XRPRecovering from $ 2.75 support, he gained more than 5 percent during the day and approached to re -test the $ 3.0 threshold. Open positions exceed $ 7.3 billion Ripple  $2.99 He triggered a strong leverage movement for the linked Altcoin. Analysts say that an acceleration extending to $ 3.06 can accelerate the upward movement by liquidating Short positions. In the current table, XRP leads the general rise in the crypto money market today.

$2.99 He triggered a strong leverage movement for the linked Altcoin. Analysts say that an acceleration extending to $ 3.06 can accelerate the upward movement by liquidating Short positions. In the current table, XRP leads the general rise in the crypto money market today.

The background of the rise in XRP price and expectations

The basis of the rise lies in the withdrawal of the XRP last week to the support of $ 2.75. This movement only pushed the price up. Price rise at the same time open position volumeNi moved to record levels and distributed sales pressure. Market participants think that the liquidation of leveraged Short position clusters collected around 3.06 dollars can carry on a psychological $ 3.0 in a short time. The volume increase supported by short, net reaction purchases has turned the price movement in favor of the bulls.

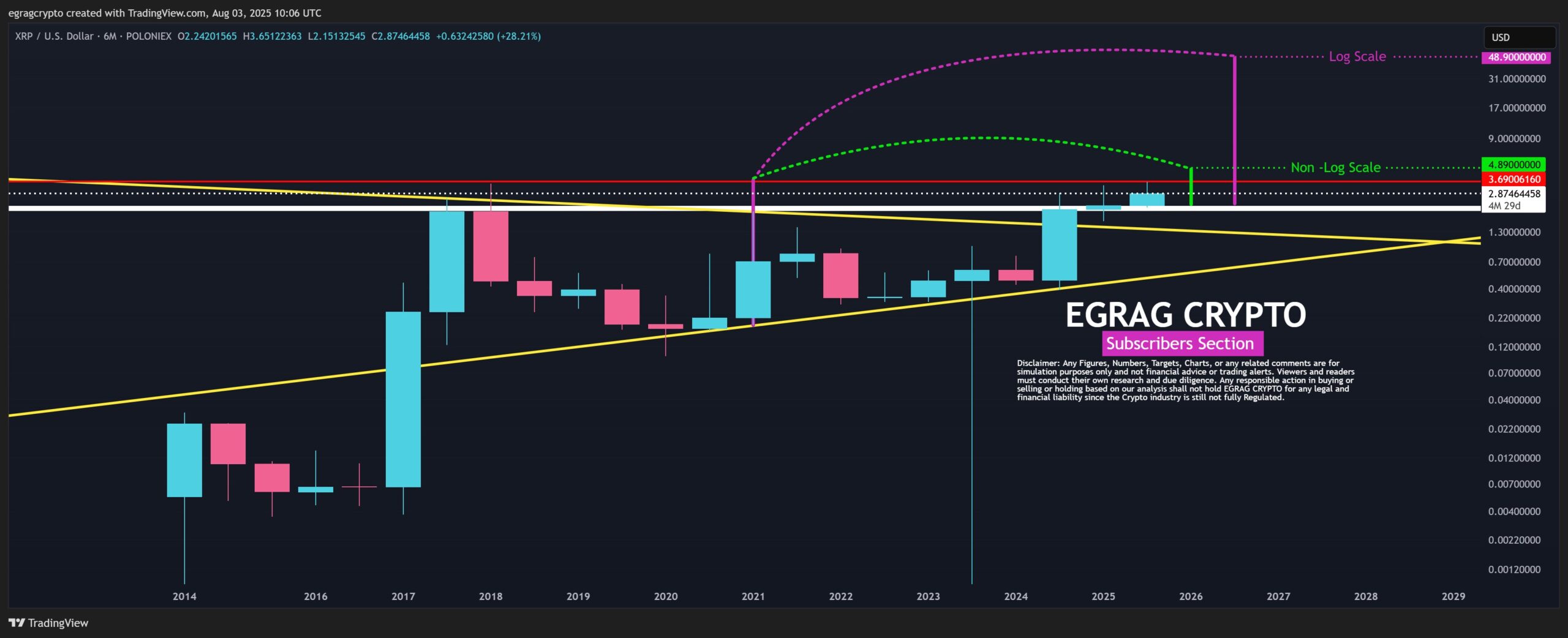

Both ECRAG CRYPTO as well as Javon Marxsupported the upward potential of the existing structure with figures. Analyst Ekrag, 4.89 dollars on linear scale, logarithmic scale, such as $ 48,90 after calculating the end price targets after calculating an average target of 27 dollars. he took off. Marx remains loyal to the target of $ 4,80 as long as the support of $ 2.47 is protected, while the road map is valid for this condition.

The role of aggressive buyers in market fluctuation and expectations

Increasing volatility when we look at the general market conditions Donald TrumpIt was decisive to announce new tariffs for imports from Asia and Europe. The statement in question weakened the risk appetite when the Fed did not approach the interest rate cut and would not approach for a while. BTSE COO Jeff MeiHe stressed that the purchases seen before the US opening may be exaggerated, and that opportunistic buyers avoided step back.

The monetary value of leveraged positions liquidated last week approached $ 1 billion. Bitcoin  $114,414.66 5 percent falling Ethereum

$114,414.66 5 percent falling Ethereum  $3,555.25 12.5 percent fell. Spot triggered with withdrawal from Bitcoin ETFs up to $ 112 thousand at a price of approximately 1 billion dollars in two days. At the same time, the $ 152 million from the Spot Ethereum ETFs reinforced the oppressed atmosphere of the market.

$3,555.25 12.5 percent fell. Spot triggered with withdrawal from Bitcoin ETFs up to $ 112 thousand at a price of approximately 1 billion dollars in two days. At the same time, the $ 152 million from the Spot Ethereum ETFs reinforced the oppressed atmosphere of the market.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.