We just announced the last minute US inflation The number came and the headline inflation expectation remained six. This is a great development and the Fed September interest rate cut the kind that will increase hopes. Probably a little later, the US stock markets are positively opened and we see that the rise in crypto currencies gained momentum. What are the details of the inflation report? What are the current expectations for interest rate cut?

US inflation report

According to the US Office of Statistics, the housing index rose by 0.2 %in July and was the main reason for the increase in all items. The food index did not change on a monthly basis; While the food index consumed outside the house increased by 0.3 %, the food index consumed at home fell by 0.1 %. In contrast, the energy index decreased by 1.1 %in July; The gasoline index fell by 2.2 %during the month. All of this led to the shaping of the July inflation report.

If Trump does not go to a major restoration with Putin on Friday, the decline in energy prices and the inflationary effect of tariffs can continue to balance. Excessive cooling signals on the employment front are compared with relatively horizontal inflation, even Powell can be willing to reduce.

The detail that draws attention in the report is that CPI was affected by the tariff change but did not offer a clear measurement. The effect of tariffs on inflation will be understood to be spread over time. Moreover, we will begin to see the results of the rates that were activated in the early August.

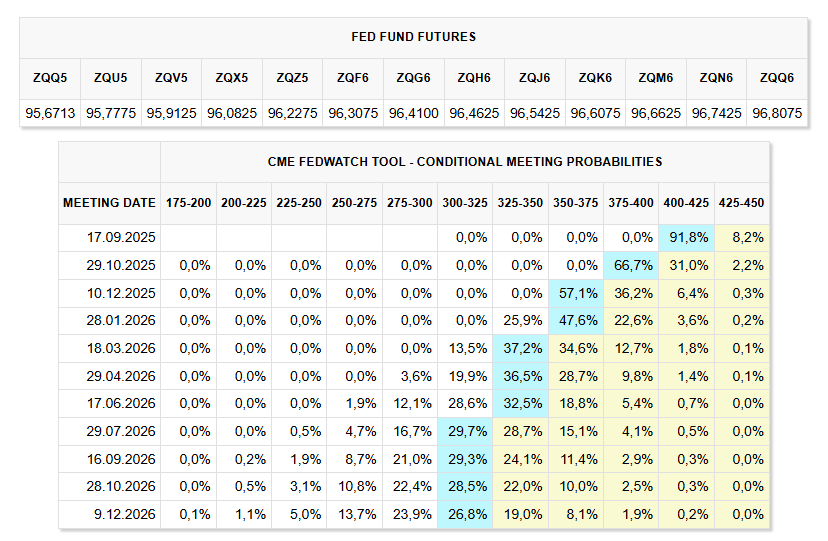

Fed Interest Discount

As the price of BTC returns to $ 119 thousand Eth as well as rising. New after 36 days 5 hours interest rate will be announced. However, after seeing the next August inflation report next month, we will see that the Fed has announced the interest rate decision, so everything will be clear. So far, 2 Fed members took a stance in the direction of discount. 1 new member was appointed by Trump and Miran is expected to vote in favor of discount. Two members said that this month’s statements can be started due to the cooling of employment.

In other words, 2 Fed members must accept that the impact of tariffs on inflation is limited, that excessive cooling signals are taken in employment and support discounts. This will probably be very likely, and if ETF approvals arrive at the September interest rate, crypto currencies will experience a nice year.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.