Repetition of historical structures in graphics in crypto coins much more psychological. In a 24/7 active market, investors hope to make rapid profit in a rapid earnings await with hope for the repetition of structures that have triggered the rise in advance. So, which structure that triggers the rise before the Altcoins is currently exciting investors?

When is the Altcoin Rally?

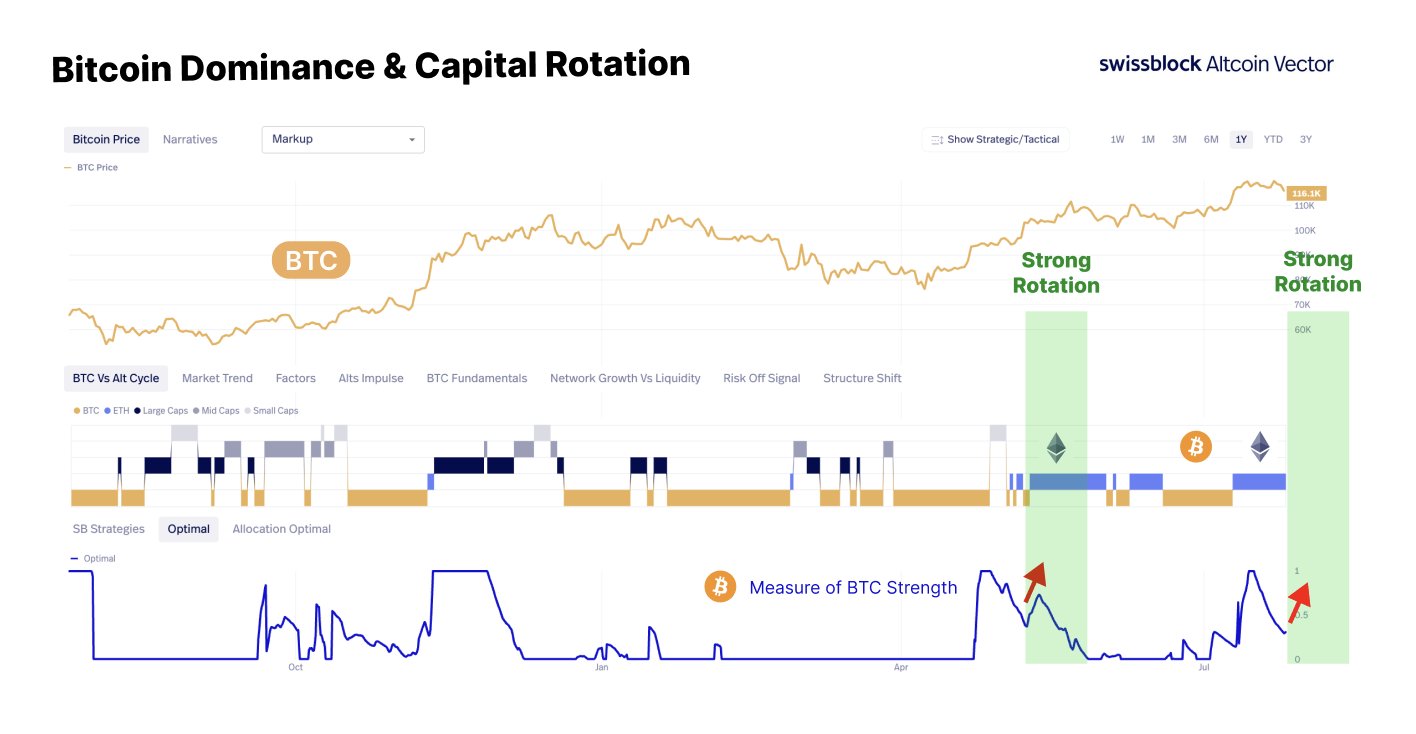

Swissblock’s rotation in today’s assessment Eth He wrote that he continued for and that the rise was now a matter of time. Analyst said that the relative weakness of the BTC before the BTC has determined a 44 %rise to the BTC’s relative weakness of the BTC earlier. The graph below supports this.

Crypto investors’ application – the reason will surprise you!

Crypto investors’ application – the reason will surprise you!

