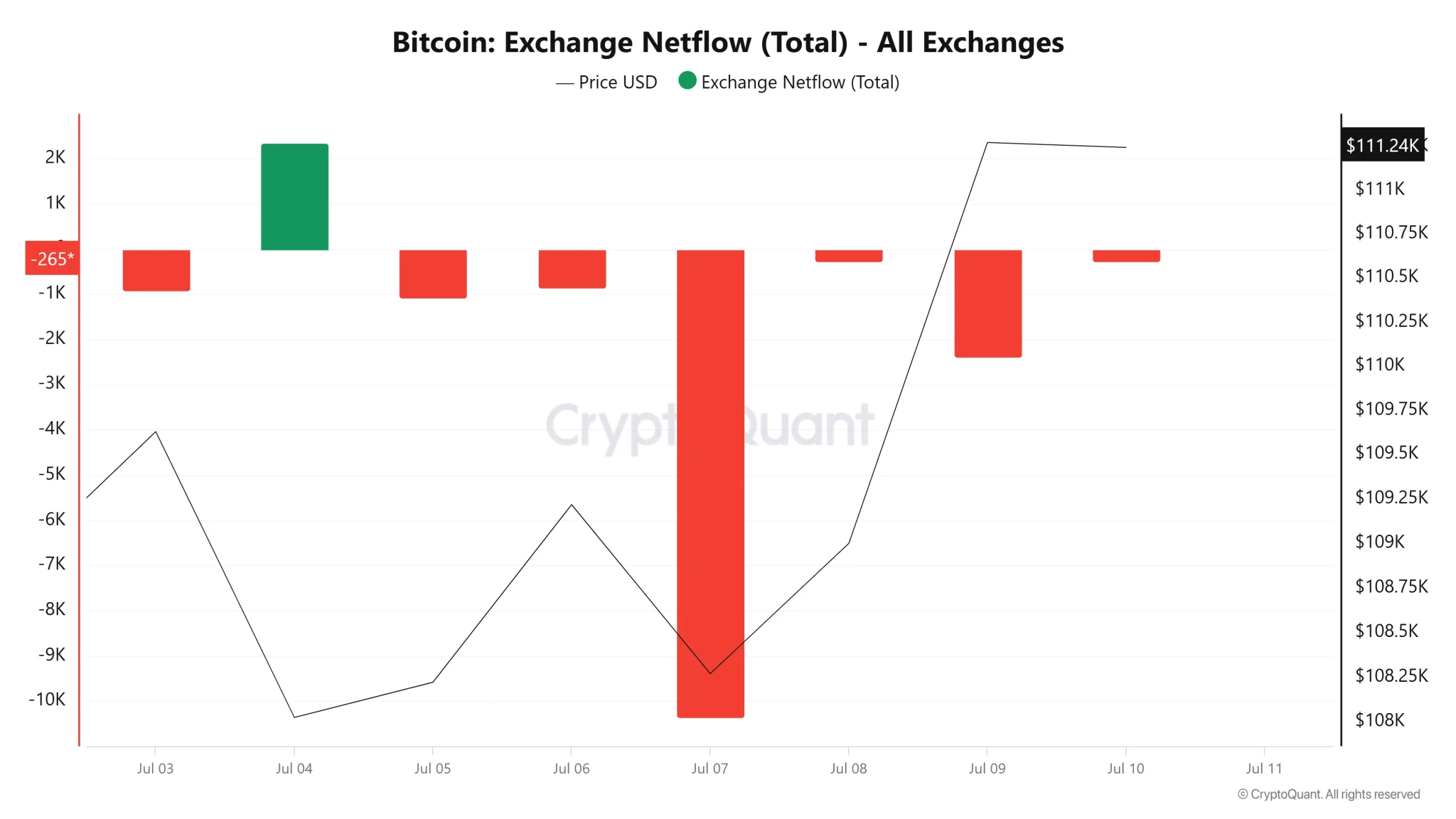

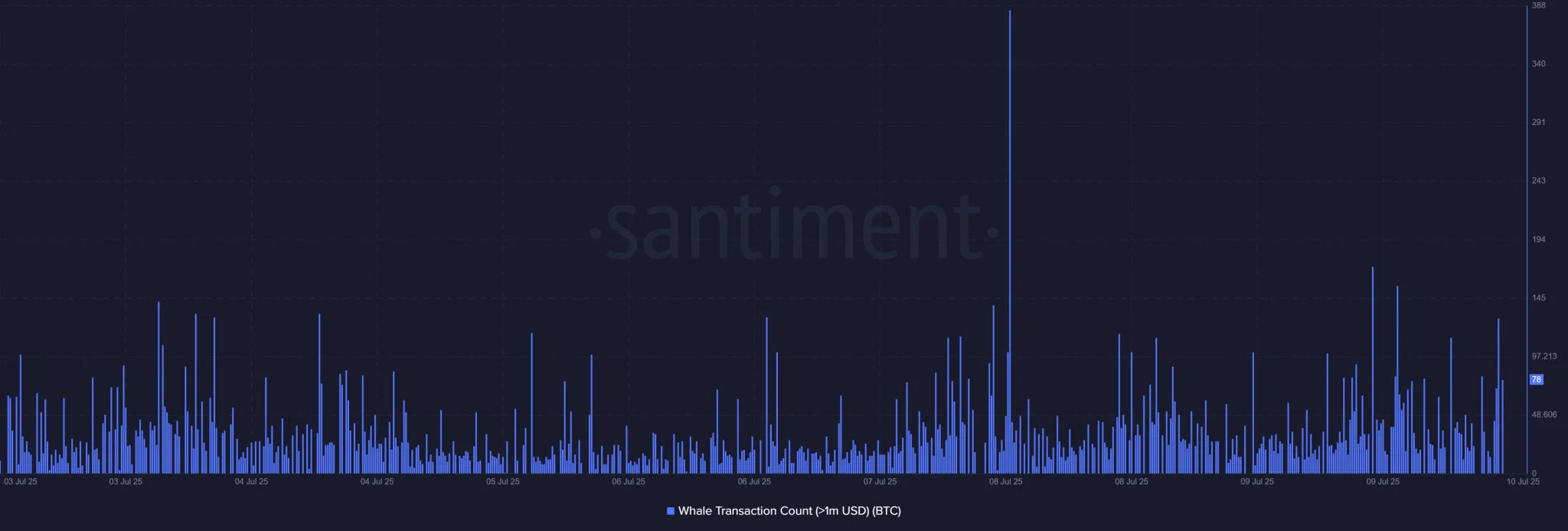

Bitcoin  $111,190.80Although it remains dominant on the market, Blockchain data indicates a remarkable break in the approach of whales since the beginning of July. Cryptoquant According to the data, 10 thousand BTC withdrawn from the stock exchanges on July 7 was recorded as the largest output of the last weeks and showed that the tendency of “holding” increased in the market. The next day CentimeterReported that there is a harsh increase in whale transactions over $ 1 million. Despite Bitcoin’s record renewal, this mobility shows that some of the major investors may have turned to Altcoins with a higher return. The total market value increases to 3.47 trillion dollars, while the crypto fear and greed index gives a greed signal with 71. Bitcoin’s dominance on the market is 63.8 percent.

$111,190.80Although it remains dominant on the market, Blockchain data indicates a remarkable break in the approach of whales since the beginning of July. Cryptoquant According to the data, 10 thousand BTC withdrawn from the stock exchanges on July 7 was recorded as the largest output of the last weeks and showed that the tendency of “holding” increased in the market. The next day CentimeterReported that there is a harsh increase in whale transactions over $ 1 million. Despite Bitcoin’s record renewal, this mobility shows that some of the major investors may have turned to Altcoins with a higher return. The total market value increases to 3.47 trillion dollars, while the crypto fear and greed index gives a greed signal with 71. Bitcoin’s dominance on the market is 63.8 percent.

