BTC It was moving to 121 thousand dollars and the US markets were opened with rising at the time of preparation. US tariffs have been commissioned with April rates for all countries for 13 days. Trump thinks that the tariffs are a good weapon to balance the rapidly growing US debt. So how many billion dollars are targeted annually? What is the importance of crypto coins?

US Tariffs

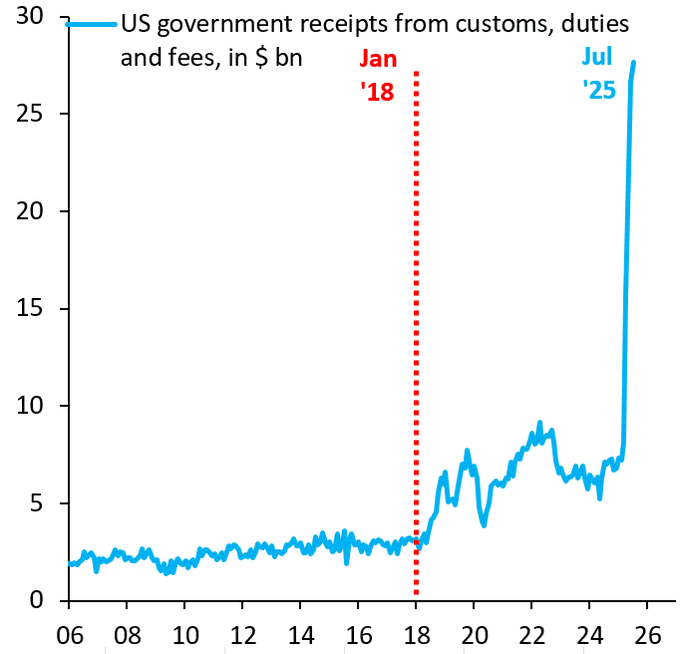

We are trying to understand the effect of tariffs in every US economy report. One of the ways to realize how much tariffs are showing themselves is to monitor tariff revenues. Tariff revenues that increase from month to month also show that the role of tariffs on the economy increases day by day.

In July, US customs duties revenues increased by 300 %, leaning for 29.6 billion dollars, a record -level record -level. If this continues to increase rapidly Trump As long as he is in office, a customs duty income of close to $ 350 billion can be seen annually. Of course the only benefit of the tariffs customs duty not income. Apple will make US investment of $ 600 billion alone for tariff exemption. So the indirect effect of tariffs is more than visible.

Moreover, customs tax revenues, which are constantly from month to month, say that the impact of tariffs on inflation cannot be fully understood until these revenues are stabilized. In other words, when tariff revenues stop breaking new records and return to bed, we will now see that the impact on inflation (we have seen the maximum consequences of tariffs) is clearly emerged.

TKL touched on this issue. In today’s evaluation, he shared the graph below and revealed today’s difference with the tariffs in 2018.

Trump’s first trade war The program started during the first presidency and tariff revenues did not exceed 10 billion dollars even 1 month. Today, more than 3 times the summit of that period is available. Moreover, this Chinese agreement will increase even more.

Tariff Revenues of 2025;

- March $ 8 billion

- April 15 billion

- May 22 billion

- June 26 billion

- July 30 billion

Despite the 90 -day pause, this rate of increase is remarkable. 100 billion dollars have already been exceeded. Of course, the trade volumes that increase with the expectation that taxes will increase further are also effective.

Effect on Crypto Coins

This month, customs duties are expected to exceed $ 40 billion. The increase in customs duties to India, 40 %to Brazil and 15 %to Japan will be effective in this increase in income. Will the US debt be closed?

Dogge expenditures are trying to weaken the debt by cutting, but the debt is still increasing. Trump promised to use customs duties to reduce the budget deficit. Despite the tariff revenue of $ 30 billion, the increase in budget deficit in July reached 19 %to 47 billion dollars. The government’s expenditure for a single month is over $ 630 billion. In July 2025, we saw a huge budget of $ 291 billion. In other words, not only the budget deficit rate increase rate can not close tariff revenues.

Alright Crypto Coins? Gold and Bitcoin  $120,676.68 It gains strength because the budget deficit does not decrease, while interest rates are becoming compulsory.

$120,676.68 It gains strength because the budget deficit does not decrease, while interest rates are becoming compulsory.

Moreover, we will see that tariff revenues write a story that will increase the motivation of interest cuts. If it progresses at this speed, the tariffs can soon generate more income as much as the corporate tax. Trump is across the screen and says the United States earns tremendous income. The tables justify him. Many does not see that the debt caused by the expenditure problem does not close. Interests fall, the US interest expenses weakens Trump once again in front of the screen and says our greatness. Crypto coins rise more. The possible scenario seems like this.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.