Crypto Money Market This week, Washington will be tested with news flow. The ready -to -bear inflation data from the United States has the potential to create harsh volatility in both stocks and crypto currency prices, which is brought to the Congress and the 30 percent customs tariff brought by President Donald Trump to Mexico with the European Union and Mexico. Bitcoin  $118,024.47 And Ethereum

$118,024.47 And Ethereum  $2,963.55 All crypto currencies, including the data and political decisions to be announced in the coming days, will officially go through a test.

$2,963.55 All crypto currencies, including the data and political decisions to be announced in the coming days, will officially go through a test.

In the US data to be explained during the week

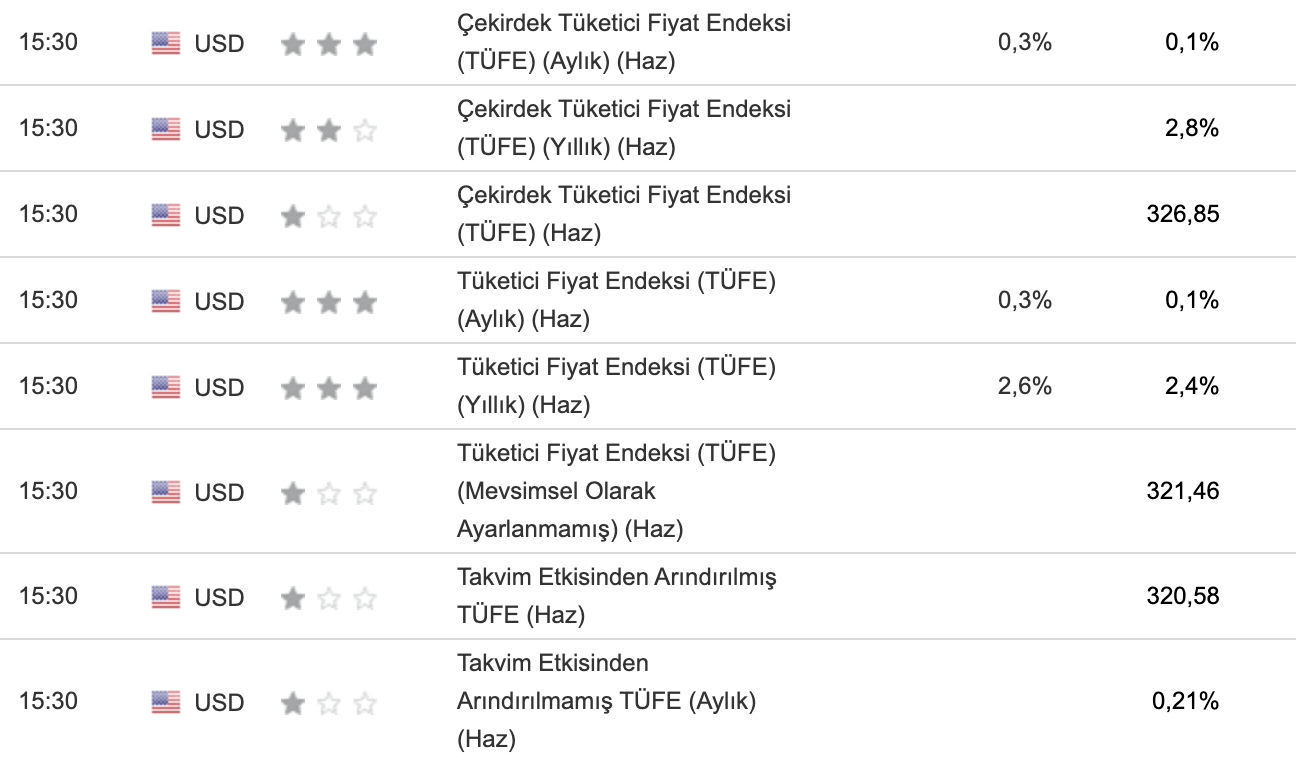

Investing data Regarding June to be announced on Tuesday Consumer Price IndexIt is expected to be announced as 0.3 percent on a monthly basis and 2.6 percent on an annual basis. A data flow that exceeds expectations may undermine the hope of the priced interest rate reduction since mid -June. Because a data flow that exceeds expectations will relieve the Fed’s interest rate cut, reducing liquidity in the market and suppressing crypto money prices. Bitcoin, which is parallel to expectations or a future data flow below expectations, increases the risk appetite. altcoinIt can bring a new purchase wave to the s.

Wednesday will be announced on June Producer Price Index0.3 percent on a monthly basis, is expected to arrive around 3 percent annually. A high expectation data flow undermines the risk appetite by showing that cost inflation will rise, while the expectation of six data flow Cost InflationIt can feed the risk appetite in crypto currencies by signaling that it will fall.

Will be announced on Thursday retail sales And it will be announced on Friday Michigan consumer trustAs a possible decline in the economy will strengthen the perception of slowing down, it can increase the pressure of monetary relaxation on the Fed. This can directly strengthen the rise acceleration captured by Bitcoins and Altcoins by feeding the crypto money market directly.

While the trade war continues, eyes will be at crypto money week

On the other hand, the US President Donald TrumpAfter the closure of stock exchanges on July 12, the European Union and Mexico will apply 30 percent of customs tariffs announced. The decision of drug trafficking and trade deficit was shown as a justification. S&P 500, 6 thousand 259.74 points after the closing of the opening of the risk of volatility at the opening of Monday. Experts stocksHe warns that the capital that escaping from the short term can move to crypto currencies and carry the price up, or that there may be a temporary correction to the crypto currency market with stocks.

Crypto Money Week starting with the new week House of RepresentativesOrganizing Stablecoins Genius lawclarifying the classification of crypto currencies CLARITY Act and the Central Bank limiting its digital money Anti-CBDC Law will argue on. While Republicans support the regulatory clarity, the attempt of “Anti-Cripto Money Corruption Week” attempt, led by Maxine Waters, can slow down progress. For this reason, investors will closely monitor committee voting, potential additional changes and lobbying activities.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.