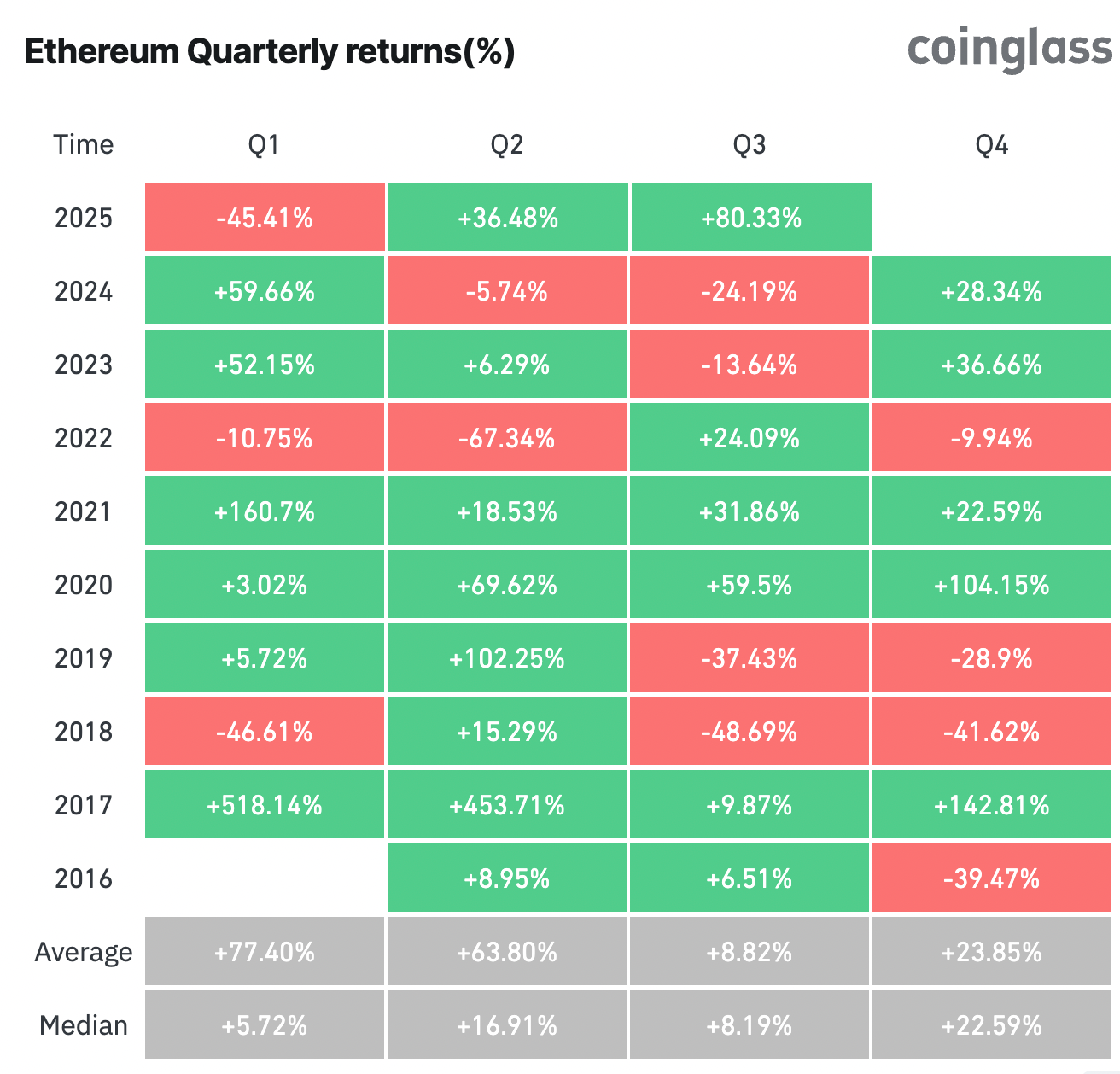

Ethereum (ETH) $4,560.64shows the third most powerful quarter performance in its history with an increase of 80 percent in the quarter. CoinglassThe data provided by the largest Altcoin’s Bitcoin, which gained only 10 percent value in the same period  $118,396.50shows that he left behind.

$118,396.50shows that he left behind.

Data Record Point the third quarter

EthThe existing performance of the current quarter reveals that a measurable separation occurs in the market. In spite of the limited rise in Bitcoin (BTC), there is an increase in ETH that exceeds the double households and sees over 80 percent. These two located at the center of the market crypto currency When it is placed side by side, the winner of the period and the data are clearly ahead.

Previous best third quarter In 2020, it was recorded in the process referred to as defi, ETH rose by 59.5 percent. At that time, while Yield Farming increased the interest, the total value of locked assets on the network increased by 380 percent compared to the previous quarter. The third quarter of 2020 was engraved in memory as a peak period in which the interest towards the Ethereum ecosystem in every aspect was embodied.

ETH’s best quarter of the whole time took place at the beginning of 2017 with a 518 percent rise. ICO At the beginning of the fury, many projects collected capital with the ERC-20 exports. Developers and corporates were more closely in Ethereum. Today, the market value of $ 539 billion is considered to be low for a similar splash for ETH.

Recorded in the third most weakest quarter 2018

On the other hand, Ethereum was recorded in the third most weakest quarter 2018. At that time Crypto Money Market With the effect of the collapse throughout ETH, ETH lost 49 percent. The tremor on the ICO side increased the severity of the decline. The adoption of low -decentralized application (DApp) and the progressability problems made the pressure permanent. The third quarter performance at these two opposing ends makes the historical context between the quarter periods.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.