Bitcoin (BTC)  $113,966.40123 thousand dollars in mid -July, the historical summit of about 10 thousand dollars decreased from the 113 thousand dollars of the band is currently traded. Since July 31, the price that could not hold in the range of 117 thousand – 120 thousand dollars, went down to 112 thousand dollars on 2 August and tested the lowest level of the last three weeks. Analyst Ali MartinezAccording to the $ 983 million leverage liquidation, deepening the wave of sales deepened attention to the support zone between 105 thousand and 107 thousand dollars. The volatility and Donald Trump, which can increase with the opening of the week, are closely monitored.

$113,966.40123 thousand dollars in mid -July, the historical summit of about 10 thousand dollars decreased from the 113 thousand dollars of the band is currently traded. Since July 31, the price that could not hold in the range of 117 thousand – 120 thousand dollars, went down to 112 thousand dollars on 2 August and tested the lowest level of the last three weeks. Analyst Ali MartinezAccording to the $ 983 million leverage liquidation, deepening the wave of sales deepened attention to the support zone between 105 thousand and 107 thousand dollars. The volatility and Donald Trump, which can increase with the opening of the week, are closely monitored.

105-107 thousand support for Bitcoin critical

Bitcoin’s acceleration weakened after he went above $ 123,000 on 17 July. The price was stuck in the band of 117 thousand to 120 thousand dollars for about ten days. Although the attempt of fake ascension on July 25 was defended by the bulls, the real dissolution came at the end of the month. The largest returned from 119 thousand dollars on July 31st crypto currencythe next day, seeing the bottom level of 112 thousand dollars by seeing the trust of investor shook.

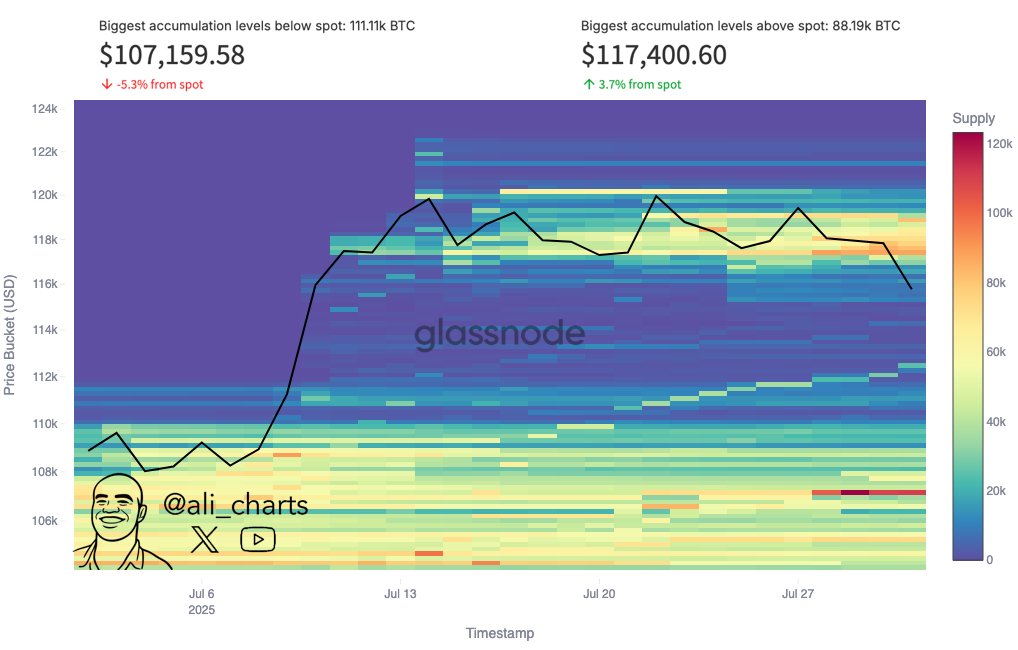

Ali Martinez, Blockchain metrics intense in the range of 105 thousand to 107 thousand dollars BTC that you show your purchase emphasized. In case of loss of this support zone, sales pressure may increase, while protection may prepare the ground for short -term recovery. The analyst reminds that the region has been tested many times during the July rally and that buyers have gained strength every time. For now, around 113 thousand dollars, the price of buyers in balance thanks to the approach of the defense line is in balance.

