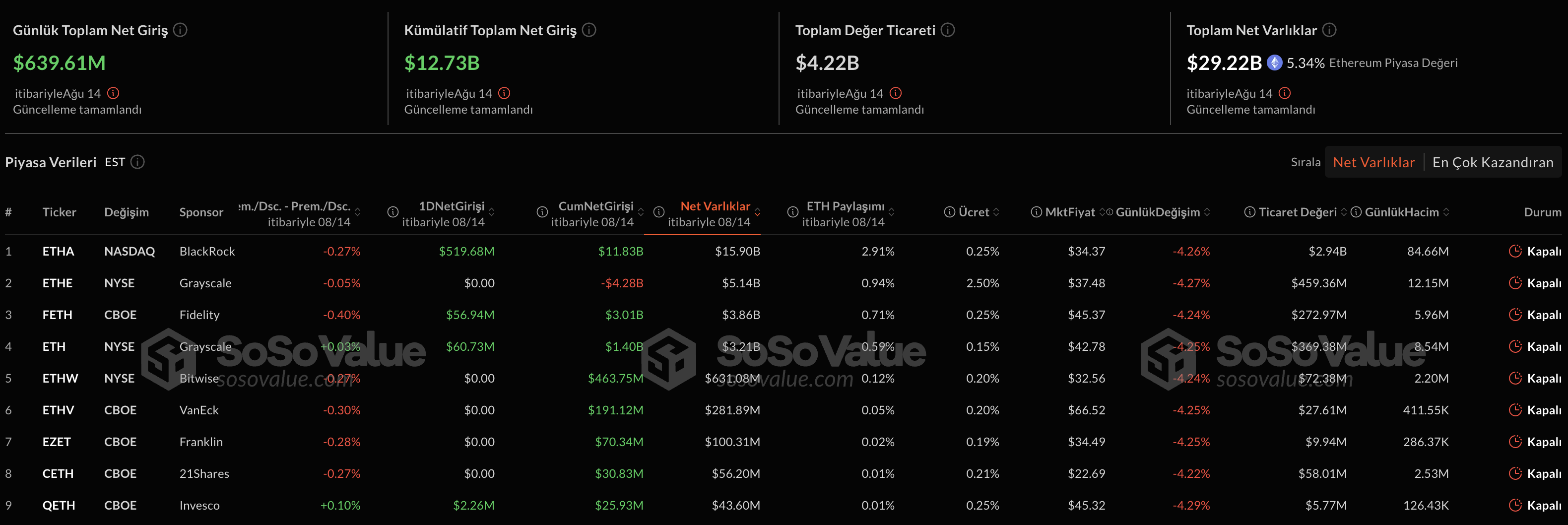

In the USA Spot Ethereum $4,712.64 ETF‘s on Thursday, 639.6 million dollars with a net entrance to the eighth consecutive day also closed positively. According to Sosovalue data, Blackrock’s ETHA is 519.7 million with a net entry with a net entry pulled. Cumulative entrance to ETFs in the last eight days reached $ 3.71 billion. Altcoin giant Eth, CryptoappsyAccording to the price data of the last 24 hours, a decrease of 2.03 percent in $ 4,655 is traded.

ETHA took the lead with $ 519.7 million

Ethereum The net entrance to their ETFs on Thursday was $ 639.6 million. Thus, the ETFs in the United States formed a positive entrance series that lasted for eight days in a row. This development showed that the demand for the ETF channel continued after record -breaking volumes at the beginning of the week.

In the ETF -based table Blackrock‘s ETHA’ $ 519.7 million with a net entry of the day was the leader of the day. Grayscale Ethereum Mini Trust Net 60.7 million dollars, FidelityThe conquest product of the net has entered 56.9 million dollars. Invesco’s Ethereum ETF was also on the positive side, albeit limited.

There is a strong start behind the positive entry series. The net entrance record of $ 1.02 billion on Monday carried the momentum up during the week. Entrances, which reach $ 3.71 billion in eight days, indicate that the interest rate of investor throughout the product family is widely based.

LAST SITUATION IN ETH PRICE

EthShort -term fluctuation is remarkable on the price side. The price based on $ 4,800 during the week decreased by up to 6 percent in the last 24 hours to 4,400 dollars. Since then, some recovered ETH is traded for $ 4,655 at the time of the news. However, in the weekly time period, the Altcoin giant is priced with an increase of 18.95 percent.

Momentum was also reflected in the estimates of the institutions. Standard Chartered Analysts increased the end of the previous year’s target to $ 7,500 for Ethereum, $ 4,000. Behind this change, the strengthening of market acceleration was effective.

Bitcoin for comparison  $120,894.38 Looking at the façade, Spot Bitcoin ETFs were $ 230.9 million on Thursday. Although the figure is low to Ethereum ETFs, the $ 86.9 million entrance on Wednesday is significantly over.

$120,894.38 Looking at the façade, Spot Bitcoin ETFs were $ 230.9 million on Thursday. Although the figure is low to Ethereum ETFs, the $ 86.9 million entrance on Wednesday is significantly over.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.