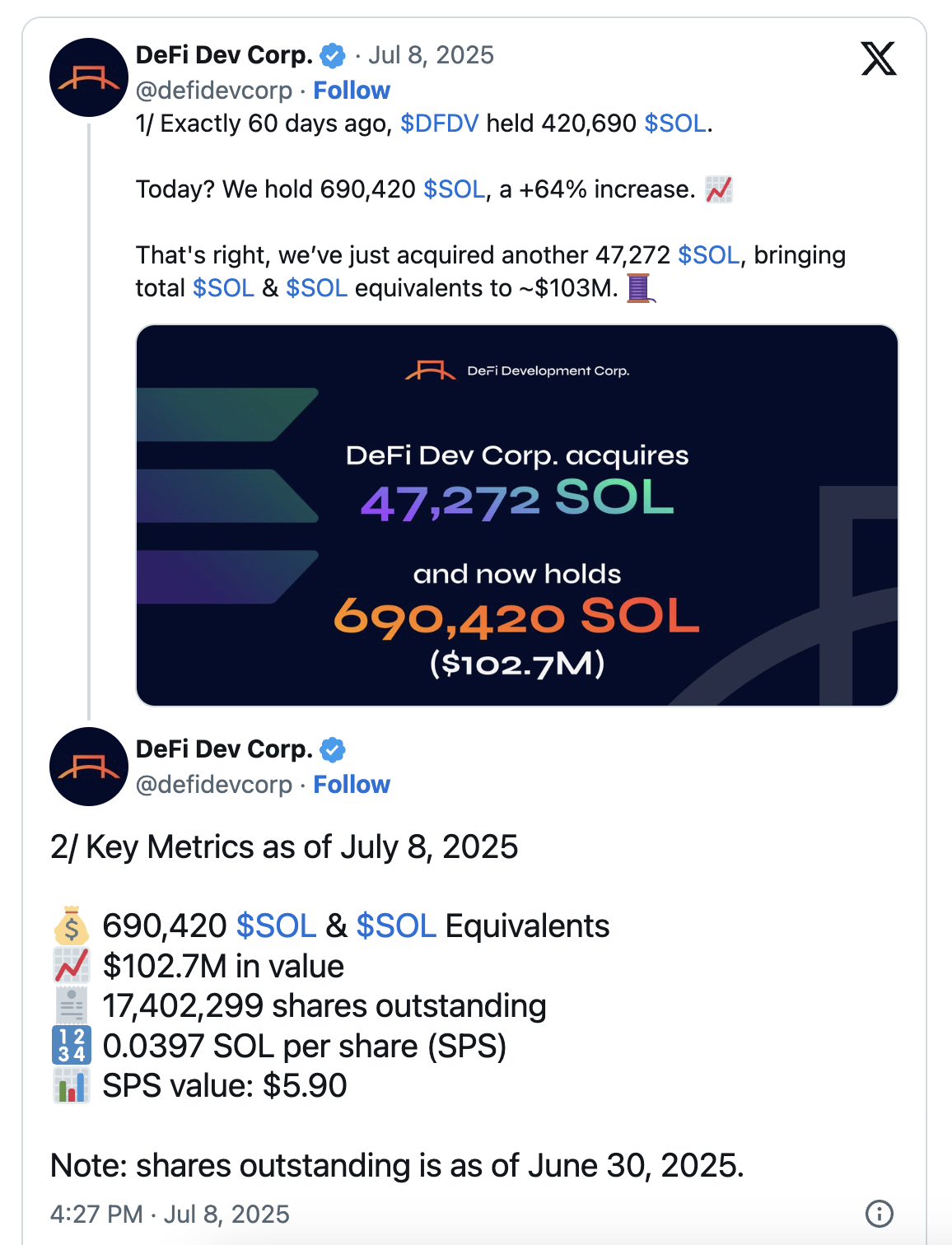

Defi DevelopmentIn order to expand the Solana -oriented treasury model, he bought 47 thousand 272 left lefts on July 8 and increased his total savings to 690 thousand 420 coins. The purchase of approximately $ 7.03 million reveals that the company has increased its assets by 64 percent in the last two months. The fact that the Lefts added to the treasury will be stacked emphasizes the search for sustainable return. The transaction revived the expectations that the price would rise in the Solana network, where corporate interest increased rapidly.

