At the beginning of 2021, crypto currency investors did not care about the texts that wrote “PMI, and for them, this was the three ordinary letters that came side by side. Today, we follow a lot of things from the US effective customs duties rate to whether the white palace’s lights are burned. Although the second is an exaggeration crypto currency This is the situation of investors. So what does the last report tell us?

US PMI Report

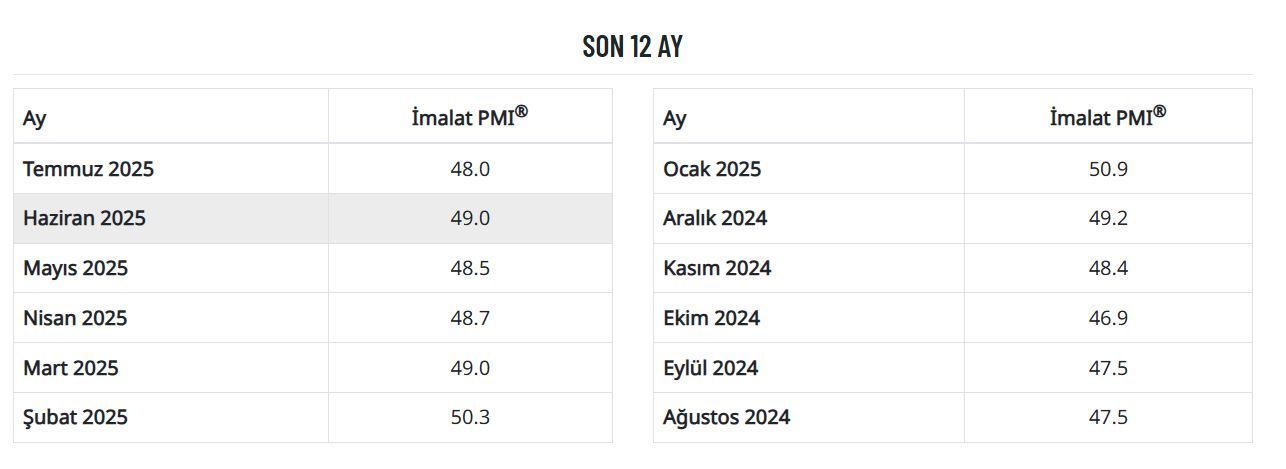

PMI Reports It is the feedback given by the purchasing managers in the relevant field of the economy regarding current conditions. The earliest acquisitions such as the cost of living, the sales status of companies and so on. For July, the finalized US manufacturing PMI data came. The expectation was 49.5 %, but it was a surprise and 48 %below the previous month.

New order and accumulated jobs are decreasing. Employment narrows and raw material stops are decreasing. The economic activity in the manufacturing sector has been narrowing for 5 months in a row. MBA Susan Spence, President of the Labor Survey Committee, said;

“Manufacturing PMI EMMUZ, 49 percent recorded in June, 1 -point decrease in compared to 48 percent was recorded. The general economy continued to expand at 63 months after a month’s contraction in April 2020. (The manufacturing PMI index is over 42.3 percent for a certain period of time.

The new orders index narrowed the sixth month in a row after a three -month expansion period; The number of 47.1 percent is 0.7 points higher than 46.4 percent recorded in June. The July value of the Production Index (51.4 percent) is 1.1 points higher than 50.3 percent in June. The Prices Index continued to remain in the expansion (or ‘increase’) zone by recording 64.8 percent with a decrease of 4.9 points compared to the 69.7 percent rate recorded in June.

In July, US manufacturing activities narrowed more quickly and the decreases in supplier deliveries and employment indices were effective in manufacturing PMI decline. ”

The report also includes comments of participants from different sectors. For example, a purchasing manager at the leather business said;

“These tariff wars began to wear us. It was very difficult to estimate what we will pay as customs duties and calculate the cost savings we have obtained this year. In addition, customs tariffs have broken customs import ties.

The above figures FedHe says that the conditions of the day, when the 50BP began to rapid interest rate cuts, has been almost reached. But tariffs PowellHe ties his hand.

USA non -agricultural employment

Today’s TDi and Unemployment rate The data was a bit uncomfortable for the labor market. Monthly employment increase came as 73 thousand. However, the surprising thing was that the data that had arrived the previous month was revised to 14 thousand out of 125 thousand. With this data, the stock market futures fell and treasury returns sharply declined.

The size of the revision is a very interesting picture. The Fed, who chooses to stay on the edge due to the inflationary effect of tariffs and will not have a 2 -month interest rate reduction, is now watching the cracking in employment. There is more time for the September meeting, and the chaos in employment in employment can make it difficult to decide with the inflation effect of tariffs.

Manpower Group North American Regional President Ger Doyle said that today’s report gave signs of cooling in employment and the pressure increased.

“Jerome, a stubborn moron,“ too late ”Powell should now significantly reduce interest rates.

Trump shared the above before the data. After the data came, “Powell It’s a disaster, ”he said.

Comments from Fed

Williamson from S&P points to deterioration in the operation conditions of the manufacturing sector. Fed member Hammack said that despite the data incoming, he said;

“Right now Fedis experiencing much more deficiencies on the inflation side compared to the employment target. We can see some weaknesses in the labor market. I expect an increase in inflation figures due to customs duties. Fed’s policy is a bit restrictive, not far from neutral. ”

Bostic, FED member, said the following;

“Work data were important, revisions were greater news. The labor market slows down from strong levels. The risk of inflation is much larger than the risk of employment. The risk on the employment front may come to a better balance with inflation risks.

The underlying power under the labor market is still very large. This week, the biggest risk was on the inflation front. In many respects, the labor market still looks good.

I still haven’t heard from the businesses that they were about to dismiss many people. The problem seems to be slowing down the labor market, but it is unclear how weakening it will be in front of us.

Today, I’m waiting for an interest rate reduction this year. I wouldn’t change the Fed decision this week. If the data supports, we are open to change the Fed’s opinion. I’m not ready to raise 2025 interest rates estimates. Customs duties cannot be ignored as examples in textbooks.

Inflation is more far from employment than target. If the customs duties are successful, the FED cannot ignore them. It will take time for enterprises to reflect the increase in customs duties to prices. ”

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.