Bitcoin (BTC)  $114,414.66At the beginning of August, fell below the critical support in 116 thousand dollars, damaged the risk appetite of global investors. Jihan Wu’s Matrixport showed seasonal price weakness and macroeconomic uncertainties as the main triggers of this decline. In the report published, it was emphasized that the fact that the big wallets turned to profit purchase increases the sales pressure. On the other hand, Strategy’s 21 thousand 21 BTC purchases reminds us that corporate interest continues, but the short -term look requires cautious.

$114,414.66At the beginning of August, fell below the critical support in 116 thousand dollars, damaged the risk appetite of global investors. Jihan Wu’s Matrixport showed seasonal price weakness and macroeconomic uncertainties as the main triggers of this decline. In the report published, it was emphasized that the fact that the big wallets turned to profit purchase increases the sales pressure. On the other hand, Strategy’s 21 thousand 21 BTC purchases reminds us that corporate interest continues, but the short -term look requires cautious.

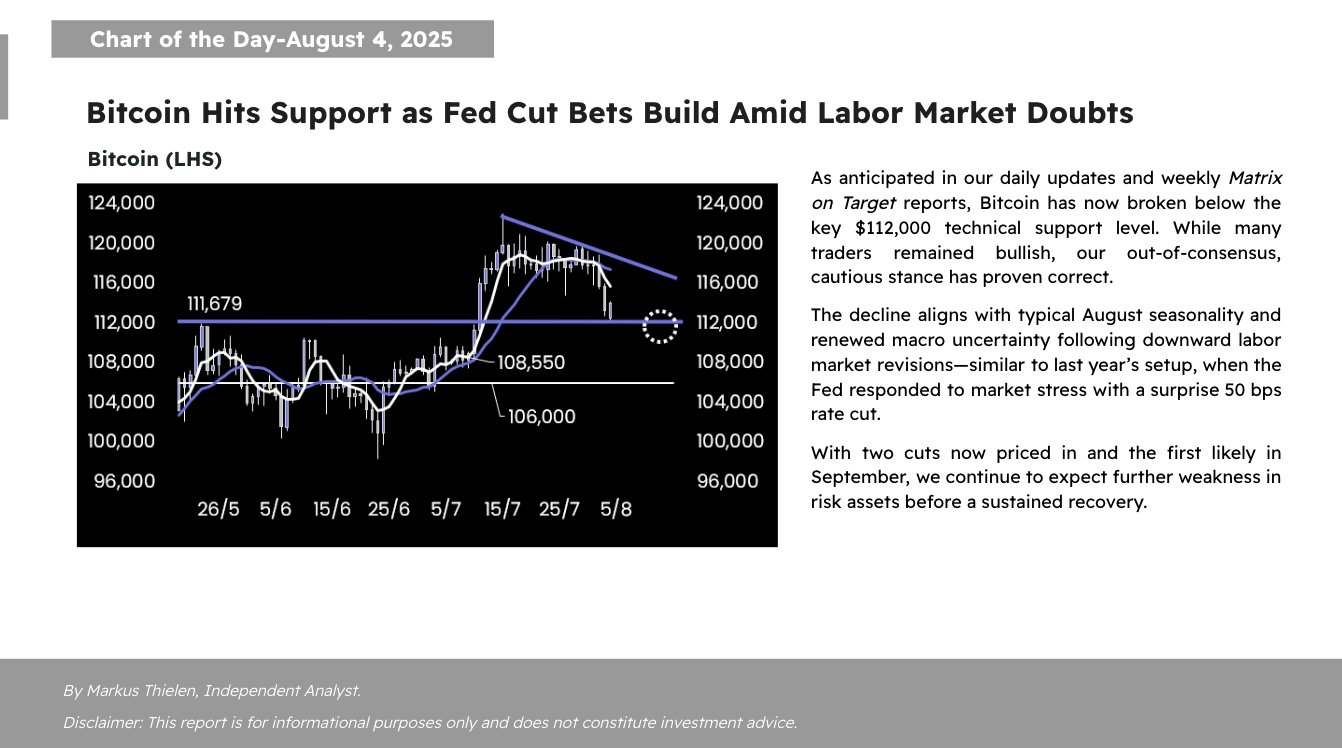

Support Breeding Warning from MatrixPort

MatrixPort Pay attention to the withdrawal of Bitcoin’s withdrawal in the same period in the last two years pulled. Last year after the weak US employment data accelerated sales wave this summer re -revived with the expectations of interest rate reduction said. Although the loss of 116 thousand dollars does not mean trend return, the price goes down to 114 thousand 714 dollars.

Analysts warned investors with the phrase “Stay in defense until the basic indicators became clear”. Bitcoin’s market share of 61 percent of the capital yet altcoinAlthough it shows that it does not flow, the decrease in a 24 -hour process volume of a 24 -hour process confirms the lack of fresh buyers.

Analysts stated that the low liquidity conditions specific to the summer season facilitates harsh movements and added that the rise potential can only return with a positive signal of macro data.

Corporate purchases shape market expectations

Led by Michael Saylor Strategylast week an average of 117 thousand 256 dollars of 21 thousand 21 BTC’dın reporting that the cuffs decorated. This high -volume purchase, which is realized as a “resistance zone de in matrixport analysis, reinforces the company’s long -term growth strategy. However, the limited impact of the purchase news on price acceleration shows that the market is still focused on data and policy signals in the short term.

CryptoappsyAccording to data, Bitcoin’s market value is at $ 2.28 trillion and the loss in the last 7 days is 3.51 percent. Experts emphasize that permanent rise in risky assets should not be expected in risky assets without healing macro conditions or a strong regulatory catalyst.

Although Strategy’s brave Bitcoin strategy shows that the risk -taking appetite in the corporate segment is not completely lost, most of the short -term investors prefer to wait outside the market due to price fragility.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.