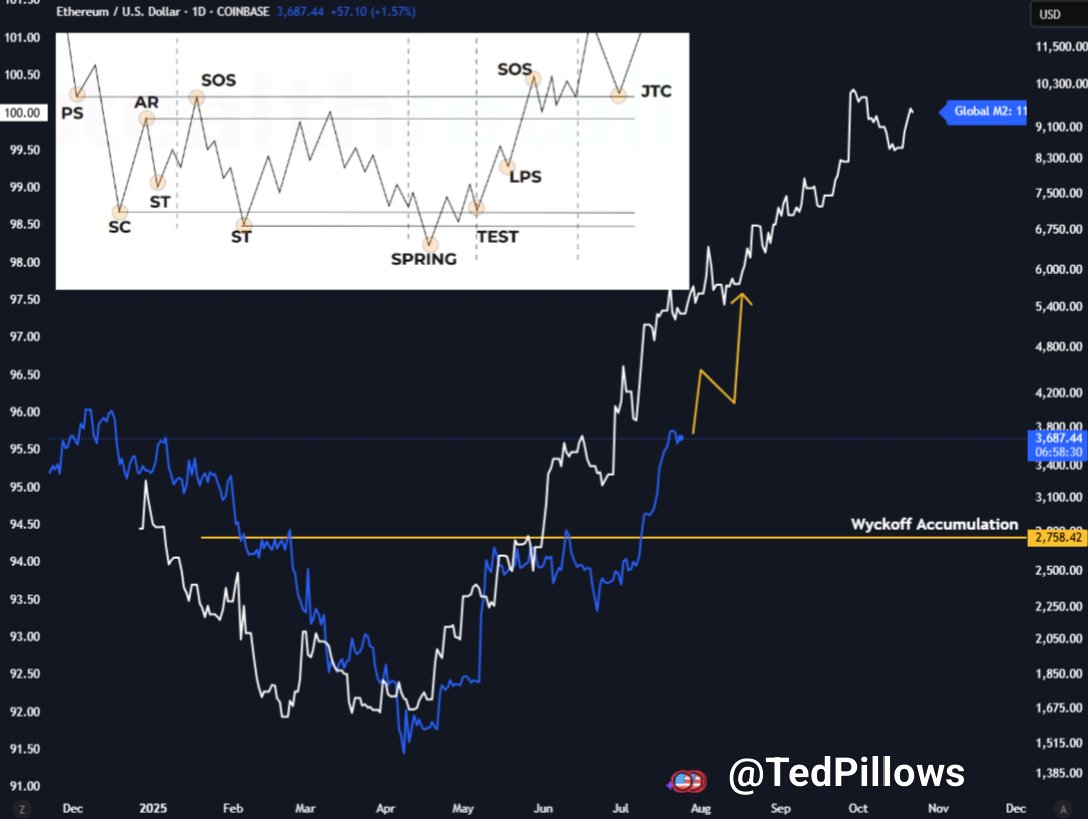

TED Pillows’s global liquidity and Ether‘Swissblock’s gospel to support the sharing he is talking about, he says ETH price can reach AC. This scenario triggers a large rally in the ETHBTC parity and prepares the ground for the general rally of the subcoins by loosening BTC.D. TED wrote the following for global liquidity and ETH yesterday.

“ETH is trying to capture global liquidity. When M2 compared to the supply increase, ETH had to be traded over $ 8,000 at the moment. This shows how much ETH is below and is probably one of the best investment opportunities.”

In summary Eth quite cheap.

Will crypto coins rise?

Daancrypto discussed the totalcap graph today. What is this important? BTC.D is something we want to relax, but if the total value of crypto currencies quickly melts during this relaxation, this is not in favor of the subcoins. So when BTC.D loosening, the market value here subcoins It should take and increase the totalcap further.

“Totalcap It returns in a wide range.

The important area to hold here for bulls. If it is accepted in this range, I would say that there will be a slightly longer consolidation/cooling period after the recent sharp rise.

Some of the following wicks are not a problem, you just don’t want to start closing more than one daily candle under it. ”

In the last 24 hours, we saw $ 500 million liquidation and $ 101 million would be short positions. Open positions decreased by 1 percent and Short positions are dominant with 52.44 %. In the midst of the volume of the weekend, there are investors waiting for more decreases.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.