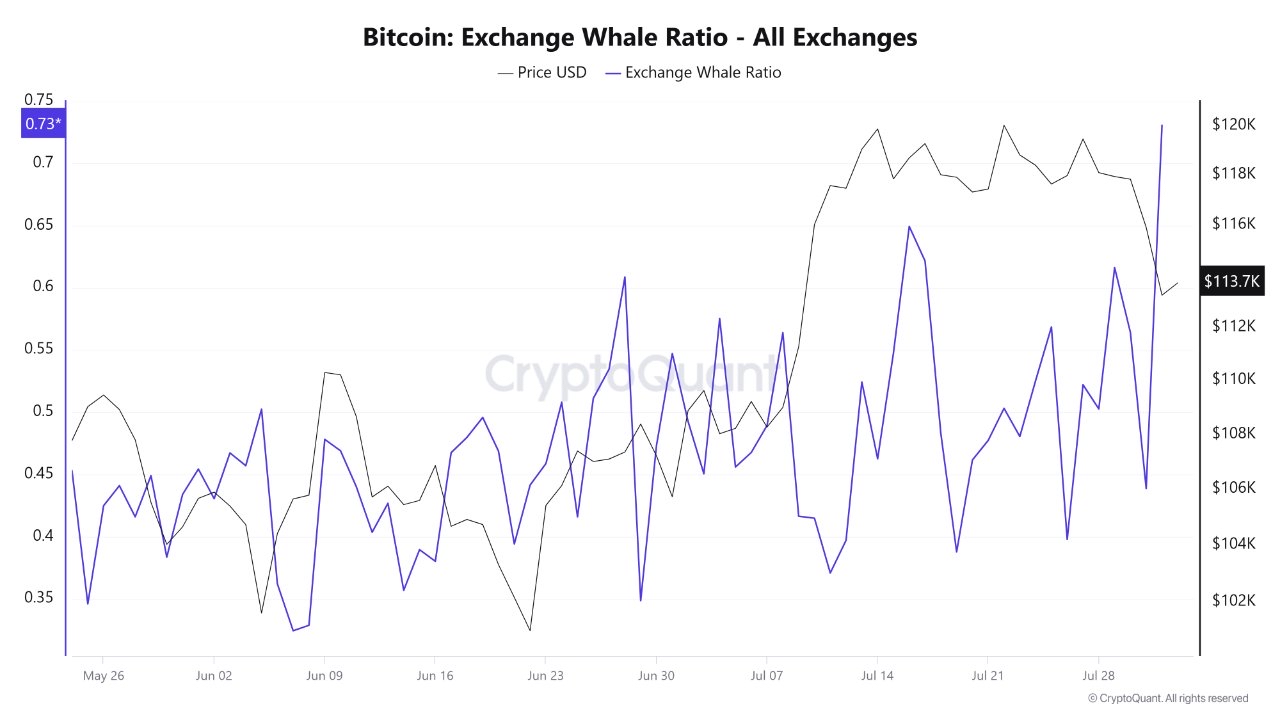

Great in recent days Bitcoin $114,414.66 Investors, ie whales, carried a significant portion of BTCs to the stock market, causing the data platform Cryptoquant to increase the Exchange Whale Ratio indicator to 0.7. This ratio indicates that whales transfer a huge amount of Bitcoin from personal wallets to the stock market wallets for the purchase of profit or position. The fact that long -term investors still say 67 percent of the total Bitcoin supply indicates a controlled re -positioning process away from panic atmosphere.

Great investors ran to the stock market

Transferred to stock markets BTC The volume has gained momentum, especially in the last week. Cryptoquant’s Exchange Whale Ratio indicatorThe fact that it increased to 0.7 reflects this situation directly. Whales were ready to turn their unprecedented profits in the previous months and turn them into land and turn them in cash. In particular, US employment market data, which came below expectations last week, increased the tendency to escape the risk and pushed institutions and funds demanding cash.

Experts who analyze investor behaviors evaluate the rise in the rate as a short -term profit purchase approach and preparation for the fluctuation in the market. The natural market cycle, where extreme technical steps are avoided, continues. According to experts, whales aim to meet liquidity needs before the next bull run.

Market response and support levels

CryptoappsyAccording to data, Bitcoin’s price found around 114 thousand dollars after the fell to 112 thousand dollars despite the fact that the whales were directed to the stock market. Technical indicators show that 115 thousand to 116 thousand dollars are an important threshold. The inability to overcome this level may trigger the horizontal movement by being under pressure from the receiving appetite. 110 thousand dollars and $ 100 thousand thresholds stand out as two psychological support levels.

With all this long -term investorsIn Bitcoin, the fact that they are not fully action and controls a significant portion of the supply contributes to price stability in Bitcoin. Although it flucts with variable rates, it seems to be digesting the sales of market whales for now. Moreover, both spot and derivative stock exchanges are not disrupted. This indicates that the general trust environment in the market is preserved.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.