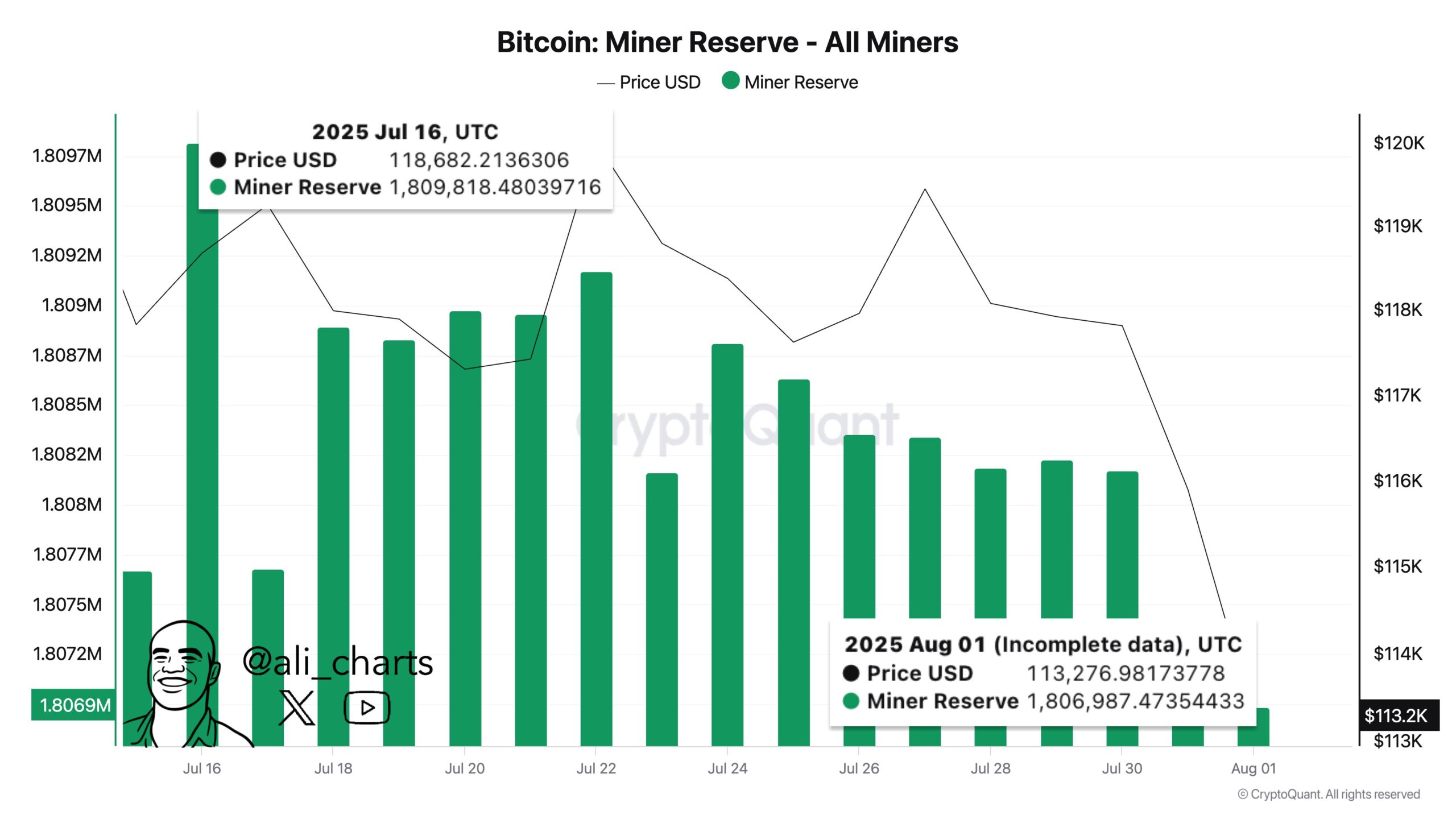

Miners also sell

Global economic uncertainty, geopolitical tensions and question marks on the policies of the Central Bank reduce the risk appetite. While investors began to evacuate their loaded positions as of the end of July, approximately $ 1 billion leveraged transactions were liquidated during the last fluctuation. Martinez said that miners accelerated the decline by selling 3,000 BTCs in two weeks, and the liquidity output is clearly seen in Blockchain. stated. This sales tendency Bitcoin minesis progressing in parallel with operational cost pressure.

Analysts are waiting for a new wave of volatility with the opening of the US and European stock exchanges on Monday, August 4th. The direction of traditional markets will shape the short -term course of Bitcoin’s price. Also US President Donald Trump‘s Sunday nights, the surprise statements that the markets have mobilized the markets in the past, a flash explanation or explanations that may come tonight should not be ignored.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.