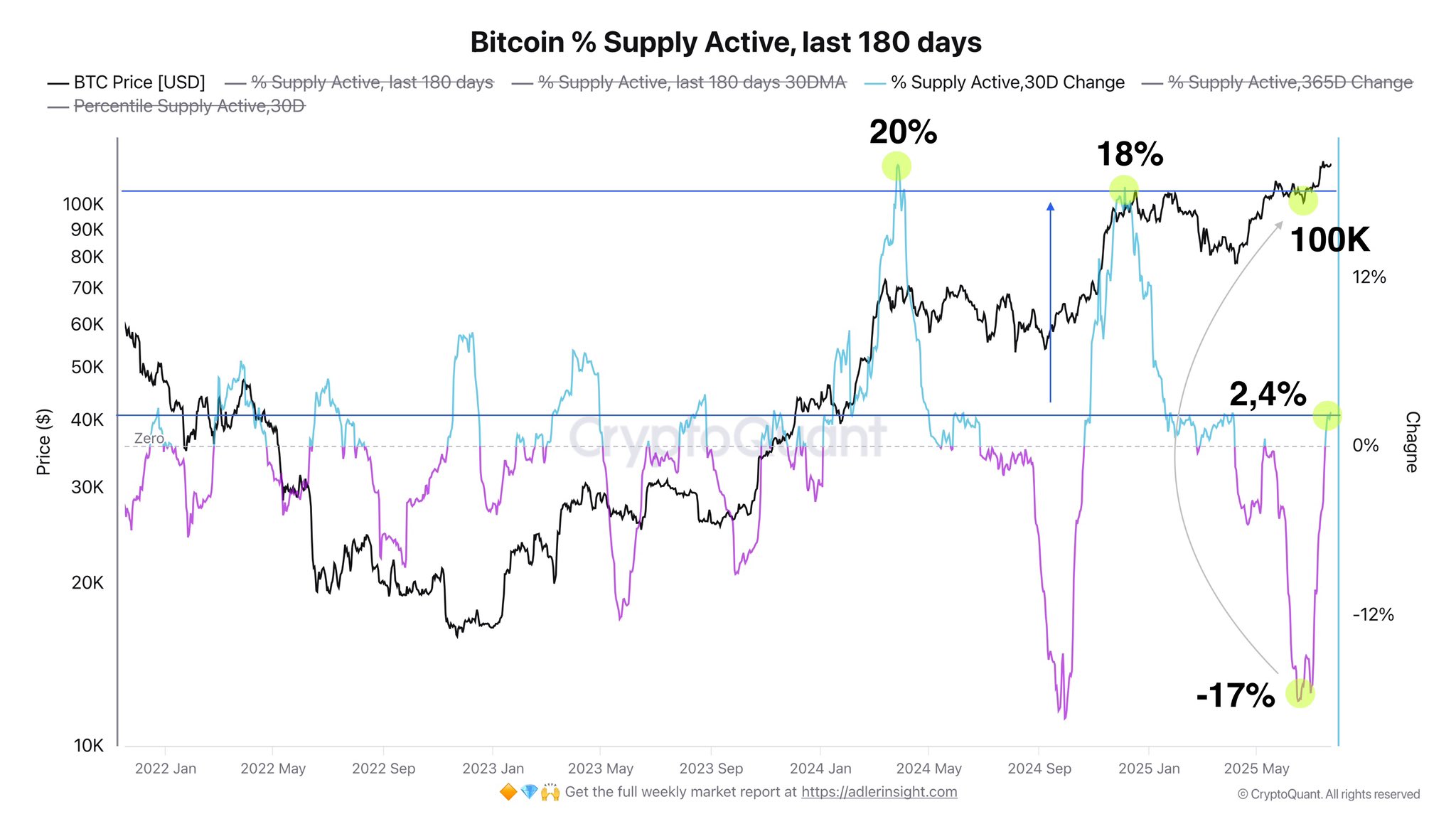

Bitcoin  $118,630.73The increase in the supply of actively active in 180 days indicates that a new wave of sales may be approaching. Cryptoquant Analyst Axel Adler JR., the increase in the active supply data shows that Coins that have not moved for a long time have been circulating again. Although the rate in June increased by about 2.4 percent in the last 30 days, the price is around 118 thousand dollars, while these movements coincide with the early distribution phase. For Bitcoin, which has a market value of approximately 2.35 trillion dollars, a possible breakage of 120 thousand dollars may mean that the supply in the activity can be moved to the gradual 8–10 percent band and then to the range of 18-20 percent in the previous peaks.

$118,630.73The increase in the supply of actively active in 180 days indicates that a new wave of sales may be approaching. Cryptoquant Analyst Axel Adler JR., the increase in the active supply data shows that Coins that have not moved for a long time have been circulating again. Although the rate in June increased by about 2.4 percent in the last 30 days, the price is around 118 thousand dollars, while these movements coincide with the early distribution phase. For Bitcoin, which has a market value of approximately 2.35 trillion dollars, a possible breakage of 120 thousand dollars may mean that the supply in the activity can be moved to the gradual 8–10 percent band and then to the range of 18-20 percent in the previous peaks.

Increased supply movement can trigger sales

Axel Adler Jr.In the graph examined, the share of the supply moving in the last 180 days has increased It is seen. Such an increase is often associated with profit intake or distribution of coins to different addresses. This behavior strengthens the tendency to move the coins at hand as the price rises. The analyst emphasized that the trend has just begun, although the movement is still low.

Past examples also support this reading. In the spring of 2024, the price increased to 70 thousand dollars, while supply activity spread to 20 percent. In December 2024, Bitcoin exceeded $ 100,000 for the first time, while the rate rose to 18 percent. Crypto investors’ application – the reason will surprise you!

Today, the table is different but similar. The ratio is increasing with small steps. This is also a great sales pressureIt means that the floor has not yet been activated, but the floor is preparing. The market can first be accelerated on $ 120,000 before a medium -sized sales wave.

Early distribution phase and possible scenarios in Bitcoin

In June active supply The limited increase in data shows that the cycle is at the beginning. According to Adler, if the price remains strong, the ratio can first reach the 8–10 percent band and then the old hills. The action of supply in this process will also shape the investor psychology. While the increase in profit purchases will suppress the price, new entrances can keep the wave alive.

Lightly withdrawal of the price in the last 24 hours is not decisive in the general picture. The market value is still huge and the movement area is wide. For this reason, short -term decreases do not overshadow the long -term distribution trend. The main determinant of the active supply will be the rhythm of the active supply and its simultaneous movement at the price.

On the other hand, compared to past loops, today’s low -rate sellers are not in a hurry yet. This supports the interpretation that the end of the rally does not come, but only a breath of breathing. When the threshold of 120 thousand dollars is exceeded, the data may rise harder.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.