Bitcoin (BTC)  $118,630.73Ethereum (ETH)

$118,630.73Ethereum (ETH)  $3,675.13Many, especially XRP and Solana (left) crypto currency Since the evening of 23 July, he has been under intensive pressure. The largest crypto currency was deleted by 6.8 percent in 24 hours from the market value. Bitcoin is withdrawn to 117 thousand 300 dollars, Ethereum 3 percent, XRP 13 percent, solana lost 8 percent. Market data describes as a Long Squeeze in which the leverage positions are liquidated by leverage positions of the combination of open positions in prices and accompanying the decrease in prices. It is emphasized that the decline is not limited to a certain crypto paral, and that it is spread throughout the market.

$3,675.13Many, especially XRP and Solana (left) crypto currency Since the evening of 23 July, he has been under intensive pressure. The largest crypto currency was deleted by 6.8 percent in 24 hours from the market value. Bitcoin is withdrawn to 117 thousand 300 dollars, Ethereum 3 percent, XRP 13 percent, solana lost 8 percent. Market data describes as a Long Squeeze in which the leverage positions are liquidated by leverage positions of the combination of open positions in prices and accompanying the decrease in prices. It is emphasized that the decline is not limited to a certain crypto paral, and that it is spread throughout the market.

Leveraged position output in futures markets increased rapidly

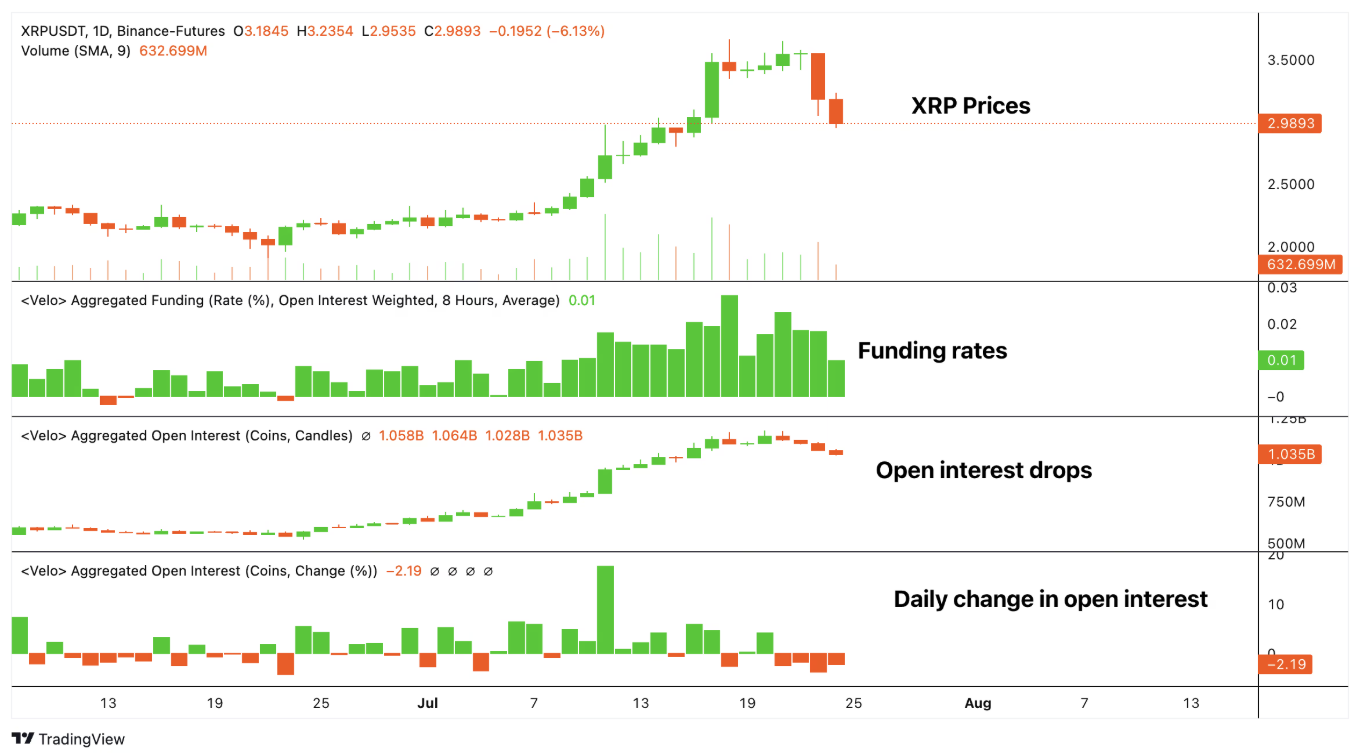

Velo’s Binance, OKX And Bybit As of Thursday, according to the dollar and USDT -based constant transaction data in offshore stock exchanges XRPThe open position fell more than 6 percent in two days. LEFT 5 percent of the decline for BTC 1.5 percent for Eth On the side was measured as 2 percent. These figures show that traders have closed their positions to reduce the risk level and rapidly withdrawn from the leverage use. As a result of liquidations or voluntary exits, the number of contracts decreased significantly.

Funding Rates is still positive. In other words, in constant futures transactions, the price is traded compared to the price of the spot and those who carry long positions pay for those carrying short positions. Since there is no transition to the negative rate, the decline in prices is new Short position It is understood that it is due to the cleaning of the current ascension -oriented positions, not from its opening. As open positions decrease, contracts that maintain their premiums show that market participants maintain their basic belief, but excessive leverage pressure was rated. Crypto investors’ application – the reason will surprise you!

“Long Squeeze” shook prices

While the decrease in open positions decreases the price, the number of contracts is separated from a typical short pressure. The sales pressure in the market did not grow artificially, as position closes were carried out by both compulsory liquidations and voluntary risk reduction. Only the leverage was cleaned. Thus, the decline in prices of BTC, ETH, XRP and Left Coin is overly optimistic rather than a general position. long positionIt was a reflection of the liquidation of the s.

Market observers Long SqueezeHe points out that it is a necessary cleaning. Because when the extreme leverage disappears, the price formation sits on a healthier ground and space for potential new rise. Although the downward mobility in the market since the evening of July 23 seems to technically negative, it can enable the market to increase the power by deleting non -secure leverage positions.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.