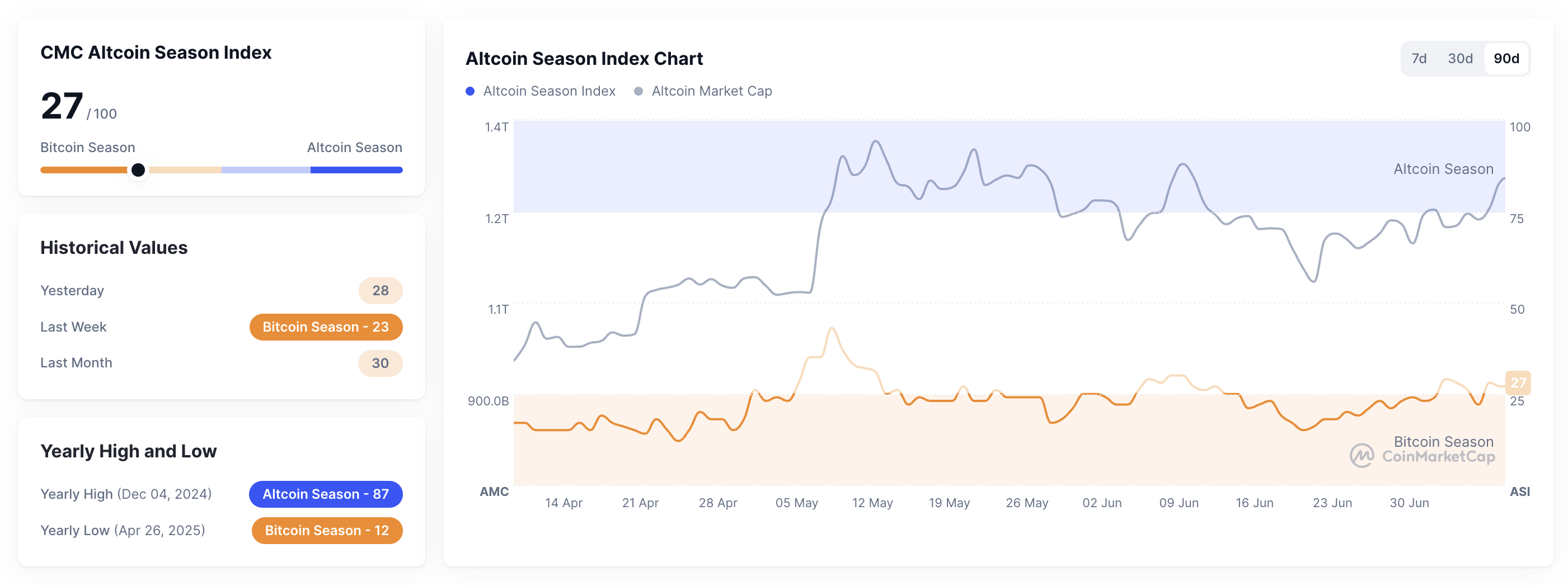

Are the whales slip from Bitcoin to Altcoin?

CoinMarketcap’s Altcoin Season Index is now 27/100 at the level. This means that a complete capital rotation is not yet confirmed. Again Ethereum  $2,780.37 And Solana such as leading Altcoins showing that coin accumulation increases in whale wallets with price movements stripped of consolidation. At the same time, the stablecoin entrances towards Altcoin -weighted stock markets gained momentum. This tendency makes high risk – the radar of the big players in the pursuit of the priest makes it not only Bitcoin is no longer.

$2,780.37 And Solana such as leading Altcoins showing that coin accumulation increases in whale wallets with price movements stripped of consolidation. At the same time, the stablecoin entrances towards Altcoin -weighted stock markets gained momentum. This tendency makes high risk – the radar of the big players in the pursuit of the priest makes it not only Bitcoin is no longer.

On the technical front of the market, Bitcoin faces a strong resistance just below its new record. Rsi And Macd It supports the possibility of a short -term cooling by pointing to overheating indicators. However, the Altcoins have a very large area in the upward direction thanks to relatively low domination rates. As a matter of fact, the price leaps that started on July 9 reveal how the portfolio diversification of whales adds speed to prices.

What does Blockchain internal data say for Altcoins?

Bitcoin outlets from stock exchanges usually show the intention of storing long -term. Since the first week of July, negative net flows to the stock exchanges confirms the motivation to hold strongly.

Centimeter dataThe July 8 whale processing splashing is interpreted in two -way: There are new purchases as much as profit purchase.

The fact that the data arrives just before the price explosion reveals that the timing is not a coincidence. On the other hand stablecoin Mobility of the whale wallets altcoin By concretizing his transition to his stock markets, he keeps the expectation that a potential mini subcoin rally will be triggered.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.