According to Coings’ data, in the last 24 hours crypto currencyThe Long and Short position of over $ 1.25 billion in the s were liquidation. The biggest loss Bitcoin with 640 million dollars  $117,784.11 It took place in futures. Ethereum

$117,784.11 It took place in futures. Ethereum  $2,988.34 Futures transactions ranked second with 260 million dollars. More than 268 thousand investor prices in the prices were one of the positions. In this wave, Bitcoin brought the new peak of $ 118,000.

$2,988.34 Futures transactions ranked second with 260 million dollars. More than 268 thousand investor prices in the prices were one of the positions. In this wave, Bitcoin brought the new peak of $ 118,000.

The liquidation wave in crypto currencies shook the market

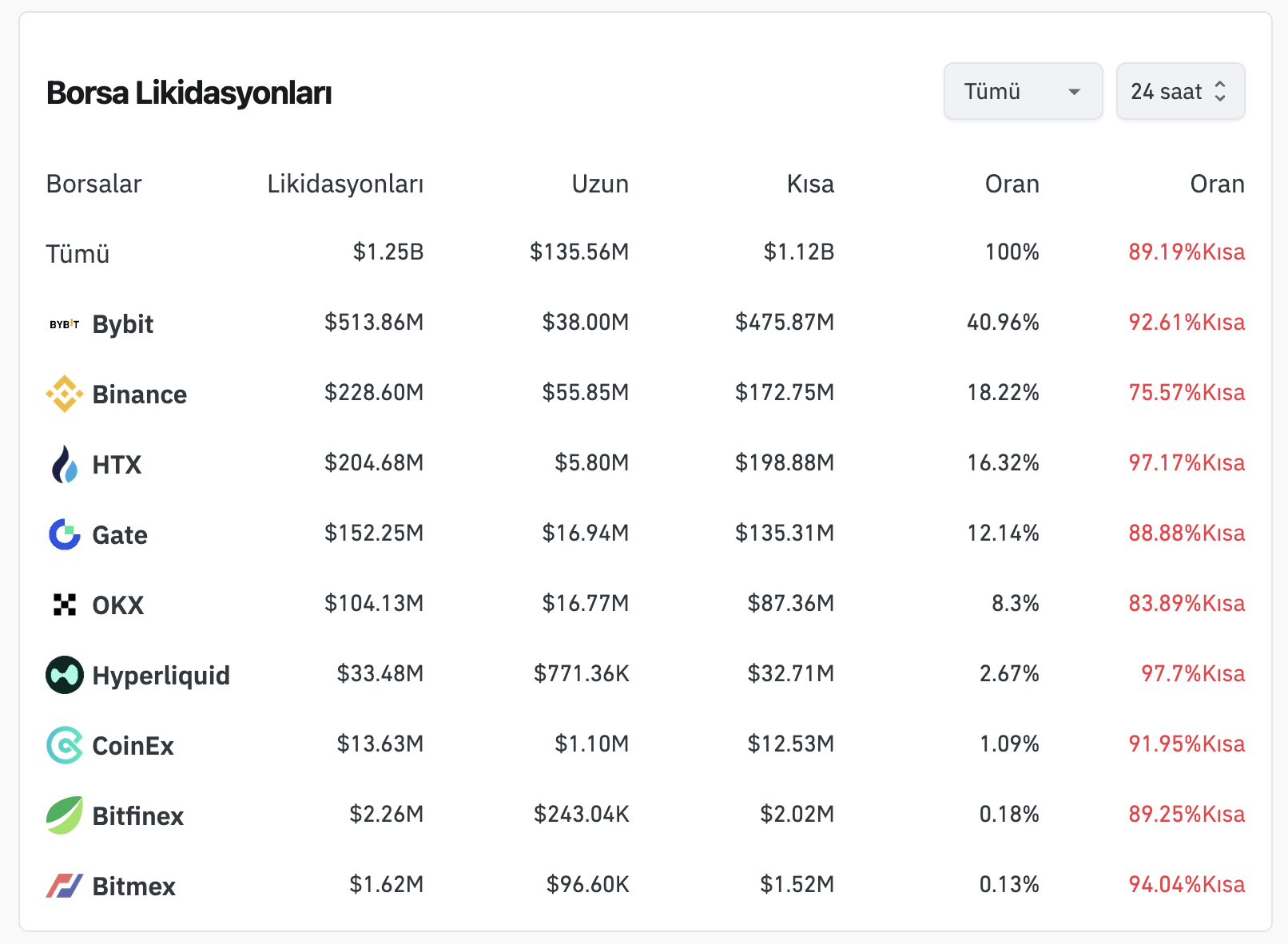

The liquidation of CoNSS according to the stock exchanges according to the figures Bybita total of 513.86 million dollars of liquidation sat at the top of the list. 93 percent of the liquidations came from short positions. HTX 204 million dollars, Binance He reported $ 228 million liquidation. The biggest singular loss HTX The stock market came from the Short position in the BTC/USDT parity with $ 88.5 million. The resulting figures once again showed how critical risk management is on platforms where high leveraged transactions are intensified.

Nearly 90 percent of the liquidations came from the short positions opened with the expectation of a decrease. Investors could not foresee the harsh rise and the rapidly triggered Stop-Loss mechanisms created a domino effect and contributed to the further acceleration of prices. Thus, short -term speculators were largely erased from the market, while the upward trend was strengthened.

ETF demand and macro developments add strength to the market

US -based Spot Bitcoin ETFA total of capital entering the $ 15 billion exceeded. Blackrock’s IBIT fund came forward in the corporate arena with more than 700,000 BTC. The fact that the entrance to ETFs continues is the basis of the rally by stabbing the price rise in Bitcoin. According to analysts, as the capital flow to ETFs continues, the rise trend can be protected during the summer.

US President on the Macro Front Donald Trump‘s interest rate should be reduced to 1 percent calls to increase the risk appetite. Investors are preparing for the possible financial expansion of the FED by turning to high -use purchase options such as 130 thousand dollars in futures markets.

Triggered by Bitcoin’s driving force Altcoin Rally It continues by gaining strength. Ethereum‘s volume of futures for the first time in passing Bitcoin’i price for $ 3 thousand, XRP $ 2,60, Dogcoin  $0.199136 For $ 0.20, Solana $ 165. Altcoin mobility in the market shows that some of the investors focus on the side outside Bitcoin.

$0.199136 For $ 0.20, Solana $ 165. Altcoin mobility in the market shows that some of the investors focus on the side outside Bitcoin.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.