Crypto Money Market It continues to maintain its power as it is preparing to leave behind the week of August 11-18. Bitcoin (BTC) $118,396.50 While seeing the highest level of all time with $ 124,457 on August 14 Ethereum (ETH)  $4,560.64 He approached the top of 2021 and tested the $ 4,788. In the new week, pricing in crypto currencies will determine possible peace talks between Russia and Ukraine, FOMC minutes, use of weekly unemployment rights, and speech headings of the FED President Jerome Powell. Analysts emphasize that volatility in the market may increase with this calendar.

$4,560.64 He approached the top of 2021 and tested the $ 4,788. In the new week, pricing in crypto currencies will determine possible peace talks between Russia and Ukraine, FOMC minutes, use of weekly unemployment rights, and speech headings of the FED President Jerome Powell. Analysts emphasize that volatility in the market may increase with this calendar.

Eyes in Russia-Ukraine Peace talks

USA President Donald Trump’s Monday, August 18th Ukrainian He is expected to meet with President Volumir Zelenski. Trump, Russia After meeting with President Vladimir Putin, he pointed to a peace agreement instead of a ceasefire. Such an agreement can rapidly change the perception of global risk, as it has the potential to end the war that has lasted for about three and a half years.

The decrease in geopolitical blood pressure will pave the way for capital to turn to risky assets. Bitcoin and the strengthening of the hope of peace altcoinIt can increase interest in ‘s. Therefore, the news flow will be decisive in the short term. Even the difference in tons of descriptions can bring hard, rapid direction changing movements at prices.

The other 3 important titles of the next week

On Wednesday, August 20, dated 29-30 July FOMC meetingDetailed minutes will be published. On Friday, August 22, the Fed President Jerome PowellWill share its assessments of the US economy and the review of the policy framework. The speech will follow the clues that Powell can give about the calendar for the next interest rate cut. Crypto money market both FOMC minutes Powell usually experiences hard fluctuations before the speech. Therefore, expectation management is critical.

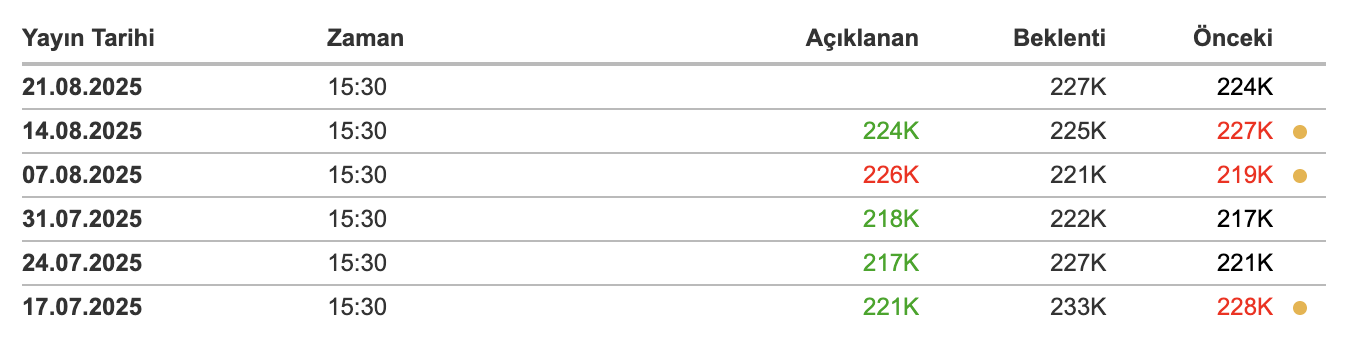

Weekly on Thursday, August 21st between the two fed titles Applications for Unemployment Rights data will be announced. Last week, applications fell from 227,000 to 224,000. This week Investing.com According to data, an increase of 3,000 is foreseen. The realization of the expectation may suppress the risk appetite and trigger harsh response movements in crypto currency prices, indicating that dismissal caused by macro and micro uncertainty increases.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.