared, despite the last retreat in the crypto currency market, he reiterated the opinion that the “long, exhausting” bull cycle continued. The intermediary institution said that the current cycle can extend beyond the traditional four -year model with the US political support and the impact of corporate adoption. Note Bitcoin $115,546.30(BTC) will climb to the range of $ 150,000-1200,000 in the next 12 months.

Bernstein: Taurus market can extend until 2027

Bernstein analysts Gautam chhugani And MahikaHe argued that the US administration is at a critical stage in the goal of making the country as the “Crypto Capital of Crypto”, and that they expect the rise to be moved to 2026 and that the possible summit would be seen in 2027.

In the note, the cycle will not only be limited to Bitcoin, Ethereum (ETH)  $4,300.67, Solana (Left) and defi -oriented Altcoins can also feed the next leg of the rally. The expectation was based on the ground that supports the fund flows towards stablecoin exporters with the expectation process platforms.

$4,300.67, Solana (Left) and defi -oriented Altcoins can also feed the next leg of the rally. The expectation was based on the ground that supports the fund flows towards stablecoin exporters with the expectation process platforms.

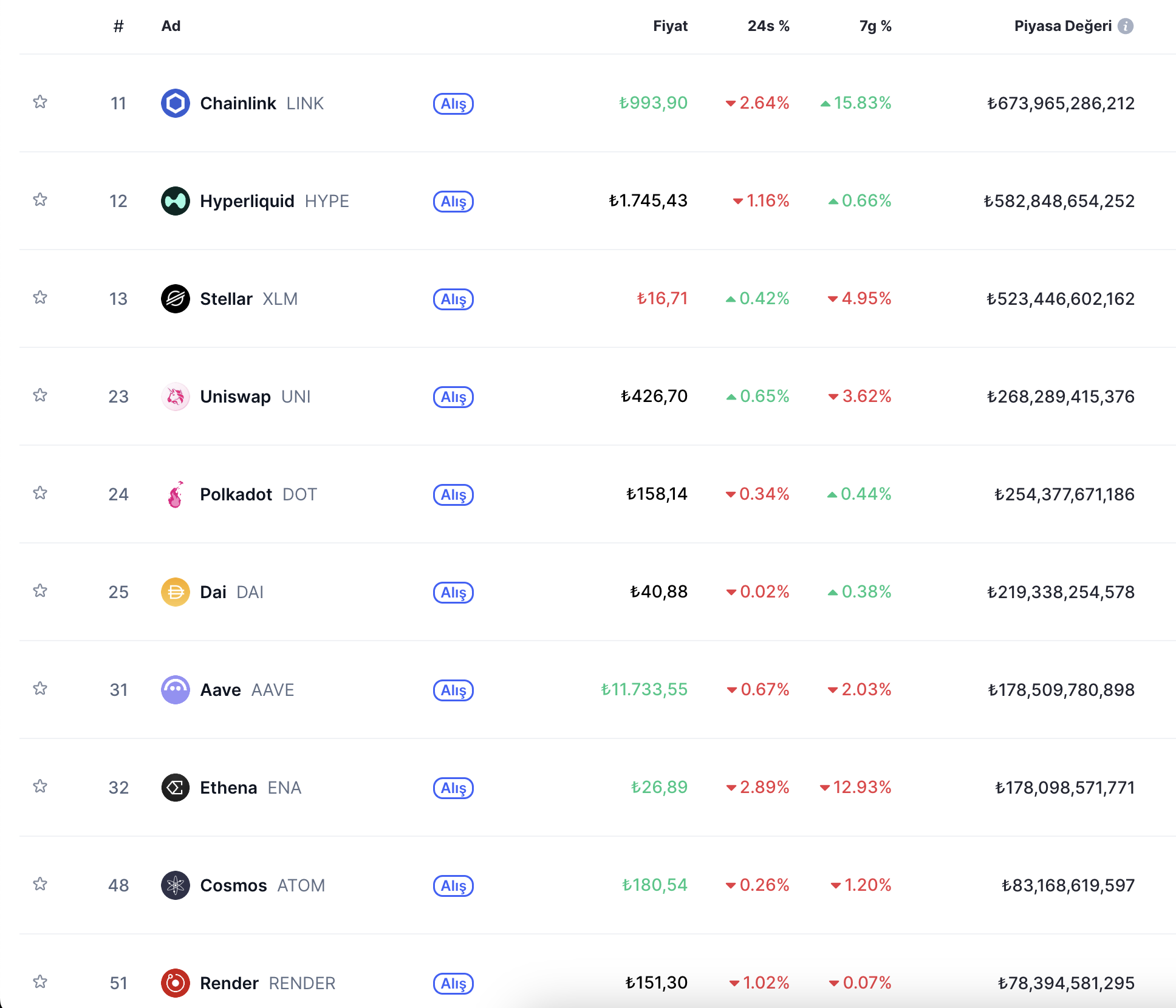

CoinMarketcapAccording to the list offered by defi -focused subcoins Chainlink  $24.71 (LINK), Hyperliquid (HYPE), Stellar

$24.71 (LINK), Hyperliquid (HYPE), Stellar  $0.408493 (XLM), Uniswap (UNI) and Polkadot (DOT) stands out.

$0.408493 (XLM), Uniswap (UNI) and Polkadot (DOT) stands out.

Target prices for Coinbase and Robinhood have been upgraded

Bernstein, Robinhood For (Hood), the target price increased from $ 105 to $ 160. As a reason, the crypto currency transaction volume in the application reached 16.8 billion dollars by reaching an increase of 110 percent on a monthly basis, the vitality on the share and option, the institutional user base of Bitstamp purchase and stinging and tokenized products in Europe were shown. According to the brokerage house, Robinhood’s diversified model is less exposed to crypto currency volatility than pure stock market shares.

Coinbase The target price for (CoIN) was shared as $ 510. Analysts, in July, more than $ 100 billion in the volume, 44 percent of the quarter average transaction income increased, indefinitely growth in transactions and 2.9 billion dollars of agreement after the integration of Deribit’s option platform highlighted. Coinbase’s role that accelerates the adoption of USDC and the vision of the “Stock Exchange of Everything” were among the catalysts shown for the second half of the year.

Circle For (CRCL), $ 230 was preserved. However, the note contains an estimation that the USDC supply could rise from $ 68 billion to 99 billion dollars in 2026 and to 173 billion dollars in 2027. Arc Blockchain -oriented focused on payment and cooperation with banks were noted as strategic differentiates.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.