Defi Development’s left investments continue

Defi Development latest purchase Solana It is located in the heart of its centered strategy. After the last purchase, the portfolio value reaches approximately 102.7 million dollars and the company steadily expands the crypto currency treasure. To obtain passive income by staging the increasing balance on the network targeting.

Growing 64 percent compared to the previous period, the portfolio showed that the company’s Solana -oriented strategy is progressing rapidly. US Securities and Stock Exchange Commission’s Spot Solana ETFIncreased talks with the fund managers about their curiosity about the future of Altcoin reinforces.

Solana network At the same time, it reached 14.63 million active addresses in 24 hours and revealed the intensity of the in -Blockchain activity. The expanding user base indicates that Defi Development’s strategy is compatible with the network foundations and contains a strong return potential in the medium term.

Technical levels affecting the solana price

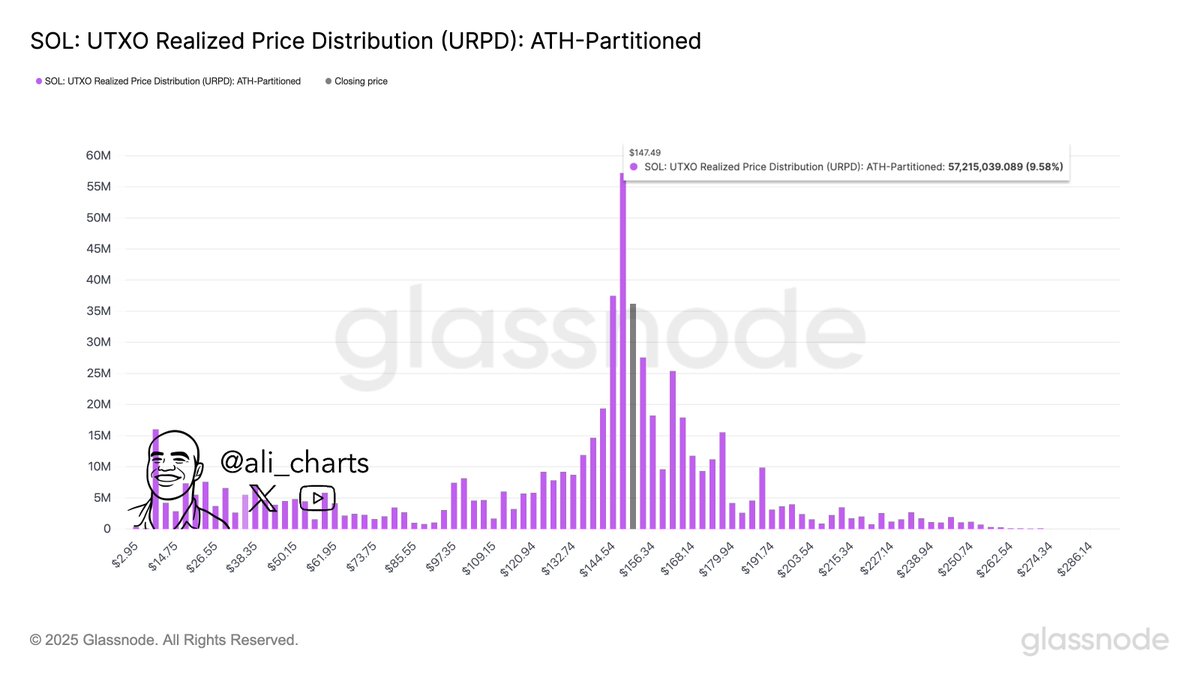

In the technical table Solana price Since last year, it has created a strong ground of around $ 125. According to technical analysts, the price in the short term does not hang below $ 149 is critical to limit sales pressure. The symmetrical triangular formation seen in the four -hour graph can bring fresh intake at closing over $ 157.

Popular analyst Ali MartinezIf the liquidity can be carried quickly up to 200 dollars if exceeded $ 157. VIEW IN THE ACTIVE ADDRESS Number of Blockchain signs that data supports the rise scenario. in. The increase in corporate interest strengthens technical signals such as demand balance and stake returns.

According to Martinez, it can trigger a strong capitulation in a short term of $ 149. On the other hand, stake revenues and ETF approval stand out as two main elements that can weaken the possible sales pressure.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.